CATEGORY

Edible nuts

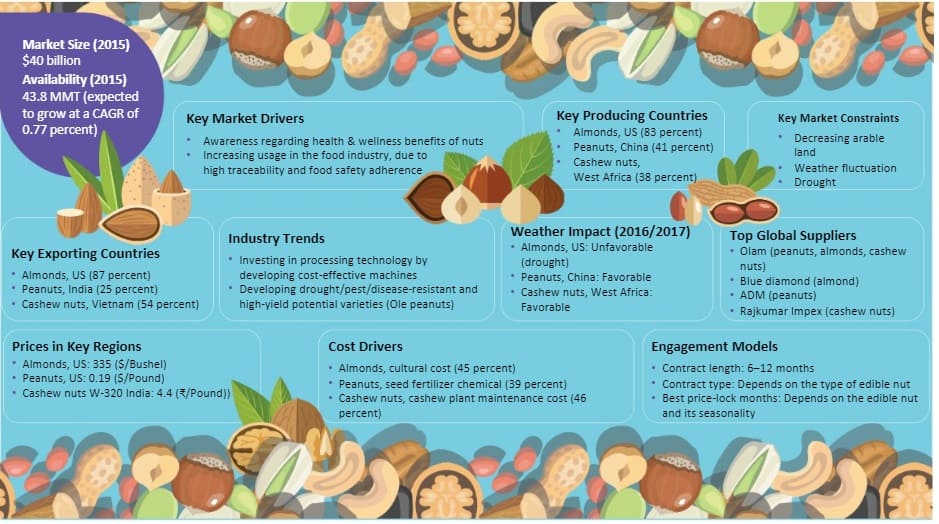

Global edible nuts market, a USD 40 Billion industry, driven majorly by the expensive tree nuts like almonds, cashewnuts, hazelnuts etc, and voluminous nuts like peanuts. Growing awareness of nutrient content of various edible nuts and their contribution to the quality of diet is likely to be the major driver for the edible nuts market.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Edible nuts.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

