CATEGORY

Black Pepper

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Black Pepper.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoBlack Pepper Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoBlack Pepper Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Black Pepper category is 5.83%

Payment Terms

(in days)

The industry average payment terms in Black Pepper category for the current quarter is 72.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

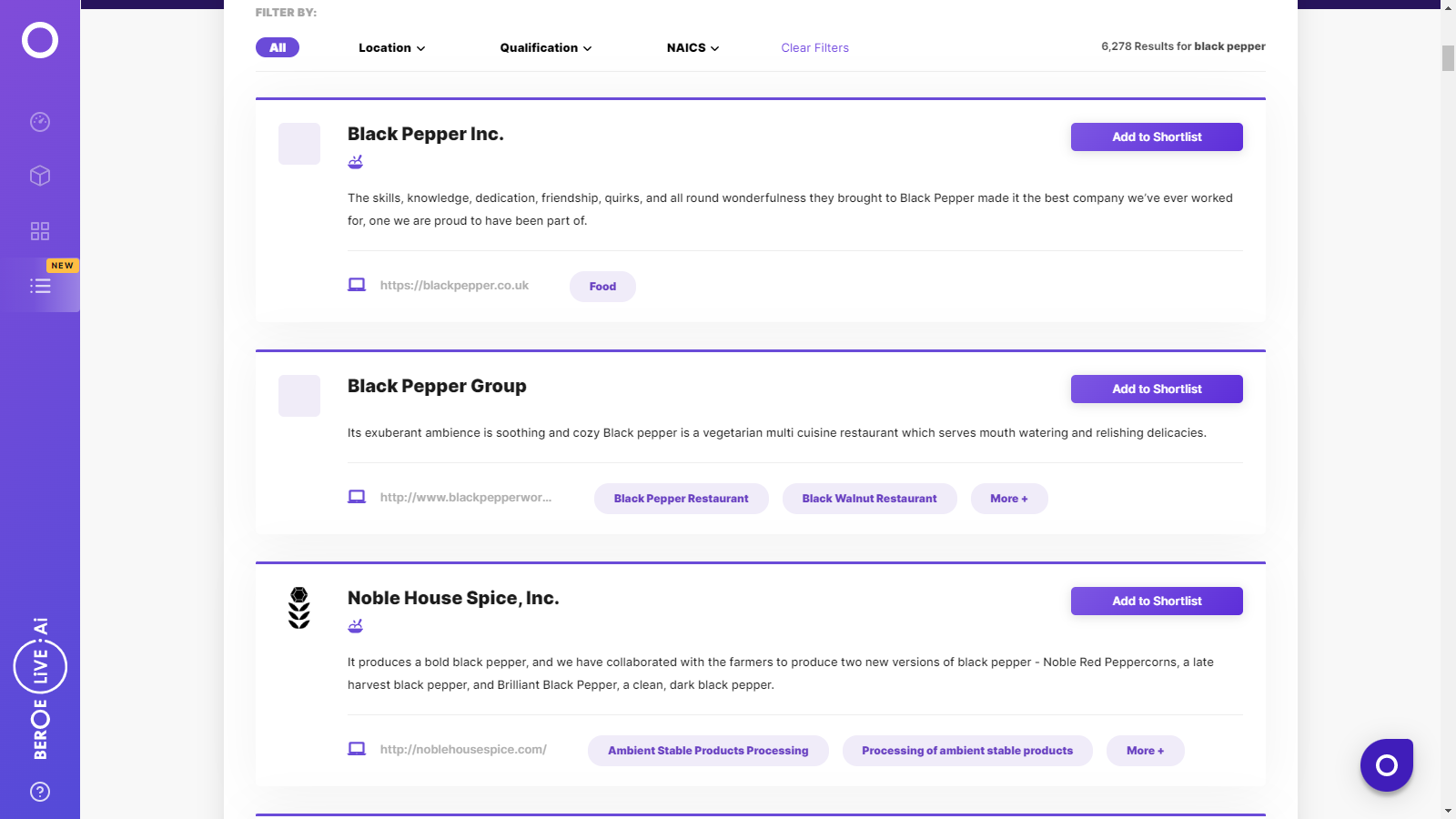

Black Pepper Suppliers

Find the right-fit black pepper supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Black Pepper market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBlack Pepper market report transcript

