CATEGORY

PE Films

PE films report coves the base films across end use applications like stretch wrapping, shrink wrapping etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like PE Films.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Elite Plastics, has installed a new three layer Blown film extrusion line in UK.

April 20, 2023Constantia Flexible Acquires Laszlopack

April 13, 2023Suedpack introduces recyclable mono layer Pure-Line PE Films.

April 05, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on PE Films

Schedule a DemoPE Films Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in PE Films category is 5.40%

Payment Terms

(in days)

The industry average payment terms in PE Films category for the current quarter is 180.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the PE Films market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPE Films market report transcript

Global PE Films Market Outlook

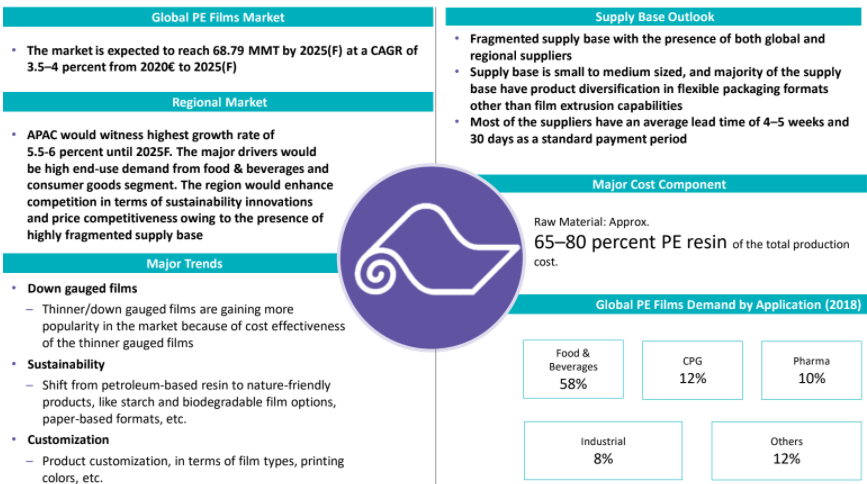

In 2023E, the global PE film demand is valued at about 57 MMT and is expected to grow at a CAGR of 3.5–4 percent from 2023E to 2027F. The top global manufacturers are expanding their capacity to meet the increasing demand

The key growth drivers are:

-

Growing end-use demand from the packaged food and beverage

-

FMCG

Global PE Films: Market Maturity

-

North America and Europe are highly mature markets. Supplier capabilities to serve complex client requirements in these regions are high. There is a in increase in demand from APAC and LATAM for PE films across segments due to increase in young population and hike in middle class income.

Global PE Films: Industry Trends

-

Downgauged films and integrated supplier engagement are the major trends that will impact PE films in 2023. Companies are restructuring their supplier engagement policies to include payment terms and KPIs more explicitly, so that losses can be minimized in case of adversities.

PE Films –Drivers and Constraints

Drivers

End-use Demand

-

One of the major growth drivers for PE films is the increasing usage of stretch and shrink films, which is expected to grow at a CAGR of 4–5 percent in Australia from 2023E to 2027F. These films are used in packaging and non-packaging applications because of its physical properties, such as tear strength, stress, durability, etc.

-

The increase in demand for food, beverages, and consumer goods product in emerging regions, due to growing urbanization and increasing disposable income of middle class

Technology and Innovation

-

Technological innovations in the field of manufacturing machineries and production process are gaining momentum, mainly due to dynamic consumer preference, which would provide PE films an edge over its rigid packaging counterpart

Constraints

Substitutes

-

There is an increase in the usage of BOPP films, mainly in food packaging segment, due to its barrier properties

Sustainability

-

In the developed markets, there is a major sustainability trend toward the use of paper, cloth, and jute bags to replace the PE bags

-

Several major cities are also banning the use of plastic bags. In the recent past, the top retail chains have moved from using plastic bags to jute/paper bags

Cost Structure Analysis: PE Films

-

The APAC is dominated by the supply from China, as it exports the raw material to the other neighboring APAC countries. The prices majorly depend on the China’s output

-

PE resin contributes to around 75–80 percent, and its a major cost driver, followed by fixed and labor cost

-

PE resin does not have any supply constraints across regions. However, there will be a temporary supply disruption and capacity outage, which results in temporary price variations

-

Fixed charges include packaging, logistics, administrative, and other general expenses and contribute to about 11–13 percent of the overall PE film production cost

Supply Trends and Insights : PE Films

Supplier Outlook

Supplier Fragmentation

-

Fragmented supply base with the presence of both global and regional suppliers

-

Global suppliers mostly compete on innovation front and regional suppliers mostly tend to compete on cost effective PE Films fronts

Integration

-

Most of the global suppliers and key regional suppliers are witnessed to be forward integrated to other converted flexible packaging formats

-

Being integrated, enables supplier to the avoid middle man in the supply chain and helps in cost saving. Most of the integrated supplier tend to pass on this cost saving to end users

Supplier Trends

Supplier Innovations

-

Most of the global and regional suppliers are focussed on innovations related to downgauged films recycled content and biodegradable film formats across regions

-

COVID situation prevailing all around the globe has reduced the number of innovations related to bio based films and are more focused in handling the price reduction of PE Films

Mergers and Acquisition

-

Global suppliers in the market mostly tend to acquire capable regional suppliers for synergy in new customer acquisition, new market access, for cutting down competition and to gain technical advantage of the acquired suppliers

-

The pandemic situation have decreased the number of acquisitions and mergers in the industry as suppliers have diverted their focus on cost cutting to financially survive the pandemic than investing on a new business

Engagement Trends

Mix of global and regional supplier Engagement

- Engaging with mix of global and regional suppliers is preferred as it would provide brand owners with access to innovation and increase buyer power for price negotiation respectively

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.