CATEGORY

Pharma Pre-Wholesale Distribution in Mexico

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Pharma Pre-Wholesale Distribution in Mexico.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Pharma Pre-Wholesale Distribution in Mexico Suppliers

Find the right-fit pharma pre-wholesale distribution in mexico supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Pharma Pre-Wholesale Distribution in Mexico market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPharma Pre-Wholesale Distribution in Mexico market frequently asked questions

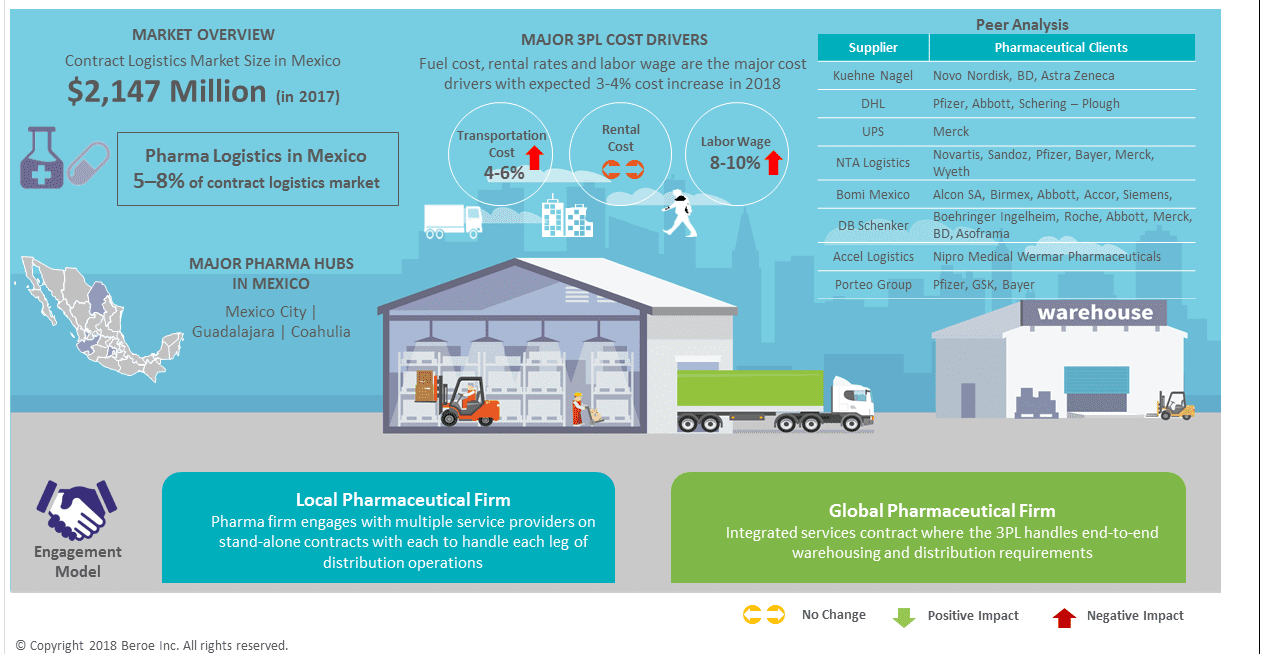

As of 2017, Mexico's contract logistics market is valued at around $2,147 million. A higher density for pharma operations exists in Mexico City, North-west of Mexico, and Central Zone of Mexico. The buyer demand here is also expected to be higher.

The major demand for contract logistics in Mexico is driven by e-commerce and advanced manufacturing industries, such as automotive, aerospace, medical, pharma, and food processing.

The pharmaceutical market in Mexico has been growing at a CAGR of 5.5 percent since 2018 and will continue to do so until 2020. The reasons for its growth can be attributed to the country's extensive healthcare needs, particularly those related to chronic diseases like diabetes, cancer, and cardiovascular diseases.

The pharmacy market in Mexico is expected to be similar to Europe and the US, where a few big Mexican pharmaceutical companies dominate the space and further their business by integrating with distributors. Presently, Mexico has over 24,000 points of sale, out of which, the SMEs hold 20-25 percent, pharmacy chains make up for 50-60 percent, and the rest is occupied by pharmacies at supermarkets like Wal-Mart, Soriana, Commercial Mexicana, etc.

