CATEGORY

Payment Processing Services

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Payment Processing Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Consumer Payment Experience driving innovation in Payment Methods

November 16, 2022Metaverse and NFT trademark applications are filed by Visa

November 01, 2022Credit laws might be favourable for FIS and Fiserv.

December 01, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Payment Processing Services

Schedule a DemoPayment Processing Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Payment Processing Services category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Payment Processing Services category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

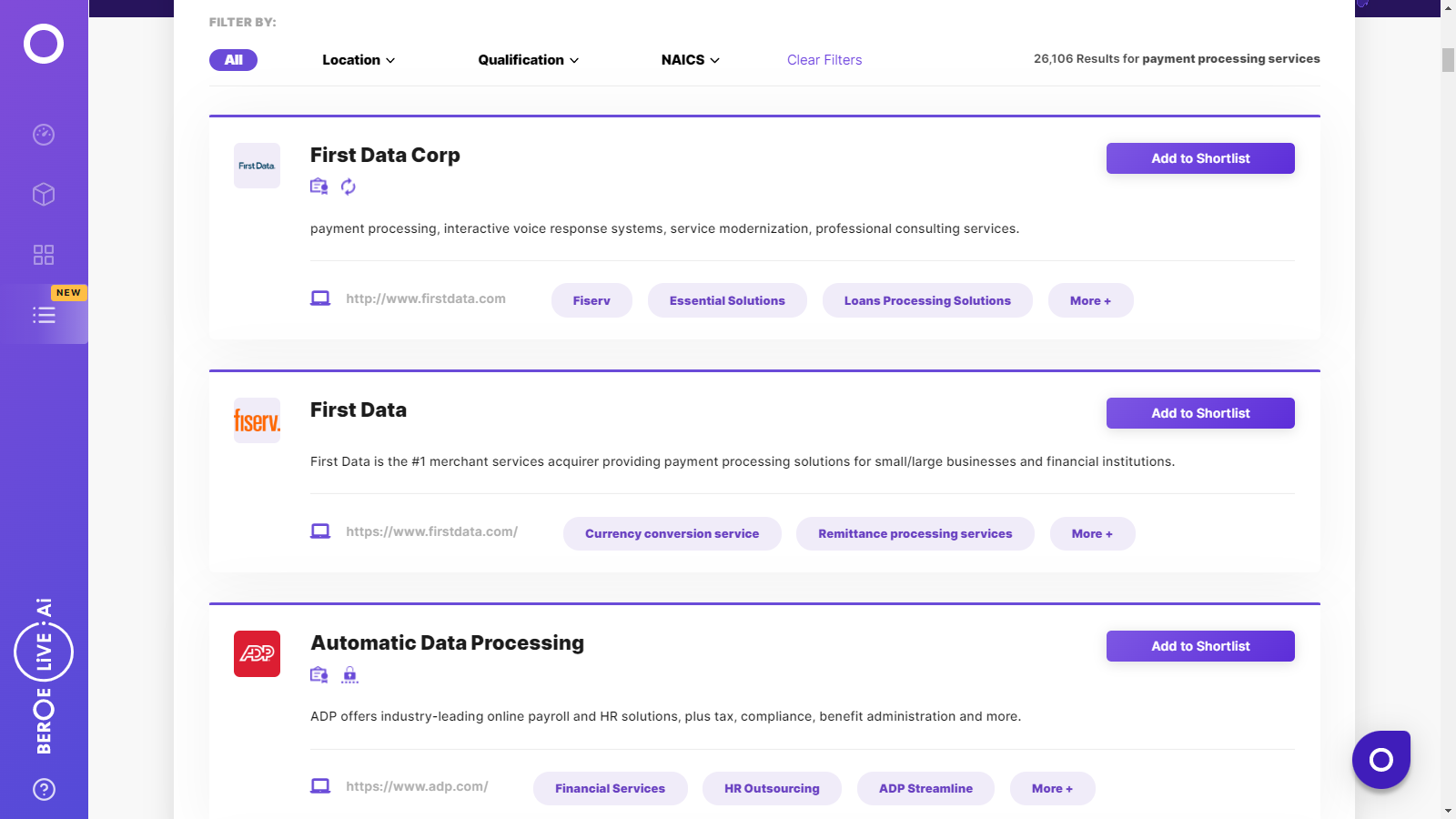

Payment Processing Services Suppliers

Find the right-fit payment processing services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Payment Processing Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPayment Processing Services market report transcript