Black Pepper Global Market Outlook

- The global black pepper market in 2020 was valued at $4 Billion and is expected to grow at a CAGR of 5 percent between 2020 and 2026. Vietnam and Brazil are the top two producers and major export destinations for black pepper

Impact of COVID-19 on Black Pepper Industry

-

Prices of black pepper has traded high, due to rising demand from major import markets, like the US, Europe, and India. Demand for black pepper has also increased from end-use industries, like pharmaceuticals and food & beverages. Prices are expected to follow a mixed trend, due to the volatility of the Vietnam pepper market.

-

Although major supply countries, Vietnam and Brazil, have relaxed restrictions, supply disruptions can be expected, as the shortage for shipping containers continue to remain as a major concern in most countries.

-

Major suppliers in the Asian countries are facing challenges, owing to labor shortage. However, most suppliers are focusing on restoring their supply chain activities, thus, supply can be expected to revive starting from Q4 2021 onward.

-

Most FMCG companies are working on their supply chains to restrict shortage of supplies. Relaxation of lockdown and easing of supply chains, supplies are expected to be moderate.

Global Black Pepper Supply–Demand Analysis

-

The global production of pepper is forecasted to increase by 3.5 percent in 2021/2022 compared to the previous year, owing to favorable weather conditions.

-

Industrial demand from the pharmaceutical and personal care industries is estimated to surge, due to medicinal properties and flavor of black pepper.

-

Globally, black pepper is mainly used in the food, personal care, and pharmaceutical industry, owing to health benefits. Asian countries, like China, India, Sri Lanka, and others, together, consume around 65 percent of the global black pepper consumption.

-

The world’s production and export of pepper are forecasted to rise by 3.5 percent and 2 percent, respectively, in 2021–2022, with major production in Vietnam and Brazil

-

Global black pepper imports have decreased by 7 percent in 2020/2021 compared to the previous year. Exports are also estimated to increase in 2021/2022, due to rising demand for pepper from various industries

-

About 63 percent of the global production is used for enhancing taste and flavor in dishes at home, thus, boosting product demand in the residential segment. About 15 percent is used in retail and 11 percent in personal care industry for perfumes, oils, etc.

-

The pharmaceutical sector takes about 11 percent of the total global production, due to its increased medicinal properties

-

China, Sri Lanka, and India, together, consume 50 percent of the total global black pepper produced

-

North America, Latin America, and Europe, together, consume about 30 percent of the global black pepper produced

-

Most of the imports by various countries are used for the food and personal care industries.

Procurement Centric Five Forces Analysis on Black Pepper

The suppliers have better negotiation power, as they are fragmented players and volumes could be at risk. The intensity of rivalry is medium to high in the black pepper industry, as the product differentiation is less.

Supplier Power

-

As the demand for black pepper is high due to rising health benefits, suppliers have a higher negotiation power than buyers

-

Supply is based on favorable weather conditions for harvest and capacity of processing facilities

-

The suppliers are fragmented and volume is small from each buyer

Barriers to New Entrants

- Black pepper processing facilities require capital, equipment, and labor. Hence, the barriers to new entrants are medium to high

Intensity of Rivalry

-

Black pepper is majorly used in the food and beverage industries. The supply of black pepper depends on the yield related to harvest in favorable weather conditions

-

The rivalry in the black pepper industry is medium to high, as there are alternate substitutes available

Threat of Substitutes

-

Black pepper can be easily substituted by white/pink peppercorns, chili powder, papaya seeds, all spice, cayenne pepper based on the recipe, as these are the closest to the flavor of black pepper

-

However, health benefits and aromatic properties provided by black pepper cannot be matched by its substitutes

Buyer Power

-

The buyers of black pepper are the food & beverage companies, pharmaceutical and personal care industries

-

Buyers do not influence the prices as much as the suppliers, due to prices being driven by seasonal and fundamental factors

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now