CATEGORY

Pharmaceutical Distribution APAC

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Pharmaceutical Distribution APAC.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

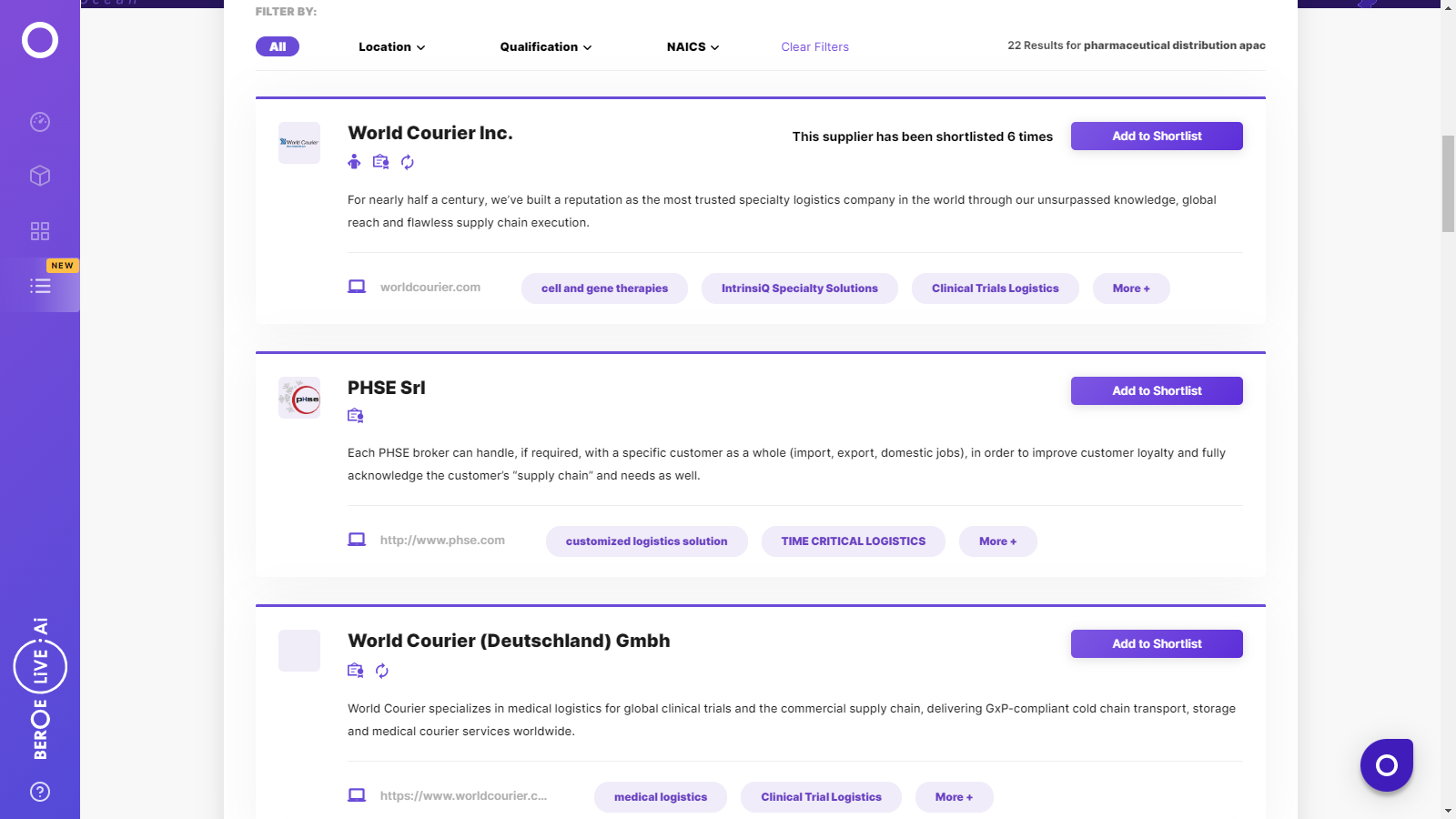

Pharmaceutical Distribution APAC Suppliers

Find the right-fit pharmaceutical distribution apac supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Pharmaceutical Distribution APAC market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPharmaceutical Distribution APAC market report transcript

Pharma Distribution: China

The industry is expected to have higher bargain and negotiation power as the market is highly fragmented. Also, implementation of two-invoice system in 2018 is expected to bring down the distributor margins

Manufacturers adopt percentage of sales as a prevalent pricing model by engaging with full-line wholesalers for the distribution of pharmaceutical product.

Engagement Model

- The multi-channel wholesaler model is the predominant channel used by pharmaceutical companies

- China has launched the two-invoice system where manufacturer's must engage with first-tier distributors to ensure geographic coverage by restructuring second- or third- tier distributors as first-tier distributors

Distribution Services

- Percentage of sales is the most widely adopted pricing model by the pharmaceutical companies for engagement with wholesalers

Wholesaler/Distribution Margin

- Distributor margin ranges between 8–12 percent

Licensing Authority

- National Development and Reform Commission (NDRC)

Shelf Life

- Most imported products should have at least six months remaining of their shelf life

Pharma Distribution: Malaysia

Industry is expected to have higher bargaining power as the market is fragmented and also most of the companies prefer to engage with regional distributors such as Zuellig Pharma and DKSH

General practice is to engage with a single national distributor; however, international manufacturers deal with more than one distributors, based on the product portfolio.

Engagement Model

- Foreign pharmaceutical companies who do not have local subsidiaries prefer to outsource distribution services and manage product registration in-house

- Multinational companies outsource their complete operations by engaging with single national distributor

Distribution Services

- Engaging with distributor for Full-line distribution services, commission as percentage of sales value is adopted

Wholesaler/Distribution Margin

- Distributor margin ranges between 5–15 percent

Sales Incentives

- On complete outsourcing of the distribution pharmaceutical companies offer incentives on sales target achievement, which is fixed at the beginning of the year

Licensing Authority

- Drug Control Authority (DCA)

Shelf Life

- Most imported products should have at least six months remaining of their shelf life

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now