CATEGORY

Organic Food Preservatives

Food preservatives are substances added to prevent microbial contamination and to increase the shelf life of food. Natural or organic food preservatives have a higher gravity due to the shift in consumer preference for healthy, safe and natural food preservatives.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Organic Food Preservatives.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Organic Food Preservatives Suppliers

Find the right-fit organic food preservatives supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Organic Food Preservatives market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoOrganic Food Preservatives market report transcript

Organic Food Preservatives Global Market Outlook

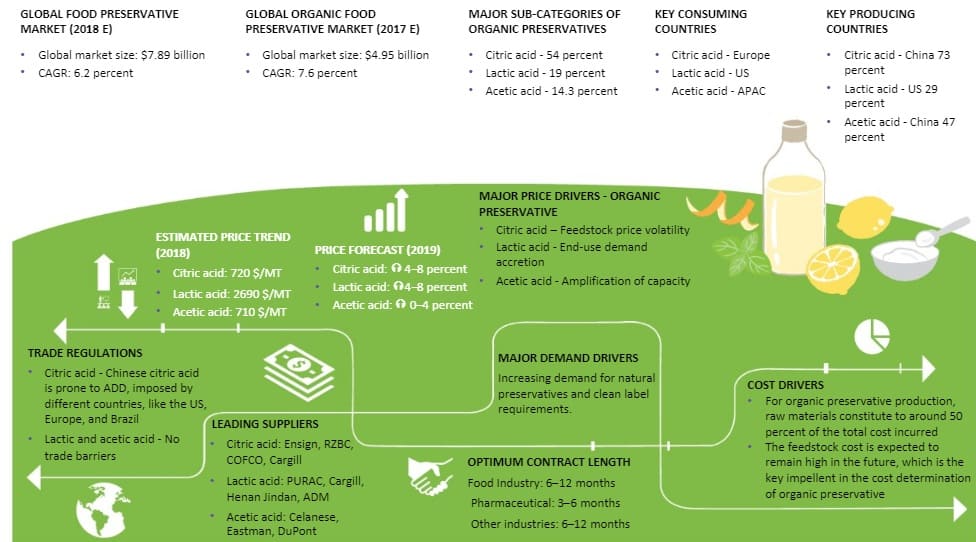

- The global food acidulants/organic preservatives market is rising at a CAGR of 7.6 percent (2015–2020)

- APAC and the US are the major producers and consumers, followed by Europe.

Procurement Best Practices - Organic Preservatives

Procurement Best Practices - Organic Preservatives

Length of fixed-price contracts largely depends on the volume procured. Food & beverage companies engage in long-term contracts, and relatively smaller buyers from personal care and pharmaceutical industries are offered short-term contracts

Contract Length

Beverages is the largest buying segment of preservatives. Length of contract largely depends on the volume procured

Supply Base

Buyers split their procurement volume across 2–3 suppliers to leverage on tight competition and benefit from competitive pricing

Supplier

To reduce cost, maintain consistency in quality and to measure supplier performance, buyers generally procure from manufacturers

Citric Acid MIP Calculation - Brazil

- Price commitment between Brazil and Chinese citric acid suppliers was initiated in 2012 to avoid the definitive ADD imposed by the Brazilian government

- MIP is calculated every quarter, depending on the price of sugar # 11 on the Futures Exchange New York (ICE), hence knowledge about the MIP formula and its implementation cycle will be the key in formulating the strategy for citric acid procurement from China

Market Analysis of Food Preservatives - Global

- The food preservative market grows at a CAGR of 6.2 percent and is expected to increase in the approaching year

- North America is the largest market for food preservative, followed by APAC and Europe

- The APAC market is expected to witness a higher growth rate during the forecast period

- Food preservatives can be segmented as synthetic and natural or food acids. The former group includes propionates, sulphates, sorbates, and benzoates. Natural or organic food preservatives are citric acid, lactic acid, acetic acid, tartaric acid, etc.

- The organic preservative market is majorly driven by citric acid and lactic acid in food applications

- Europe is expected to witness high growth of both natural and synthetic food preservatives

- APAC is expected to show the highest growth over the forecast period, on the account of shift in consumer trend toward healthy and safe food, mainly in emerging countries, such as India, China, Indonesia, Taiwan, and Malaysia

Market Analysis of Food Acids/Organic Preservatives - Global

- The global organic preservative market is projected to reach $6.1 billion by 2020, growing at a CAGR of 7.6 percent

- Increasing demand for processed foods and health conscious products is significantly propelling the growth in food & beverage industry, which, in turn, is driving the growth of the acidity regulators market at a steady rate

- Organic food preservatives majorly function as gelling agents, flavor enhancers in confectionary products & beverages and most importantly as food preservative to extend the shelf life of food

- Beverages is the largest segment in which food acids are used, followed by sauces, dressings, and condiments

- Processed food forms the third largest segment in which acidity regulators are used as food additive

- These organic acids are produced either by conventional method such as fermentation or by using modern technologies, namely methanol carbonylation and acetaldehyde oxidation

Citric Acid - Global Food Preservatives

Market Analysis

- The global citric acid production is increasing at a CAGR of 4.4 percent, gaining support from the production growth in Asia

- China, which accounts for more that 70 percent of the global production, is investing in capacity expansion, in order to increase its export market share

- The global citric acid market is expected to increase in 2017 to 2.37 MMT, owing to the augmenting demand for citric acid in the end-use industries. Around 90 percent of the citric acid is produced through fermentation, 7 percent through extraction from citrus fruits, and the remaining 3 percent produced through chemical extraction

- The need for acidulant in the food & beverage industry is a major demand sink for citric acid, consuming close to 75 percent of the citric acid produced, acidulant consumption by the food & beverage industry could increase in near future

- Suppliers in the industry are focusing on increasing their production capacities to cater to the elevating product demand

- Chinese players dominate the citric acid market, with the presence of few eminent players, such as Ensign, RZBC, and COFCO

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now