CATEGORY

Chocolate

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Chocolate.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoChocolate Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Chocolate category is 5.83%

Payment Terms

(in days)

The industry average payment terms in Chocolate category for the current quarter is 72.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

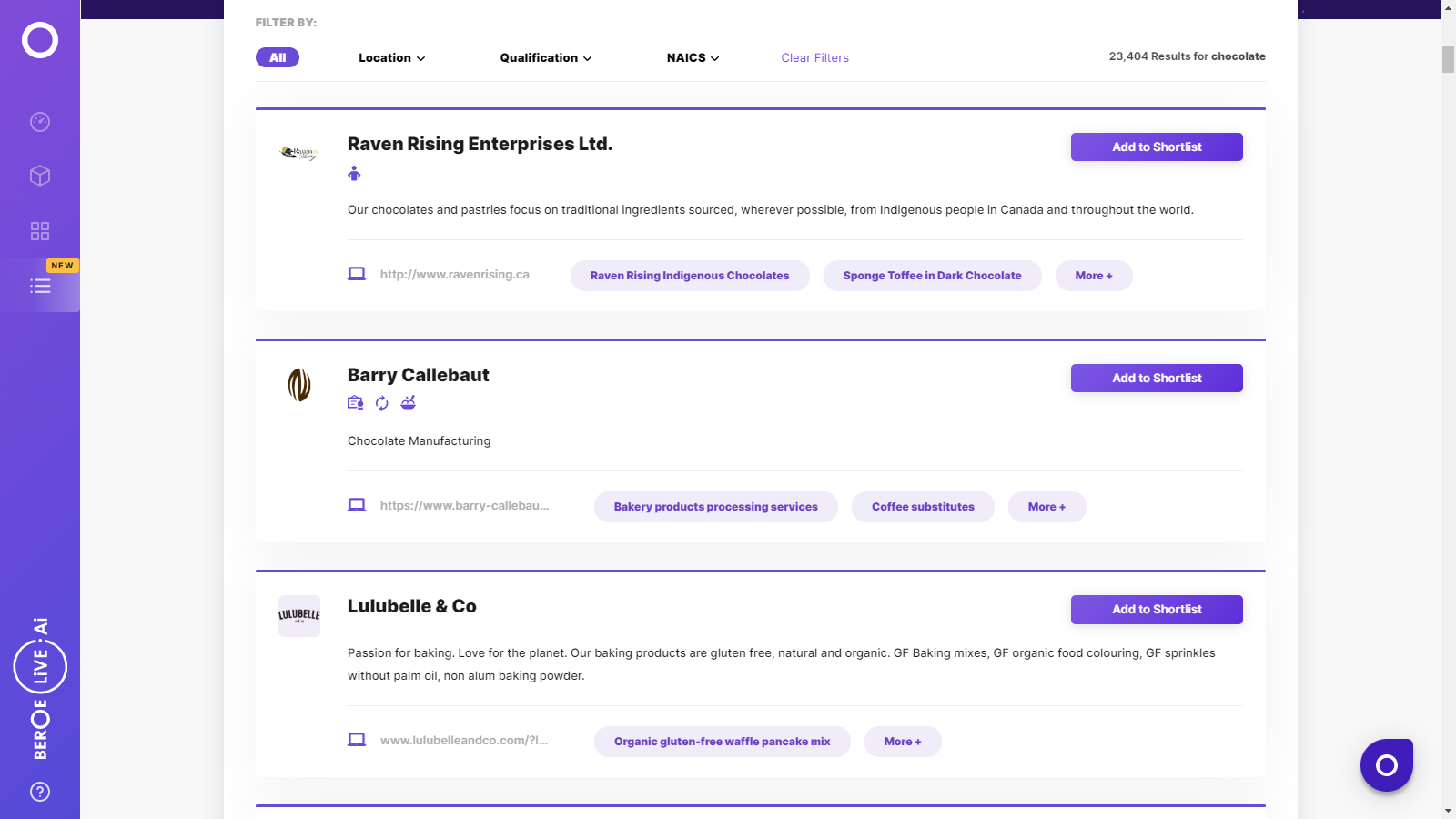

Chocolate Suppliers

Find the right-fit chocolate supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Chocolate market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoChocolate market report transcript

Chocolate Global Market Outlook

- The global chocolate market is expected to grow at a CAGR of 5 percent during 2021–2025. A significant market growth in the food & beverage market has aided the chocolate market, at 2020, it reached $120 billion

Impact of COVID-19 on Chocolate Industry

- Chocolate prices are expected to witness an increase across Europe and the US, as the demand is drove by the seasonality, and this trend is expected to stay until mid Q1 2022. The increasing import of premium chocolate by the US, due to increasing demand and the existing supply gap induced by the recovering production and trade is also aiding this hike.

Global Chocolate Market: Drivers and Constraints

Industry Drivers

-

Seasonal trends: The demand and the increase in rate of consumption have a cyclic pattern, as it is swayed by the festivals and special occasions around the globe, which then triggers the price and the requirements

-

Product innovation: Constant innovation is required to diversify the product and brand from the highly concentrated market with endless verity of products and the probability of innovation to be copied. The want for premium and innovative products by consumers drive the growth within the market

Constraints

-

Raw material availability: As the unpredictable climatic changes have drastically affected the producing regions, the production is affected and the ease of sourcing is also compromised

-

Price sensitive: Though the demand for premium products is increasing in the consolidated market, the emerging markets with great potential is still a price sensitive market, which demands for high quality products

-

Growing competition for raw material: The ease to source and the demand in the emerging markets are causing scarcity and push up the price for cocoa, as all the buyers rely on the same region to source from giving more power to suppliers

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now