Pharma Pre-Wholesale Distribution in Mexico market report transcript

Regional Market Outlook on Pre-Wholesale Distribution

Mexico's contract logistics market is estimated to grow 4-5 percent in 2018; Mexico City, North-west of Mexico and Central zone of Mexico has higher density for pharma operations where the buyer demand is expected to be higher

Mexico's contract logistics market is valued around $2,147 Million, mainly driven by e-commerce and manufacturing industries such as automotive, aerospace and medical, pharma market share is expected to be around ~5-8%

- Mexico's contract logistics market accounts to $2,147 Million in 2017 and is expected to grow 4-5% by 2018

- Major demand is driven from e-commerce and advanced manufacturing industries such as automotive, aerospace, medical and food processing

- Pharmaceutical companies are specially clustered in the central zone, Mexico City, North west of Mexico (Coahuila) and surroundings of Guadalajara

- The pharmaceutical industry in Mexico is expected to grow at 5.5 percent CAGR from 2018-2020. The country has extensive healthcare needs, particularly those related to chronic diseases such as cardiovascular, diabetes and cancer

Pharmaceutical Clusters and Distribution Channels

In future, pharmacy market in Mexico will be similar to Europe and the US, where few, big players dominate the entire business and integrate with distributors

- Currently in Mexico , there are over 24,000 points of sale in Mexico, of which SMEs hold 20-25% of the industry annual sales, pharmacy chains make up for 50-60%, and the rest is captured by pharmacies at supermarkets such as Wal-Mart, Soriana, Commercial Mexicana, etc.

- Pharmacy chains' expansion is therefore driven by acquisitions and organic growth

- Big pharmacy chains continue to grow and many independent pharmacies have gone out of business. In 2015, the Walgreens-Boots-Alliance acquired 1,030 points of sale. FEMSA has acquired different chains and now manages 2,000 POS in this sector

3PL Engagement Practices of Pharma and Healthcare Companies

Best-in-class firms engage with 1-2 pre-wholesalers for the period of 2-5 years as the market is fragmented and to have full geographical coverage and distribution capabilities.

Regional pharma firm engages with multiple service providers on stand-alone contracts with each handling a specific segment of distribution operation wherein global pharma firms engage with 1-2 global 3PL for end to end warehousing and distribution requirements.

Regional Pharmaceutical Firm:

- Pharma firm engages with multiple service providers on stand-alone contracts with each to handle each leg of distribution operations

- Regional pharmaceutical manufacturers engage on an average contract length period of 1-3 years

- Average days payable outstanding between pharma companies and regional 3PL's is 60 days

Global Pharmaceutical Firm:

- Integrated services contract where the 3PL handles the end-to-end warehousing and distribution requirements

- Global pharmaceutical manufacturers engage on an average contract length period of minimum 2-5 years

- Average days payable outstanding between pharma companies and global 3PL's is 30-60 days

Insight on Mexico 3PL Cost Drivers

In 2018, rental rates for warehouses is expected to remain stable; however warehousing cost is expected to increase by 4-7%, which is influenced by increase in labor cost (8-10%) and utility cost (1-2%). The increase in fuel price and driver wages is expected to increase the distribution cost by 4-6% for the year 2018

Overhead Employment Cost:

- Mexican government increased the minimum wages by 10 percent for the year 2018 to reach $5.23 per day, which was influenced by NAFTA negotiation between North American countries

Transportation Cost:

- In 2018, cost of distribution is expected to increase by 4-6% which is highly influenced by the fuel price and is forecasted to increase by 8-10%

Warehouse Market Overview:

- Pharmaceutical warehouses in Mexico contribute to ~5 percent of the total warehouse space in Mexico; the majority share of warehouse space is utilized by manufacturers in the automotive, aerospace and retail sectors

Driver Wage Rate:

- In 2018, the minimum labor wage for drivers in Mexico increased by 2-3% and reached USD 16.23 per hour, which is influenced by increase in demand for truck drivers to carry out cross border activities

Rentals for Occupancy:

- Class A warehouse rental rates in Mexico increased by 13 percent in 2017 to reach $5.23/sq.m./month, which is expected to remain stable for the year 2018

Technology and Other Intangible Assets:

- Cargo thefts are increasing in Mexican highway, which has made these highways a no-man land

- Use of RFID tags to products and cabin cameras are prevalent in Mexico's pharma logistics

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now