CATEGORY

Payroll Outsourcing Services

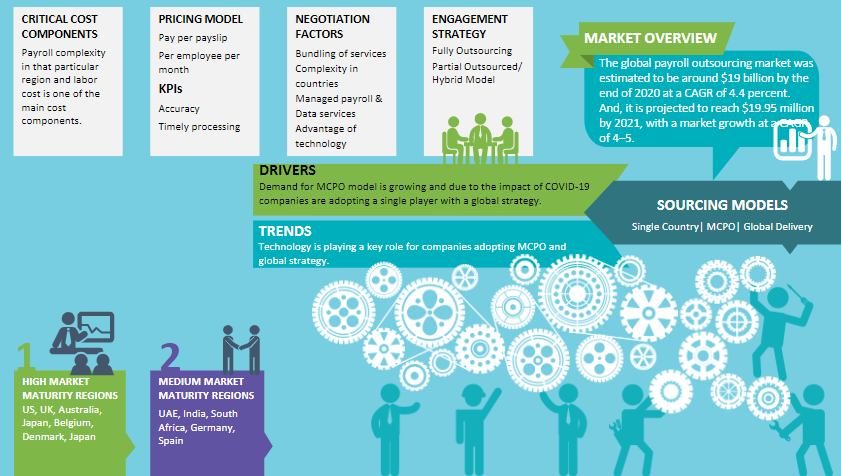

Payroll services is the process of evaluating and generating payslips for employees based on attendance. Outsourcing payroll allows employers to concentrate on its core activities and helps to reduction or control of expenditure by avoiding the hiring of new staff and technology-driven cost. The report highlights the key trends, sourcing practices and suppliers in the market.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Payroll Outsourcing Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Hogan Lovells announces its next Germany Managing Partner

December 14, 2022By designing the appropriate employee financial wellness financial stress can be lowered.

April 18, 2023SD Worx, after a cyberattack, shuts UK payroll and HR services and has taken immediate action.

April 11, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Payroll Outsourcing Services

Schedule a DemoPayroll Outsourcing Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPayroll Outsourcing Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Payroll Outsourcing Services category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Payroll Outsourcing Services category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

