CATEGORY

Pharma Pre-Wholesale Distribution Brazil

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Pharma Pre-Wholesale Distribution Brazil.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Pharma Pre-Wholesale Distribution Brazil Suppliers

Find the right-fit pharma pre-wholesale distribution brazil supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Pharma Pre-Wholesale Distribution Brazil market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPharma Pre-Wholesale Distribution Brazil market report transcript

Regional Market Outlook on Pre-Wholesale Distribution

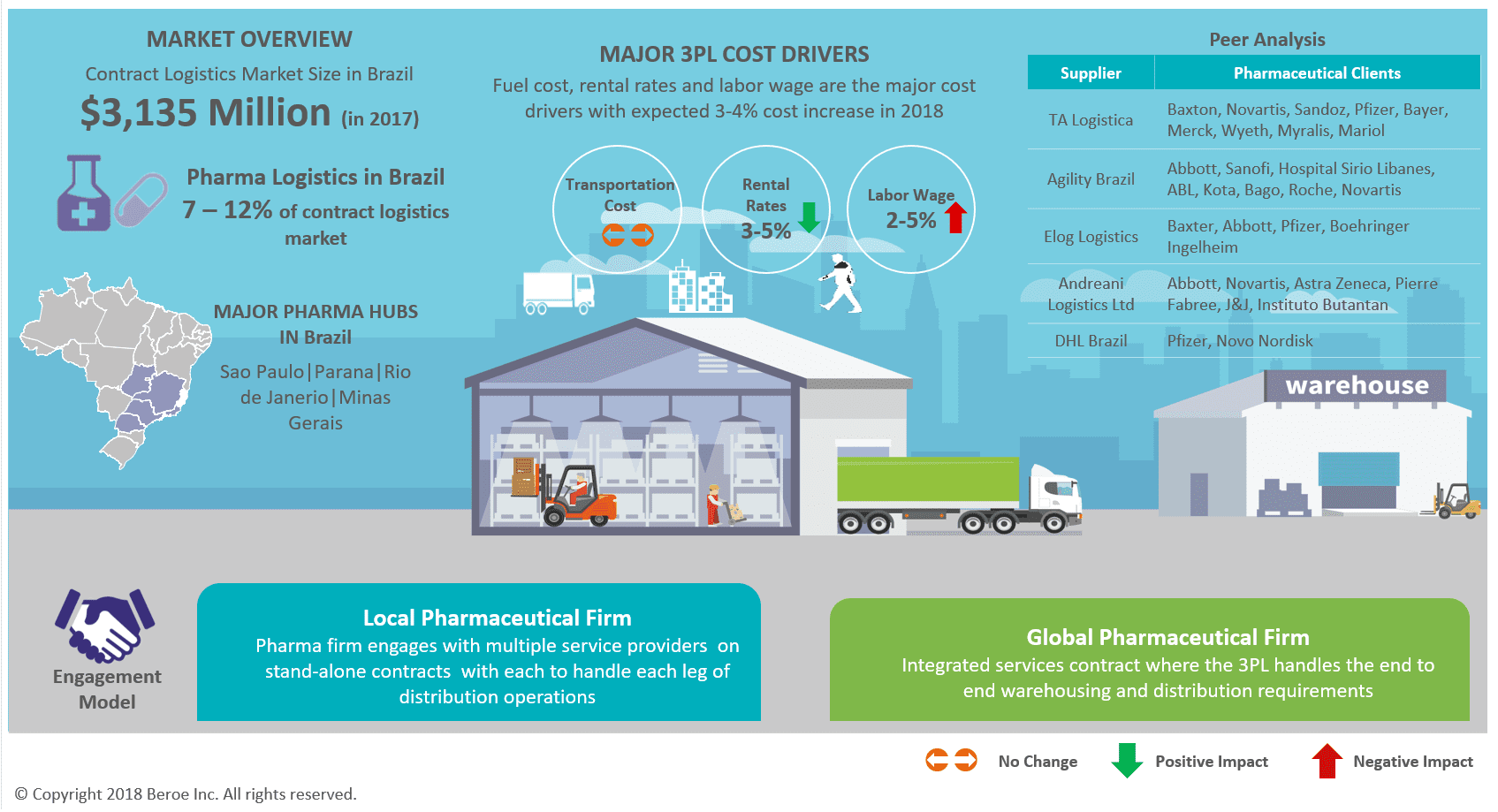

Brazil's contract logistics market is estimated to grow 2-3 percent in 2018; locations such as Sao Paulo, Parana, Rio de Janerio and Minas Gerais has higher density for pharma operations where the buyer demand is expected to be higher

