CATEGORY

Palm oil

Global palm oil supplies have been witnessing a steady growth in the recent past. It is the widely consumed vegetable oil in the world driven by the Asian demand, India is the major palm oil consuming country for food applications.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Palm oil.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

India likely to increase the import taxes to support domestic farmers

March 07, 2023Palm Oil stockpile to remain lower in the near future

April 12, 2023Malaysia and China ink pact to strengthen palm oil trade

April 03, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Palm oil

Schedule a DemoPalm oil Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPalm oil Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Palm oil category is 7.00%

Payment Terms

(in days)

The industry average payment terms in Palm oil category for the current quarter is 120.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Palm oil market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPalm oil market frequently asked questions

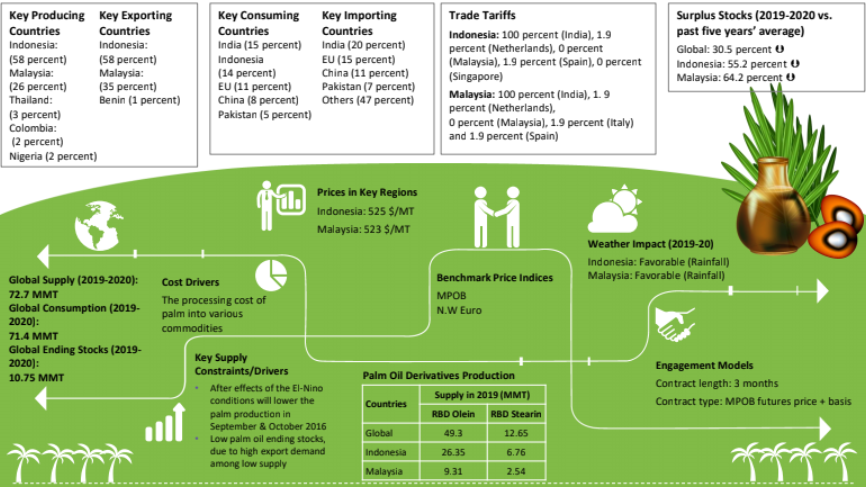

As per the global palm oil market analysis report by Beroe, Indonesia leads the pack with 55% of the global production, followed by Malaysia with 30%. Further, Thailand produces 3% of palm oil while Nigeria and Colombia produce 2% each.

The global palm oil production was expected to climb from 64.5 MMT (Metric million tons) to 68.4 MMT in 2019 at 4.3% CAGR owing to rising demand from countries such as Indonesia, Malaysia, Thailand, India, and China. The average monthly consumption of palm oil was anticipated to remain at 5.7'5.8 MMT in 2019. Furthermore, the palm oil report reveals that palm oil stock levels, as well as overall palm oil market share, are expected to increase in the near future.

As per Beroe's industry analysis and research, prices of the palm oil and contract structures are decided by distributors using MPOB and N.W Euro crude palm oil futures and adding the basis and freight expenses. The basis is the difference between cash and futures costs. The profit margin fixed by the purchasers is based on the time of purchasing and selling. The palm oil price in Indonesia was $622 per MT while the price in Malaysia was $632 per MT. The palm oil report further suggests that the price of palm oil will increase due to a decrease in production.

The global palm oil market is majorly driven by increasing demand from food applications, followed by industrial use cases such as biodiesel manufacturing. The projected global consumption of palm oil in the biodiesel industry in 2017 climbed from 8.77 MMT to 9.53 MMT, up by 9'10% compared to the previous year. Experts reckon that the palm oil demand is likely to escalate in various industries.

Palm oil market report transcript

Palm Oil Global Market Outlook

Market Overview

Global Supply (2022–2023): 144.4 MMT

Global Consumption (2022–2023): 76.7 MMT

Global Ending Stocks (2022–2023): 17.05 MMT

Cost Drivers

The labor cost and processing cost of palm into various commodities

-

Indonesia and Malaysia are the chief palm oil producers in the world and together account for around 85 percent of the global palm oil supply. Global production of the four vegetable oils- palm oil, sunflower oil, soybean oil, and rapeseed oil, is estimated to increase in 2022

-

The national crude palm oil output of Indonesia will rise by 2.5 percent to 46.5 million tons in 2022 compared to 45.3 million tons in 2021

Global Palm Oil Supply–Demand Analysis

Palm oil production in both Indonesia and Malaysia is expected to continue in a positive trend in 2023. Malaysia may continue to face the ongoing labor shortage for a few months. Indonesia will be able to have a more vigorous output recovery relative to Malaysia, due to good estate management and no halt of operations, as well as a labor shortage.

Market Outlook (2022–2023)

-

Palm oil production is expected to increase in Colombia by 0.1 MMT and in Thailand by 0.2–0.3 MMT and in other countries, Guatemala, Honduras, Brazil, and several African countries, and in Papua New Guinea

-

The major consuming country and importer, India is all set to improve the domestic supply of major edible oils to face the consumption demand and also reduce imports.

-

Malaysia’s palm oil stocks are expected to rise by 5-8 percent month-on-month (MoM) to 1.68 million tons at the end of 2022, due to higher output and lower exports

Global Palm Oil Trade Dynamics

-

Indonesia and Malaysia are the largest palm oil-exporting countries, accounting for approx. 90 percent of the global exports with most of the imports to India, the largest palm oil importing country. India’s imports were declining till June but increasing since the beginning of July and are expected to improve in the upcoming months.

-

The global palm oil trade from 2016/2017 to 2021/2022 is estimated to grow at a CAGR of 4 percent. The major export destinations of palm oil in 2021 are India, China, European Union countries, the US, and Pakistan. The US import may not increase significantly but the lesser-than-expected, soybean production estimate may strengthen demand for palm oil.

-

Indonesian Government’s unstable policies on palm oil exports have disrupted the market. The palm oil export ban is lifted by the Indonesian government, but still, the exporters had to face some difficulties, such as the unavailability of cargo. Thus, the changing export policies may not have a positive effect on the market

Global & Regional Palm Oil Derivative Markets

The crude palm oil is processed into the RBD Palm Olein and RBD Stearin. Globally, palm oil derivatives have been estimated to increase at a CAGR of 1 percent from 2015–2016 to 2021–2022. The crude palm oil prices and share prices of most of the planters are falling after the export ban is lifted. With an increasing trend in the population and FMCG industry, the usage of palm oil derivatives will substantially increase.

-

The Indonesian palm oil derivatives have been estimated to decrease at a CAGR of 4.5 percent from 2015–2016 to 2021–2022

-

The palm oil derivatives market is expected to grow at a CAGR of around 7 percent for the next five years.

-

Palm olein and palm stearin are majorly used in the food and oleochemical industry. The increasing trends of the FMCG industry in emerging markets will boost the palm derivatives production

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.