CATEGORY

Pharmaceutical Distribution Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Pharmaceutical Distribution Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

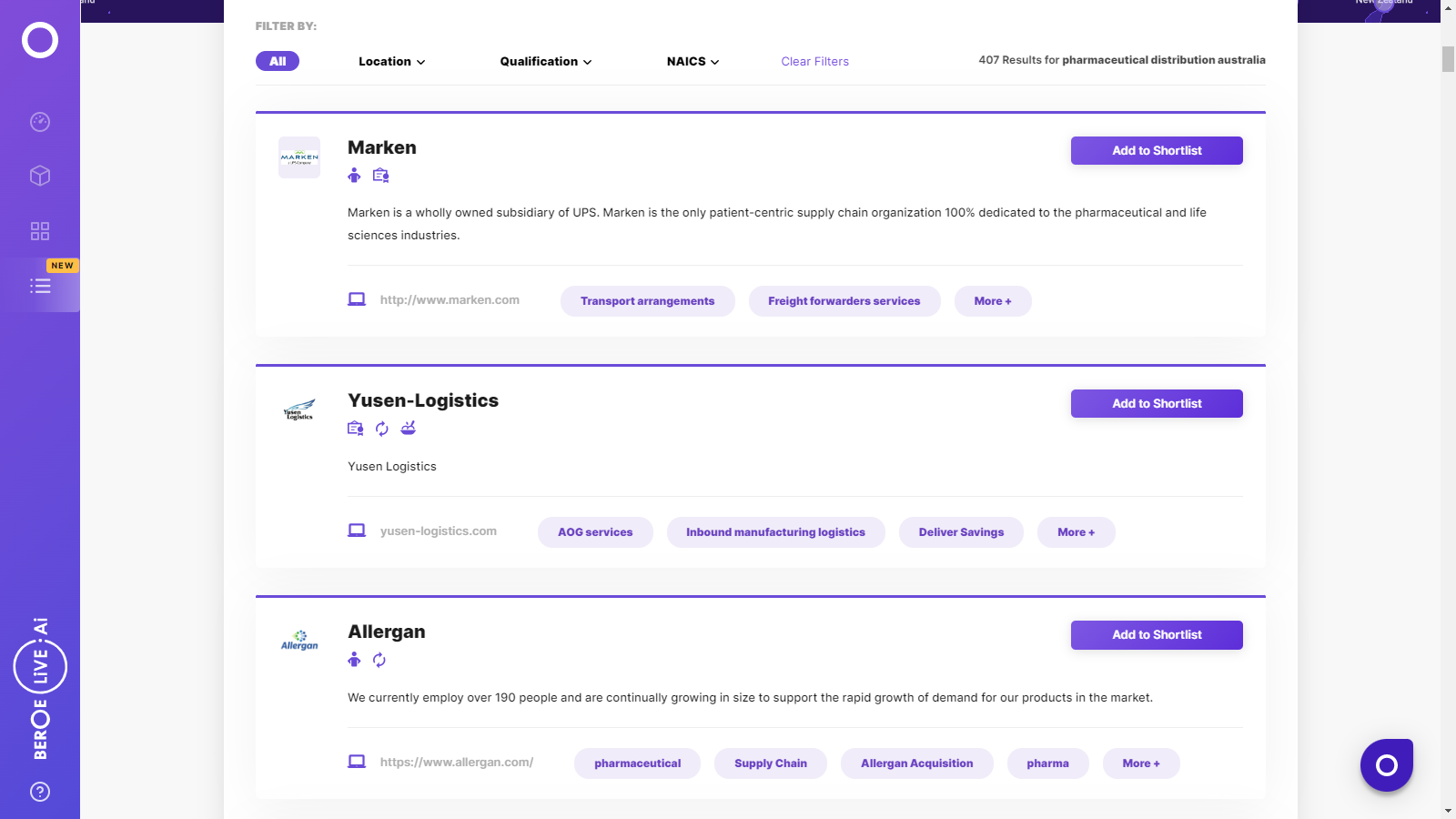

Pharmaceutical Distribution Australia Suppliers

Find the right-fit pharmaceutical distribution australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Pharmaceutical Distribution Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPharmaceutical Distribution Australia market report transcript

Regional Market Outlook on Phamaceutical Distribution

Australia 3PL Market Overview

- Overall 3PL market size is estimated to be at USD 13.3 Billion, market is highly matured and consolidated with more than 90 percent of market being accommodated by the global players

- Growth of market is primarily driven by shippers of pharmaceutical, chemical, FMCG and retail industries with warehouse location and distribution movements in Adelaide, Brisbane, Melbourne and Sydney.

