CATEGORY

Payment Card Production Market Africa and Europe

Report coverspayment card production suppliers, manufacturing costs and established market trends, price trends, sourcing best practices.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Payment Card Production Market Africa and Europe.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

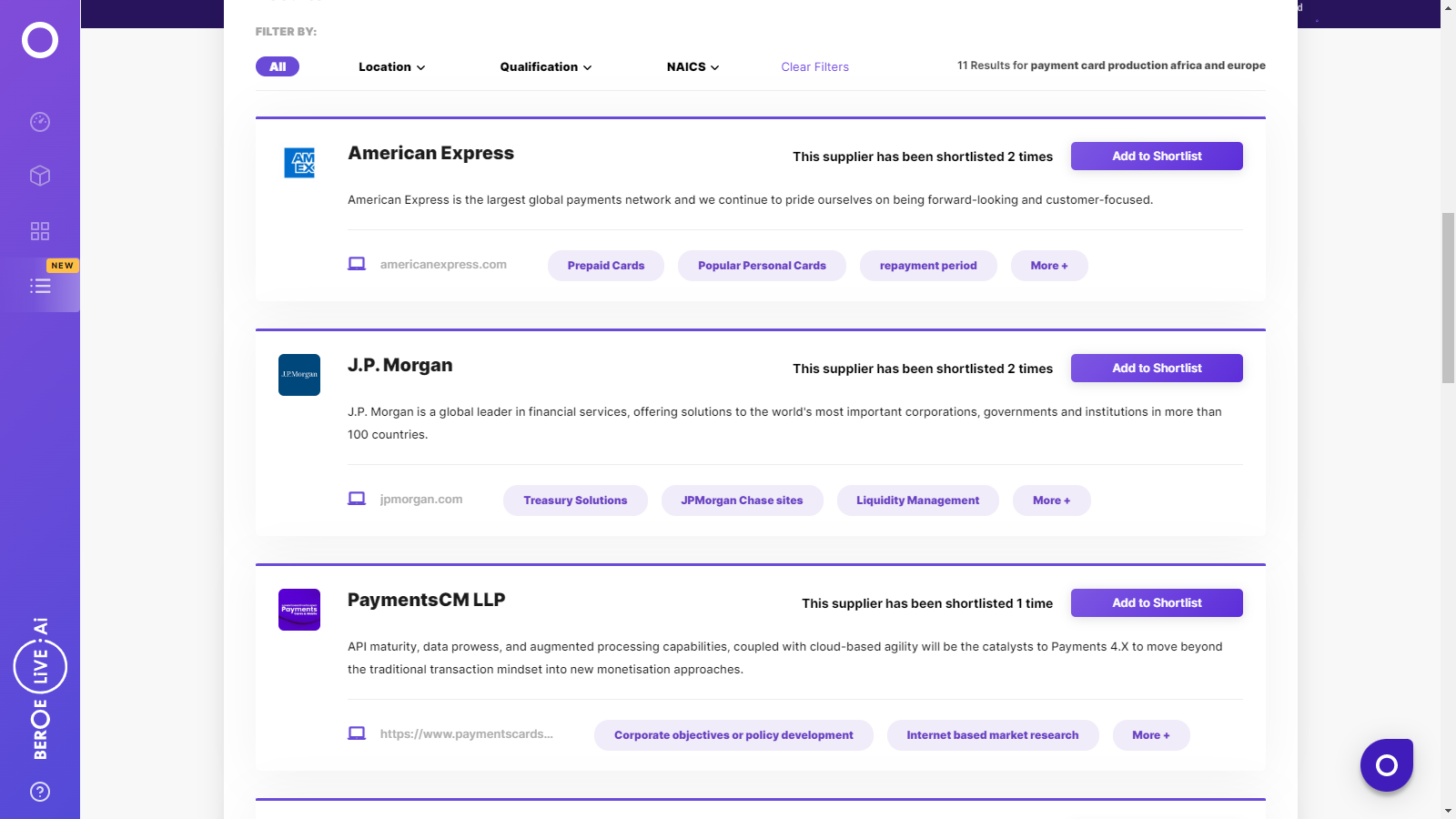

Payment Card Production Market Africa and Europe Suppliers

Find the right-fit payment card production market africa and europe supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Payment Card Production Market Africa and Europe market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPayment Card Production Market Africa and Europe market report transcript

Regional Market Outlook on Payment Card Production Market

Geographic Segmentation

Europe, which is currently the third largest card production market continues to grow, driven by increasing demand. The Middle Eastern and African markets however have witnessed a sharp decline in 2017.

Europe Market

- Europe ranks second in card production in terms of revenue at $4.38 billion, and third in terms of units at 6 billion cards

- Card production revenue declined by 5.3 percent while the number of cards produced increased by 2.4 percent

- Decline in dollars is mainly due to price volatility of chips and currency fluctuations, while the increase in number of units is driven by steadily increasing demand

MEA

- MEA region is the smallest in the world in terms of card production revenue with just $823 million in 2017

- MEA region produced 3.459 billion cards in 2017

- Volume of cards produced decreased by 9.0 percent, while card production revenue declined by 5.0 percent in 2017, in MEA

Market Segmentation

Despite lower volumes, chip cards account for higher value in terms of card production revenue across the globe.

Chip Card

- Chip cards represented 88.3 percent of revenue for cards globally manufactured in 2017

- Nearly 70 percent of all financial cards have chips

- In Europe, 59 percent of cards produced in 2017 were chip cards,but they accounted for 93 percent of card production revenue

- Similarly in MEA only 16 percent of cards produced in 2017 were chip cards, but they accounted for 84 percent of card production revenue

Financial Cards

- Financial cards make up the largest unit market and second-largest dollar market at 5.69 billion cards and $4.67 billion respectively

SWOT Analysis

- Strengths:Continuous innovation in the industry and stable growth owing to rising demand

- Weaknesses:Industry is highly susceptible to foreign exchange and market risk

- Opportunities:Growth in global e-commerce and resultant growth in demand for cards

- Threats:Losses due to card fraud,security issues due to data breach, skimming, etc, and high competition in the industry with several new entrants

PEST Analysis

Recent technology innovations and changing buyer preferences underpin card industry growth across the world in 2018.Also, increased data breaches has resulted in additional regulation such as enhanced PCI DSS.

PCI DSS – Version 2

- Dynamically evolving legal and regulatory environment presents a key challenge to companies operating in the payment card manufacturing space, particularly in Europe

- Latest change includes version 2.0 released by The Payment Card Industry Security Standards Council (PCI SSC) in 2017

Contactless Card Payments

- Similarly, continuous innovations in the industry has forced top players to invest in recent technology to retain their market position

- Mastercard has announced plans to strategically drive contactless adoption in Africa, Middle East, Europe, Latin America, and Asia Pacific

Political

- Government intervention, regulations and political stability will affect businesses of major players

Economical

- Volatility in currency markets will adversely impact the industry

- Increasing purchasing power in Africa to drive card payments

Social

- Global shift towards digital payments and EMV cards

- Buyer preferences for new payment methods like QR, contactless, etc.

Technological

- Continuous innovations force investments on technology

- Acquisitions to enhance technological competency

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now