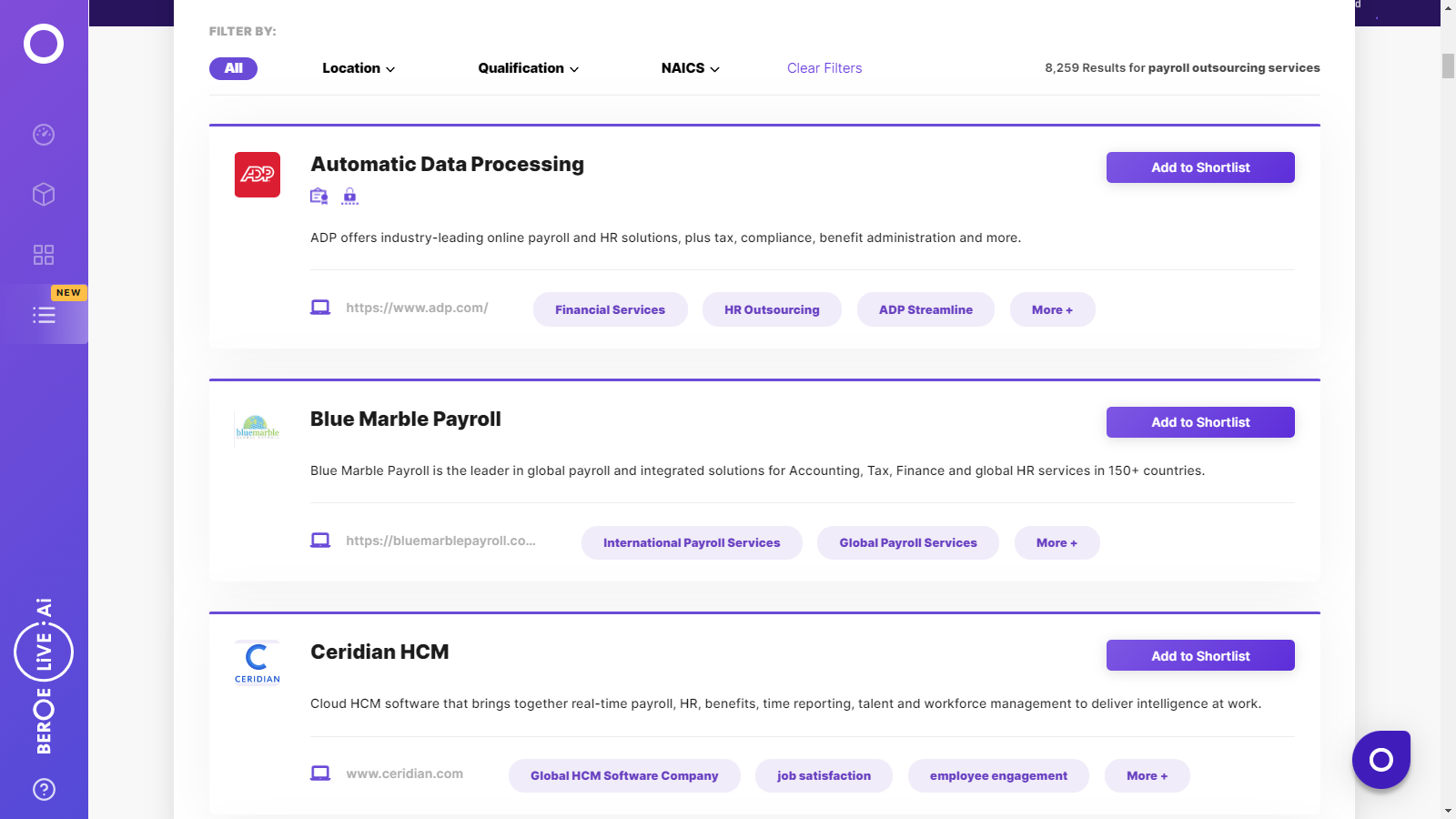

Payroll Outsourcing Services Suppliers

Find the right-fit payroll outsourcing services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Payroll Outsourcing Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPayroll Outsourcing Services market frequently asked questions

Beroe's report provides an accurate update on the latest payroll outsourcing statistics. As per the report, the payroll services industry is expected to reach a market size of $10336 million by 2023 at a CAGR of 4.4%.

The major contributors to the payroll services industry are North America and Europe with a market share of approximately 71%. Other emerging players are APAC and LATAM.

Some of the latest trends in the payroll services industry are the emergence of factors such as political uncertainty and low crude oil prices affecting the industry. Key players such as North America and Europe have grown to hold considerable market size in the industry. Finally, payroll labor and non labor costs also contribute to the total cost of payroll services.

The payroll services industry is expected to grow at a constant CAGR of 4.4%.

Some of the global drivers of the payroll services industry are outsourcing that can offer cost saving options, better compliance with payroll legislations and growth of cloud-based payroll services. Furthermore, there's also an expected increase in the abilities of single vendors who can handle payroll across countries.

Payroll Outsourcing Services market report transcript

Payroll Outsourcing Services Market Analysis and Global Outlook

-

The global payroll outsourcing market is forecasted to grow by $25.96 billion at a percentage of 5–8 by 2026

-

This year is a consolidation of the payroll services, as firms expand their regional capabilities and presence. Payroll suppliers are adding EOR to their services to benefit the remote workforce

-

Companies are engaging with multi-country payroll providers and reducing the engagement with multiple local suppliers. It would be a key to reduce the payroll complications, reducing the cost, and keeping compliance in check

Payroll Outsourcing Global Market Maturity

-

The demand for suppliers with the latest technology or the technology that assists in multi-country payroll has been increasing. The technology has been assisting the clients in line with the compliance part. Suppliers are innovating to offer clients a one-stop solution for their payroll needs. For example, Mercans has been placed as a unique global payroll technology supplier that can assist any global payroll services delivery model, including SaaS, managed payroll, and EOR.

