CATEGORY

Paper

Printing and writing paper or graphic papers can be used for a variety of end use applications such as Books, Magazines, Office printing and writing paper, Brochures, Pamplets, Paper labels, leaflets, inserts etc. Graphic papers at a high level can be classified into coated and uncoated, woodfree and mechanical papers.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Paper.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Stora Enso plans to shut down one paper line at the Anjala manufacturing plant in Finland.

April 13, 2023Mondi in partnership with ATS- Tanner introduces paper band for food bundles and multipacks

April 03, 2023Increased energy and material prices caused a cash shortage, leading to the bankruptcy of Crown Van Gelder.

January 31, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Paper

Schedule a DemoPaper Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPaper Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Paper category is 5.00%

Payment Terms

(in days)

The industry average payment terms in Paper category for the current quarter is 50.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Paper market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPaper market frequently asked questions

Beroe's paper industry analysis finds out that the major players in the industry are Asia, LATAM, and MEA.

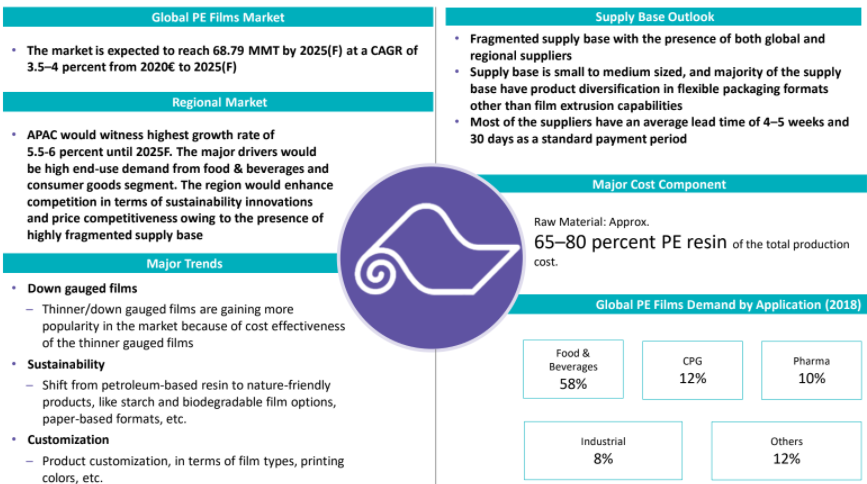

As per Beroe’s category intelligence report, the global production volume of paper will multiply at 3.5-4% CAGR during 2020-2025, reaching around 69 million metric tons (MMT).

The global paper industry statistics suggest that the global demand for paper is declining, so is the demand for North American and European writing and printing paper. One of the major cost drivers for the paper industry as per the paper industry report by Beroe is raw materials.

A majority of the global paper market revenue will come from food and beverages. Moreover, market players are exploring potential avenues in pharmaceuticals and consumer packaged goods (CPG).

The global paper industry report by Beroe reveals that global paper demand is expected to decline at a CAGR of 4-5%.

Despite the countrywide lockdowns and subsequent supply chain disturbances amidst the COVID-19 crisis, leading paper producers are striving to satiate the growing demand for tissue papers from healthcare institutes. Moreover, the public-health crisis is influencing manufacturers to develop antimicrobial tissues that are efficient in combating the COVID-19 infection.

The major price drivers for the global paper industry are supply and demand. Supply disruptions like mill closures can lead to price fluctuations. Some of the other price drivers are raw material cost, labor cost, and energy and chemical cost.

Rising internet penetration, along with increasing usage of electronic gadgets, has driven online retail sales worldwide, especially in emerging regions – China, India, and Brazil. Consumers are increasingly shifting toward digital channels to purchase various essential products. Moreover, paper packaging is lightweight and convenient for transportation and logistics. As such, the booming e-commerce sector will push the demand for corrugated boxes and paper bags over the years ahead.

The increasing shift from petroleum-based resin to eco-friendly alternatives, such as paper-based formats, starch, and biodegradable films, and product customization are significantly influencing the growth curve of the global paper market.

Paper market report transcript

Global Paper Market Outlook

-

The paper market is likely to grow at a rate of 3–4 percent from 2023 to 2026, attributing to rising demand for paper packaging in the FMCG, retail, hospitality, healthcare, quick service restaurant, and pharma industry, along with increasing consumer environment sustainability concern and awareness issues, like biodegradability, health problems, and global warming produced by plastic, leading to a higher shift to paper packaging

-

The COVID-19 impact has changed the consumer buying preference to online from in-premise, leading to increased e-commerce and restaurant takeaways, increasing the demand for paper packaging

Global Paper Market Overview

-

The paper is expected to grow at a rate of 3–4 percent from 2023 to 2027, driven by the rising demand for packaging paper by major companies in the retail, FMCG, pharmaceutical, and hospitality industries. Increasing concerns over the environment sustainability, such as biodegradability, health problems, and global warming produced by plastic, are leading to a higher shift to paper packaging

