CATEGORY

PET

Polyethylene terephthalate is one of the most commonly used thermoplastic polymer which is predominantly used in fibres and bottling applications apart from engineering plastics. Beroe estimates Asia to witness the highest growth rates compared to other matured geographies like US and Europe.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like PET.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Impact of the earthquake in Turkey on PET

February 14, 2023Increase in anti-dumping duties on Chinese and Indian imports entering Europe

January 30, 2023Force majeure declared by JBF-RAK

July 21, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on PET

Schedule a DemoPET Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPET Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in PET category is 6.50%

Payment Terms

(in days)

The industry average payment terms in PET category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the PET market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPET market frequently asked questions

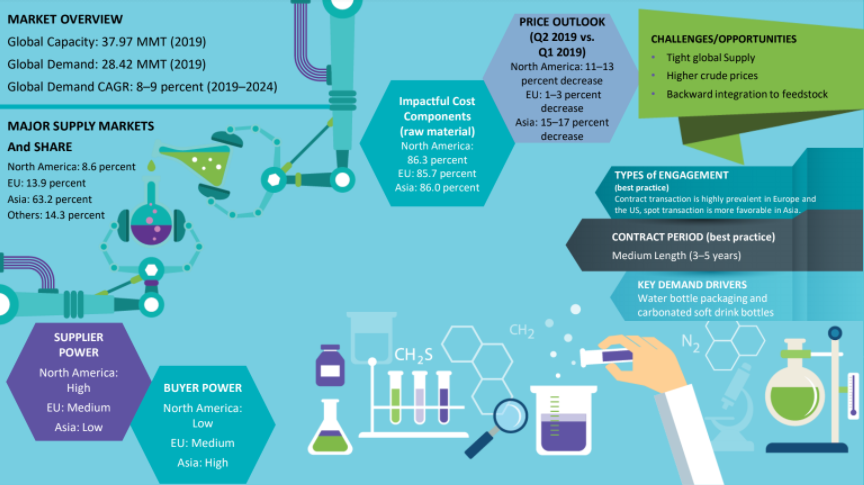

The Asia Pacific (APAC) PET market value is slated to multiply at around 6.7% CAGR through 2024. Asia is the leading PET exporter, with a consistent trade surplus of 2–3 MMT per year over the last five years.

Driven by the healthy demand, the APAC PET market, holding over 60% of the overall supply, continues to attract market players and stakeholders. Furthermore, the European Union (EU) and North America collectively capture around a fifth of the global PET supply.

While PET market players in the US and Europe highly prefer contract transactions, spot transactions are the most favorable type of engagement in Asia.

In 2019, the global PET production and demand pegged 37.97 MMT and 28.42 MMT, respectively.

Squeezed global supply and rising crude prices are the key factors negatively impacting PET manufacturers’ profit margins.

Significant PET usage is observed in producing films, while usage in fiber and bottle production is likely to grow at 4.8% and 4.3% CAGR.

North America and Europe have been net PET imports over the past five years, mainly due to disruption in domestic supply.

In Asia, the buyer power is high, while in the EU and North America, the buyer power is medium and low, respectively.

Beroe’s analysis shows that the global PET demand will grow at 8-9% CAGR during 2019-2024.

PET market report transcript

Global Marketing Outlook on PET

-

During 2023–2026, the global market is estimated to grow at the rate of 3–4 percent, mainly driven by the APAC PET market

-

The APAC PET market is likely to drive the market through its healthy demand (3–5 percent CAGR) until 2025

-

Supply to increase in 2023-2024 period majorly in Asia, hence exports from Asia to increase in the upcoming years. Overall, supply risk to be low to medium, with buyers can source from Asia as an alternate sourcing destination due to low prices and higher availability

Global Market Size : PET

-

PET market is expected to reach 57.2 Billion by 2025. Film, Fiber and Bottle are the current key demand drivers for the PET industry and is expected to continue till 2025

-

Due to drop in prices and weak demand, the market size contracted in 2020. Prices and trading activities rebounded in 2021, which caused a steep recovery in market size and similar trends continued in 2022.

-

Prices to drop in 2023 amid weak demand which is expected to cause a decline in market size for 2023.

Global Capacity–Demand Analysis

-

Asia would continue to be a net exporter of PET. Capacity additions in Asia would further increase the exports in the upcoming years. The demand is estimated to grow at a CAGR of 3–4 percent, primarily driven by food & beverage and bottle sector.

Market Outlook

-

Capacity Dynamics: The global PET production capacity is expected to touch 60.1 MMT by 2026, driven by the capacity additions in Asia and the US

-

Production: The operating rates are expected to be in the range of 70-80 percent in 2023. Due to surplus capacities, there are high possibilities that the operating rates to drop during 2023 owing to weak demand

-

Demand: The global PET demand is estimated to grow at 3–4 percent, driven by film segment, applications in the packaging sector and bottle segment

Capacity Trends

-

APAC: The region has witnessed the healthiest demand and is expected to witness capacity additions of nearly 3 MMT/year by 2022–2024

-

Europe: The mature market has seen a modest growth rate; however, no capacity addition is planned in the near future

-

North America: Capacity of 1.1 MMT/year is expected to come online by 2025

Global Demand by Application : PET

-

Food & Beverages, Packaging and Textile industry are the major demand driving segments of PET. The current trend is expected to continue in the upcoming years

Global Trade Dynamics : PET

-

North America: Net importer for the past five years. The level of imports has increased, due to disruption in domestic production

-

Europe: Net importer for the past five years, with a trade deficit of 0.8 MMT/year.

-

Asia: Largest exporter, with a consistent trade surplus of 2–3 MMT/year for the past five years due to capacity additions

-

LATAM (Brazil): Net Importer, due to low capacity additions

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.