- Contract logistics and freight forwarding is expected to drive the demand for 3PL with more manufacturers outsourcing the transportation and distribution activities.

Pharma and Healthcare Distribution Market Overview

3PL Market Presence

- Australia's pharmaceutical and healthcare logistics market is highly dominated by DHL as it controls around 85 to 90 percent of logistics market and provides 3PL services to leading pharmaceutical manufacturers such as Novartis and Pfizer

- Pharmaceutical distributors like API, Sigma and Symbion control about 90 to 92 percent of in-market distribution of pharmaceutical products, however they have very limited capabilities for primary distribution

Key Shift in Australian 3PL Distribution Market

Few 3PL players are expanding cold chain pharmaceutical logistics services

- 3PL service providers are required to have a license from the department of health for storage and distribution of healthcare and pharmaceutical products. The additional regulations associated with pharmaceutical logistics has restricted 3PL companies from catering to the pharma and healthcare sector

- However major 3PL players like DB Schenker and Linfox logistics are taking calculated risk to gradually expand their cold chain infrastructure by making investments in refrigerated trucks and temperature controlled warehouses

Outsourcing the in-market distribution activities to specialized regional service providers

- Considering the high infrastructure cost involved, major 3PL players opt for outsourcing the distribution activities to regional specialist when compared to doing the distribution themselves

- According to experts from DB Schenker and MNX, large 3PL companies carry out distribution of high volume product types. While other specialized healthcare and pharmaceutical products which are low in volume, require extra handling and temperature control operation and are handled by specialized logistics service providers

Insight on Australian 3PL Cost Drivers

Overhead Employment Cost

- Wage rate in Australia for distribution sector has increased by 5-6 percentage in 2016

- Predominantly due to increased demand in locations like Adelaide, Melbourne and Sydney for skilled labor in the supply chain and freight forwarding market

Distribution Cost

- In 2015-16, cost of distribution has decreased by 3-4 percent due to reduced diesel prices. But post 2106, as the diesel price rebounds the cost for distribution surges

- As a result, 3PL companies operating expense on distribution has increased very minimum in the last one year

Depreciation for Plant and Equipment

- In recent times, major 3PL players in Australia have increasingly investing in new locations and equipment, hence it would be reflected as higher depreciation cost in the operating expense

Driver Wage Rate

- Australian distribution industry has been hit by the extra cost with introduction of minimum wage rate for drivers

- New wage rate regulation is expected to increase operating cost of trucking companies, which would be passed on to shippers and other supply chain management companies.

Rentals for Occupancy

- In 2016-2017, rentals rate has increased by ~5 percent annually in major locations like Melbourne and Sydney while in the case of Adelaide and Brisbane rates have remained steady compared to previous year.

- Cost of occupancy for 3PL providers is likely to increase in NSW, Victoria and Southern Australia due to increase demand from Retailers

Software and other Intangible Assets

- Capital expenditure on technological investment has increased, gradual raise in upgraded technology matching shippers demand and solving the increased supply chain complexity are primary driver of technological investment.

Supplier Landscape

The healthcare and pharma industry has very limited service providers who can cater to all their logistics and distribution needs. Also, Australia being a large landscape the shippers prefer to engage with global 3PLs who has greater geographical presence as they outsource the services to regional subcontractors.

Australia: 3PL Market Share for Pharma and Healthcare Industry

- Australia's healthcare and pharmaceutical logistics market is a consolidated market with limited number of service providers

- Being a large landscape, the global 3PLs outsource fleet and assets from regional 2PLs and 3PLs in order to expand their geographical presence

- The market is highly dominated by DHL as it controls around 85 to 90 percent of healthcare and pharmaceutical logistics and distribution market

- DHL operates on non asset based business model wherein they subcontract fleet and assets from regional and local 3PL's/2PL's

- The rest of the market is led by mix of global, regional and local 3PL's

- Most of the global 3PL's such as UPS, TNT outsource their services to local subcontractors (other than regional players like Toll and Linfox) and prefer to operate on a non-asset model

- Regional players (such as BagTrans, Dean Cargo) engagement is limited to local/regional pharma firms in Australia, as they lack country-wide presence and the ability to offer integrated logistics services

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now