-

There is a huge demand from the e-commerce and QSR industry, especially after the onset of the COVID-19 pandemic, the consumer habits changed faster than ever, and e-commerce driving the paper packaging market extensively

Cost Structure Analysis : Paper

-

Asia does not have a cost competitive feedstock, yet the prices and margins of paper are the lowest, given its excess capacity

-

Margins for the North America and Europe paper producers are high, due to high feedstock prices, which, in turn is driven by the regions’ structural capacity deficit

-

The recent capacity additions and increase in exports from Asia could increase the level of competition in North America and European regions, which could open up a scope for price negotiation

-

Raw material, pulp accounts for 60–65 percent of the raw material cost, which is the key cost driver

-

Prices are expected to increase further in the coming months, as the supply is expected to remain tight. Lack of railcars and shipment delays are also expected to continue

Paper Price Drivers

Raw Material Cost

-

Raw material is one of the key cost drivers for paper. This is because it constitutes 60–65 percent of the total cost of production. In case of paper, the cost of procuring pulp is an essential element to determine cost structure of different grades of paper. Different quality of paper have different requirements of either virgin pulp or recovered pulp, according to which the final cost is arrived

Labor Cost

-

The impact of the labor cost is moderate. However, during bulk production, it might have a significant impact on the overall cost. Labor cost varies from region to region depending upon the availability and skills. Countries like India and China would have cheap manpower due to abundance. On the other hand, countries like North America and Europe would have expensive manpower. Therefore, labor cost is one of the cost drivers for paper production

Energy and Chemical Cost

-

Utility cost including electricity, maintenance, fuel and other related cost which directly impacts the cost of production. This is considered to be the driver as these cost are added to the total cost in order to determine the overall cost of production. Though these are considered to be the variable cost, it has enough affect on the spend of the company for producing the product

Demand and Supply Dynamics

-

Supply-demand is one of the key and foremost drivers of price in the paper industry. Any increase/decrease in demand from the end-user segment will lead to manufacturers announcing price changes, even without an movement in the other costs

-

Supply disruptions like down time, mill closures by manufacturers or natural disasters would lead to shortages or a tight supply, attributing to price fluctuation. Similarly, weak demand could lead to price declines

-

Key Drivers: Downtimes, closures, new capacity, order backlogs, lead time

Exchange Rate and Inflation

-

China, being the major exporter of paper, has large demand for pulp which it generally procures from North/LATAM but due to recent fluctuations in the US dollar, production costs are expected to vary. Therefore, this cost of procuring the pulp from a foreign country in terms of foreign exchange value indicates as to how much would be the total spend of the company to produce paper

Porter’s Five Forces Analysis: Paper

Supplier Power

-

The pulp producing industry is fairly consolidated, with the top 10 players accounting for 45 percent of the market share, of which only a few large suppliers of are forward integrated with paper production

-

Major end-use industries of market pulp are P&W paper, and tissues, which account for 80 percent of the market value. Hence, the dependency on demand from P&W paper is high

Barriers to New Entrants

-

Huge capital investment is the primary barrier

-

The market is already consolidated with 75 percent market share held by the top five players in the coated grade and 60 percent in the uncoated side

-

Most importantly, the market is in a declining phase and the margins are not attractive. Hence, this market is not favored for the new entrants

-

Acquiring FSC, PEFC certifications can also be a barrier as it is a must have during supplier selection

Intensity of Rivalry

-

There is high level of rivalry in the domestic as well as the export markets in Europe mainly because the European supply of P&W grades is higher than the market demand

-

suppliers take constant effort to gain market share in the domestic market and find new customers in export market as well

Threat of Substitutes

-

Digitalization is the major threat for P&W papers. The rise in technology and evolution of smart phones, advanced computer hardware and storage systems will decrease the demand for P&W papers. While coated paper might still be used for high end printing requirements such as magazines and brochures, office paper and other uncoated paper used for books and notebooks will decline sharply and replaced by digital world

Buyer Power

-

The buyer power in the region is high as there is good availability of paper in the region. Also imports coming from South East Asian market has increased the domestic availability

-

Board suppliers are trying to push tonnage in to the market with rebates and discounts, and they are also flexible with payment terms due to declining demand conditions and excess capacity

Why You Should Buy This Report

- This report on the paper industry offers information about the market size, regional and global industry outlook, industry trends, and price drivers.

- It provides Porter's five force analysis of North America, LATAM, Asia, as well as key countries in these regions.

- It provides supplier profiles of major players such as Propal/Carvajal Pula y Papel, Lecta, and Sappi Europe, among others.

- Furthermore, the report on the paper industry trends details the major innovations in the global market.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.