CATEGORY

Fruits

Asia and Europe are the leading producers of fruits globally, with USA and Europe being the top consuming regions in the processing sector. The preference forfruits for fresh consumption is growing among the consumers and is dispaying a higher demand growth than processed fruits.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Fruits.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Fruits Suppliers

Find the right-fit fruits supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Fruits market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoFruits market report transcript

Global Overview of the Fruits Industry

The US, Europe, and Asia are expected to produce over 70 percent of the global fruit market supply. Highest growth can be expected in the minimal processed sector, with APAC having the highest CAGR, owing to increased demand for convenient food and rise in the living standard

Procurement Insights Based on Seasonality

Prices can be expected to be the lowest during harvest and post harvest periods and higher during off season. Ideally, buyers could capitalize the low price periods and procure a higher share of their raw material requirements and secure contracts that ensure a steady supply throughout the year, as bulk buying would incur additional costs, such as cold storage and inventory maintenance and spoilage losses. The buyer should also anticipate the surge in demand during the harvest periods, which could push the prices slightly up and plan their procurement strategy accordingly.

Supplier Identification Parameters

- Spot markets, contract suppliers, and contract farmers are the common procurement channels for the fruit processors while exporters usually use spot market and contract supplier sources. Contract farming is popularly viewed as a secure source of raw materials by food processors/manufacturers. However, the lack of structure in managing linkages with small farmers, especially in developing countries is a challenge faced by the industry

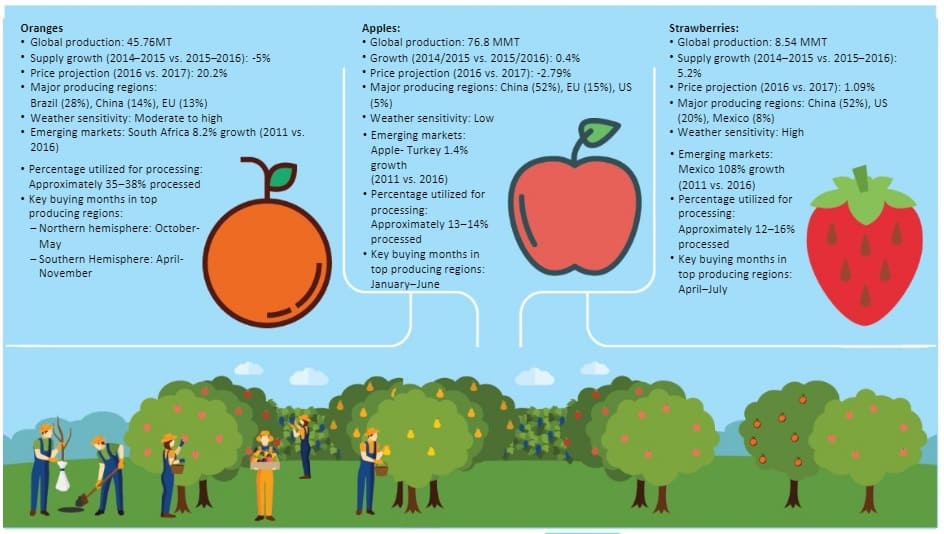

Apples Market Snapshot

Key Price Drivers (2016-17)

- 3.8 percent increase in production since 2013 and surge in exports

- Increased preference for fresh fruit consumption, growth in demand mainly driven by emerging markets

Key Price Drivers (2017-18)

- Increased acreage, existing stockpile and higher production, if good growing conditions prevail, would significantly impact prices

- Strengthening of the dollar might affect exports from the U.S.

Global Apple Supply and Demand Analysis

- Apple supply witnessed a downturn of about 9.3 percent in 2018, which can be attributed to the losses, due to unfavorable weather like drought and excessive snow in major growing belts, like Europe and China. However, in Poland, apple output experienced a favorable trend, which helped supply levels from falling further

- However, the overall apple supplies are favorable, owing to higher stock, due to increased output from Poland. However, the current season output is estimated to be lowered, due to frost damage

- Low production cost and large-scale production makes Poland a leading producer and supplier of apples, globally However Poland's production is expected to drop by 23 percent in 2017-18 due to spring frosts

- Consumption of fresh fruits, on the whole, is displaying an increasing trend. However, the consumption/demand for apples individually remain largely unchanged, which could be attributed to the availability of a variety of other fruits in the market

Apples Global Demand Analysis

- The increase in consumption of fresh apples by 14 percent and lateral decrease in consumption for processing by 10 percent, reflects the widening gap between apples for fresh consumption and processing in the past five years

- About 40 percent of processed apples in the US is utilized by the juice sector, which is a decrease from previous years

- An overall lowering in demand for processed fruits can be attributed for the reduced demand of industrial apples. A surplus stockpile of apples is expected in 2017

- In the processed apples sector, marginally processed, frozen-cut apples are expected to increase in demand, whereas, the juice sector is expected to display a declining trend in the upcoming years

Apples: Top Consuming Regions in Processing

- China’s apple production is high due to increased acreage, whereas the U.S. has almost double the yields but a lower production area

- There is a surplus production of apples in Poland, with about 15 percent increase in store/stocks, calling for Poland to look at new export markets, with Asia being an attractive prospect

- New Zealand is gaining prominence as an emerging supply base for apples, with significant demand from Asian markets like China and Taiwan

Apples - Global Trade Dynamics

- The ongoing US–China trade conflict continues to impact trade between the two countries, with China looking at alternate markets

- The European exports from the southern hemisphere have declined, due to overproduction, and those shipments have been finding their way, mainly to Asia

Fresh Apples Exports by Country

- Exports to China, India, and Mexico account for about 50 percent of US apple exports, which is expected to have a significant impact as a result of the trade conflicts

Apples Pricing Analysis

- The overall apple supply is anticipated to be favorable, supported by increased output, due to expanded acreage in addition to the existing inventory. The drop in quality of fruits, however, will prevent prices from rising significantly.

- The prices for Chinese apples are witnessing a surge, due to the ongoing US–China trade conflict

Cost Structure Analysis - Apples

Harvesting cost, one of the large cost contributors is driven by labor rates. Labor rates are on a rise in Poland and is expected to affect the production cost of apples in the upcoming years.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now