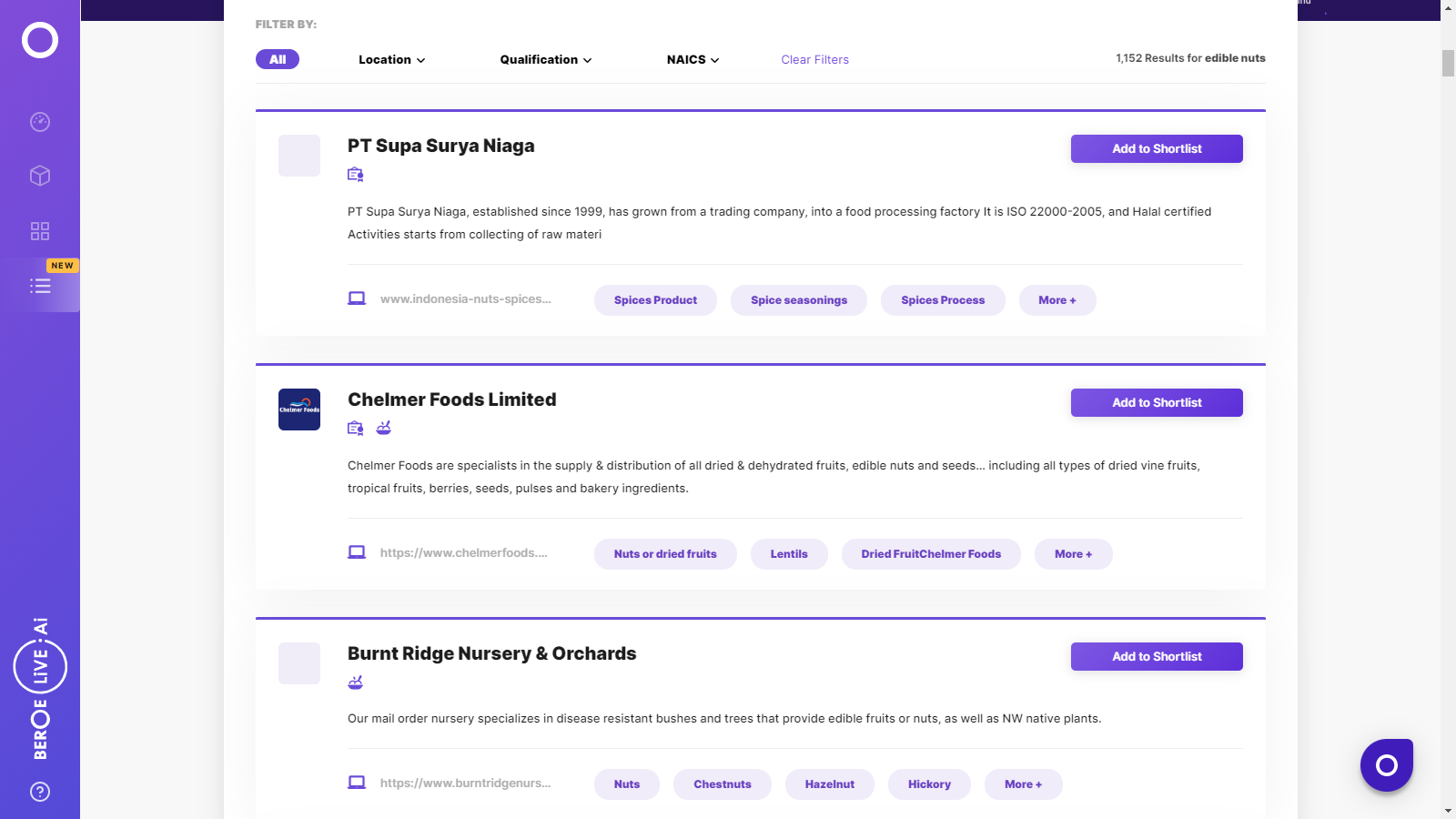

Edible nuts Suppliers

Find the right-fit edible nuts supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Edible nuts market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoEdible nuts market report transcript

Industry Overview-Edible Nuts

The global edible nuts market is valued at $40 billion, majorly driven by expensive tree nuts, like almonds, cashew nuts, hazelnuts, etc. Almonds supply witnessed a high growth rate, owing to its health benefits, followed by pine nuts, pecans, and macadamia

Edible Nuts Production Share (2017-18)

- Favorable weather conditions during 2016/2017 and the demand growing at a CAGR of 8 – 10 percent over the last five years drove a positive outlook for the edible nuts segment

- Approximately 20 – 25 percent of the nuts are sold as ingredients to the food industries, used primarily in bakery, confectionery, flavored drinks, breakfast cereals, snacks, butter & spreads, dairy products, etc., while the rest goes into direct consumption or oil extraction.

- Expanding global trade of edible nuts has led to an increase in investments in processing machines and packaging techniques by suppliers, in order to meet the growing demand and global standards expected by the leading buyers

Market Drivers and Constraints

The major driving force of the edible nuts market is the increasing demand, due to its health & wellness factors, whereas, the major constraint would be the unpredictable weather in the producing regions.

Drivers

Rising health & wellness awareness

- Increasing per capita consumption of various nuts is an indicator of the increasing demand

- Significant promotions by the industry is also helping the consumers to understand the health benefits and various applications

- Increasing disposable income and convenience factor also favor the industry growth

Increasing application in the food and beverage industry

- Increasing adherence toward traceability and food safety of the nuts sourced are encouraging, especially for the products sourced from developing countries

- Sustainability and focus on carbon footprint are seen as the supply assurance strategies by consumers

R&D

- Development of new varieties with high-yield potential and drought/disease/pest resistance are the key factors in the growth of the edible nuts market

Constraints

Climate change and weather volatility

- Unpredictable weather and the evolving climate are the major factors that decide the supply availability each year, irrespective of the increasing demand

Limitation on arable land

- Rapid urbanization is restricting the availability of land for cultivation and various government policies, in terms of land utilization, are magnifying this trend

High cost of production

- The processing of nuts is a complex process, which influences the net cost of the products.Thereby, the high costs of nuts could prevail as an hindrance to the growth of global market

Global Supply–Demand Analysis

The global almond market is estimated to reach 1.28 MMT by 2017/2018 at a CAGR of 4.7 percent. Despite drought and water shortage, which are likely to affect the yield in major producing regions, like California, supply is expected to increase, due to increase in acreage

- Australia is the fastest growing almond supplier, with an average production growth rate of 9 percent since 2014. Almonds occupy about 50 percent of Australia's tree nut acreage

- Australian almond production is expected to increase to 97,000 tons by 2017

- The EU's contribution to global production is forecast to decrease, as more farmers are shifting to other crops for higher profit margins. Spain accounts for 80 percent of production, followed by Italy and Greece

- The US prices have increased by more than 23 percent Y-o-Y between 2013 and 2015, due to extreme drought conditions in California, the major almond growing region

- More than 50 percent of almonds are sold as pure or whole almonds to various food channels and retail stores, whereas the rest of it goes as ingredients into the food applications of confectionery, beverage, dairy, snacks, etc

Global Trade Dynamics

Drought and bad weather continue to be a cause of concern for the US farmers. Underlying threat of fungus infestation continues to persist and is likely to effect the production levels. Buyers can focus on Australia as a possible alternative to avoid supply chain risks, caused due to dependency on a single destination

- Australia, being the fastest growing almond industry, is considered as an emerging competitor, along with Benin, with its good yield rates and a positive market outlook

- The trade volume may witness an average 4 percent growth, as supply increases with increased production. Export demand is also driven by festive season in the consuming countries

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now