Brazil's contract logistics market is valued around $3,135 million in 2017 mainly driven by e-commerce and manufacturing industries, pharma market share is expected to be around ~7-12 percent

Brazil Contract Logistics Market Size (2014-2018F)

- Brazil's contract logistics market accounts to $3,135 million in 2017 and is expected to grow 2-3 percent by 2018

- Major demand is driven from e-commerce and manufacturing industries

Pharmaceutical Market Overview

- Brazil's major pharma hubs are located in Sao Paulo, Parana, Rio de Janerio and Minas Gerais where the major pharma production units is located

- Brazil holds ~40 percent of the regional demand in Latin America; it also has compelling healthcare demographic growth drivers,such as strong projected GDP per capita growth,which will lead to increased healthcare consumption

Pharmaceutical Clusters & Distribution Channels

About 80 percent of the major pharmaceutical companies outsource their distribution activities to a large 3PL. Since a traditional distribution model is followed,finished products are distributed through wholesalers or retail chains DC's

- European and American companies, who own or operate through subsidiaries, control the major market share of 70-75 percent including access to SUS (Unified Health System) contracts

- Due to this, almost 80 percent of the raw materials necessary for manufacturing of generic drugs are imported, therefore heavy concentration of manufacturing plants and DC's are found near the access ports and entry points to the country

- Another factor which affects the placement of distribution center is the regulation by certain states, licensing is required for having a manufacturing and distribution center operations located in the same state

ICMS Tax: Brazil

In early 2016, about 12 Brazilian provinces increased the rate of the ICMS for medicines, citing storage problems due to the economic recession. For medicine, tax increase was ~1.2 percent on average when compared to 2015 value. Thefts continue to increase in Sao Paulo and Rio, which accounting to 80 percent of total thefts

- ICMS is a value-added tax (VAT) that applies to sale of goods and services. It is levied by the provinces and not Brazilian federal government. In general, companies pass this tax to consumers

- When there is movement of goods from one province to another, ICMS is shared between the provinces in two ways. The lesser developed state gets higher share of the ICMS tax. For instance, when ICMS is 18 percent, 12 percent is for less developed province and remaining 6 percent for the more developed

- Secondly, it is based on producer and consumer status of the province. The producer province gets 7 percent or 12 percent of the value of the product and the consumer province gets the rest of the amount that totals to rate. For instance, if a shipment is charged in 18 percent in the destination province, the producer province gets 7 percent or 12 percent and the consumer province will get rest 11 percent or 6 percent

Type of Service Providers

The lack of integrated service providers specific to pharma industries which needs expertise in operation and customized facilities are limited which is a challenge for the client in Brazil.

In Brazil, ~85 percent of service providers (>5400 suppliers) are road freight companies followed by storage service providers who hold 5-8 percent (>500) market share in the supplier landscape

Type of 3PL Logistics Players in Brazil

- Road freight companies are the major service providers in Brazil since 65-70 percent of goods are transported via road; further lack of quality and connectivity of rail transport has increased the dependency for road freight transportation

- Warehouse operators (cargo storage and handling service providers) share 5-8 percent of the logistics suppliers with high demands from e-commerce, automotive and pharmaceutical industries

- Integrated service providers hold a market share of 1-2 percent however availability of suppliers with expertise in pharmaceutical and healthcare operations is low due to requirements such as customized facilities, regulations and high demand for skilled labors

Insight on Brazil 3PL Cost Drivers

Overhead Employment Cost

- The cost of labor wage has increased up to 3-5 percent from 2017 to 2018 which is all time high wages in Brazil. Despite high wages the demand in Brazil is high due to high volume of consumers

Transportation Cost

- In 2016-2017, cost of distribution has remained same despite increase in fuel price, which is influenced by the abundance availability of trucks. The situation is expected to remain same for the year 2018

Depreciation for Plant and Equipment

- In an attempt to bring balance to the market after the economic recession land owners have adopted delivery on-demand strategy, and designing projects that meet the tenant's needs

Driver Wage Rate

- The minimum labor wage for drivers in Brazil is $26 per hour for the year 2018 which is 1.8 times higher than the median wage of the country

Rentals for Occupancy

- In 2018, rentals rate are expected to decrease by 4-5 percent in major locations like Sao Paulo and Rio de Janerio, with high vacancy rates of 20-22 percent and lack of demand

Technology and other Intangible Assets

- RFID asset tagging to products remains a predominant trend in pharmaceutical industry, which has gained popularity due to increase in theft of medical goods in Brazil

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now