Payroll Outsourcing Services Global Industry Trends

-

Companies are facing challenges in long-tail countries

-

Companies are facing challenges with a lack of knowledge of the nuances in HR processes among long-tail countries

-

The number of employees is so low. They are faced with high fixed costs per employee, as the local HR service has become exorbitantly high

-

Clients are planning to invest in modern technology, particularly cloud platforms. It will assist organizations in truly automating, harmonizing, and transforming payroll into a single experience.

-

Suppliers are innovating their offerings by the adoption of Earned wage access and technology that automates the payroll process

Global Payroll Complexity Index Analysis

-

The payroll complexity of European countries is very high. Western European countries, like France, Germany, Italy, and Belgium, are higher than the average complexity. There is no one-size-fits model for Europe

-

In LATAM, Venezuela, Argentina, Brazil, and Mexico are the countries that top the list in payroll complexity. The constant legislative changes are also one of the reasons for the payroll complexities. In Columbia and other LATAM countries, the complexity has reduced, due to the automation in payroll. It has replaced the manual process

-

In the APAC region, Japan, UAE, Singapore, Australia, and New Zealand have high Payroll complexity

-

The higher payroll complexity will lead to an increase in Cost Per Payslip

-

Companies can consider critically, evaluating the potential suppliers‘ geographic service delivery model, particularly for the below-listed countries, to minimize the compliance risk

Cost Structure Analysis : Payroll Outsourcing Services

System Costs

-

To keep up with the payroll outsourcing demand, suppliers will need to upgrade infrastructure, which will result in higher costs.

Payroll Labor and Non-Labor Costs

-

An increase in salary requirement of training professionals to keep up with the changes and the hiring of new staff will lead to an increase in payroll cost.

Time Collection Costs

-

With the increase in automated solutions for time and attendance services, the requirement for manual entries is decreasing, resulting in a decrease in cost.

Payroll Maintenance Costs

-

The increase in infrastructure and requirement for experienced professionals to maintain it will lead to an increase in payroll outsourcing costs.

Supply Trends and Insights : Payroll Outsourcing Services

Global/Regional Supplier

Increase in the adoption of cloud technology

-

Suppliers are continuing to boost automation capabilities, which include robotic process automation, artificial intelligence, machine learning, and chatbots to replace manual payroll processing activities

-

Online accounting maker Xero and Gusto have announced a new partnership that will allow Xero users to have integrated access to Gusto’s full-service payroll solution.

Single-payroll processes

-

Suppliers are increasing their capability to provide MCPO services to satisfy the buyers’ demand for single-payroll processes/technology across all countries.

-

I Solved HCM acquired AmCheck provider to offer payroll services with offices across the US

Tier-2/Local Supplier

Increase in acquisitions of local suppliers by global suppliers

-

SD Worx, the payroll supplier, has acquired HR and Payroll Software Intelligo. This acquisition has assisted SD Worx to expand its presence in Ireland.

-

SD Worx has expanded its coverage in Spain by acquiring Integrho. It aims to be a leading European provider of integrated end-to-end HR solutions.

-

UKG has acquired UK-based Quorbit. It’s a workforce planning solutions company that assists in labor budgets and recruitment strategies.

-

Paycor HCM provider had acquired Talenya. It's an AI-driven recruiting platform that automatically sources talent quicker at a lesser cost.

Engagement Trends

-

Most adopted model globally: Hybrid/partial outsourcing

-

Why? To maintain the security of confidential data

-

Contract length: The length averages four years.

-

Pricing strategy: Pay per slip

Why You Should Buy This Report

- The report gives details on key global suppliers like Workday, ADP, NGA Human Resources, etc. including a detailed SWOT analysis.

-

It provides information on the payroll outsourcing market size and Porter’s five force analysis on the developed and emerging markets.

-

It lists out the key drivers and constraints of the global payroll outsourcing industry.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now