Payment Processing Services Global Market Outlook:

MARKET OVERVIEW

Global Market Size: USD 90.4 billion (2022)

Global Demand CAGR: 9.9 percent (2022–2026)

-

After the decline in demand for payment processing services during the pandemic, the demand around the globe has bounded back with the market size estimated at USD 90.4 billion in 2022, which is projected to grow to USD 132 billion by 2022.

-

The digital payments market is expected to grow at a CAGR of 9.9 percent for a forecast from 2022 to 2026. e-Commerce and mobile app payments are expected to drive the growth in this industry, with most of the payments being made contactless in a card-not-present environment

-

QR code has emerged as a cost-effective alternative for merchants during COVID-19 times. This method is widely adopted in the APAC region but has a lower penetration rate in Europe and the North American region, as card technology is still the biggest giant here and has even lower penetration in South America and the African Continent where cash is still used by a majority of the population

-

Payment processing to evolve to support BNPL, biometric cards, etc. to match the growing requirement for an agile solution

Payment Processing Services Market Drivers and Constraints

The market is primarily driven by technology-based payment innovations while increasing cyber risk and fraud are the major growth constraints to payments across the globe.

Drivers

-

Globally, the number of customers using voice assistants is increasing and encouraging payments via voice, mainly for e-commerce transactions

-

Machine learning can help retailers to offer targeted products and encourage the usage of payment card

-

Solutions for digital payments are expected to drive the growth of this market

-

Increased usage of cards and mobile payments over cash by both the retail and wholesale customers in a POS location

-

The pandemic time saw a drastic increase in the use of POS financing and Buy Now Pay Later options, both of which helped customers to buy huge stocks of essential goods by splitting one huge bill into 2–4 easy-to-pay installments

Constraints

-

Increasing identity theft and related fraud, e.g., synthetic ID fraud in e-commerce transactions have forced regulators to step in

-

Increasing regulatory requirements, like robust identity management and risk-based authentication, wherein several layers of security must be passed to minimize violation risk and enhance the associated cost

-

Primary growth of digital payments among the millennials and Gen Z, while more than 70 percent of Gen Y and baby boomers, still prefer cash as the primary mode of payment.

Key Technology and Market Trends in Payment Processing Services

The top advanced payment technologies expected to be adopted include QR Code and Mobile App payments.

QR Code Payments & Mobile Apps

-

QR Code emerged to be a cost-effective alternative option for merchants during the COVID-19 times

-

In addition to conventional acquiring. Central Banks of Thailand and Malaysia launched a cross-border QR payment linkage to enable their customers and merchants in both countries to send and receive cross-border payments instantly via QR payments

-

Adoption levels of mobile apps for payment are increasing globally with a major increase in the APAC and North American region

Focus on building merchant loyalty and increasing volume to stimulate growth, post the outbreak of COVID-19

Boosting merchant loyalty is expected to resolve some of the problems:

-

Waiving of rental of POS terminal, if the merchant meets certain thresholds, in terms of transaction volume

-

Providing discounts or waiving certain fees to merchants, who provide online or contactless payment options or those who sell essentials during the lockdown

Market Toward Consolidation

-

Industry consolidation is driven by large processors improving their economies of scale and expanding their geographical footprint through acquisitions

-

Reduction in revenue per transaction has resulted in the expansion of processor’s service portfolios and deepening of the value chain and market consolidation among processors

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now