CATEGORY

Maize Gluten Protein and Soybean Meal

Most of the animal compound feed sold commercially contains soybean meal, corn gluten meal or other oil seed meals as a predominant protein source. Prices of spent grains are fixed based the prices of these protein sources, hence value generated out of spent grains is largely dependent on market conditions of other protein sources used in animal feed.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Maize Gluten Protein and Soybean Meal.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

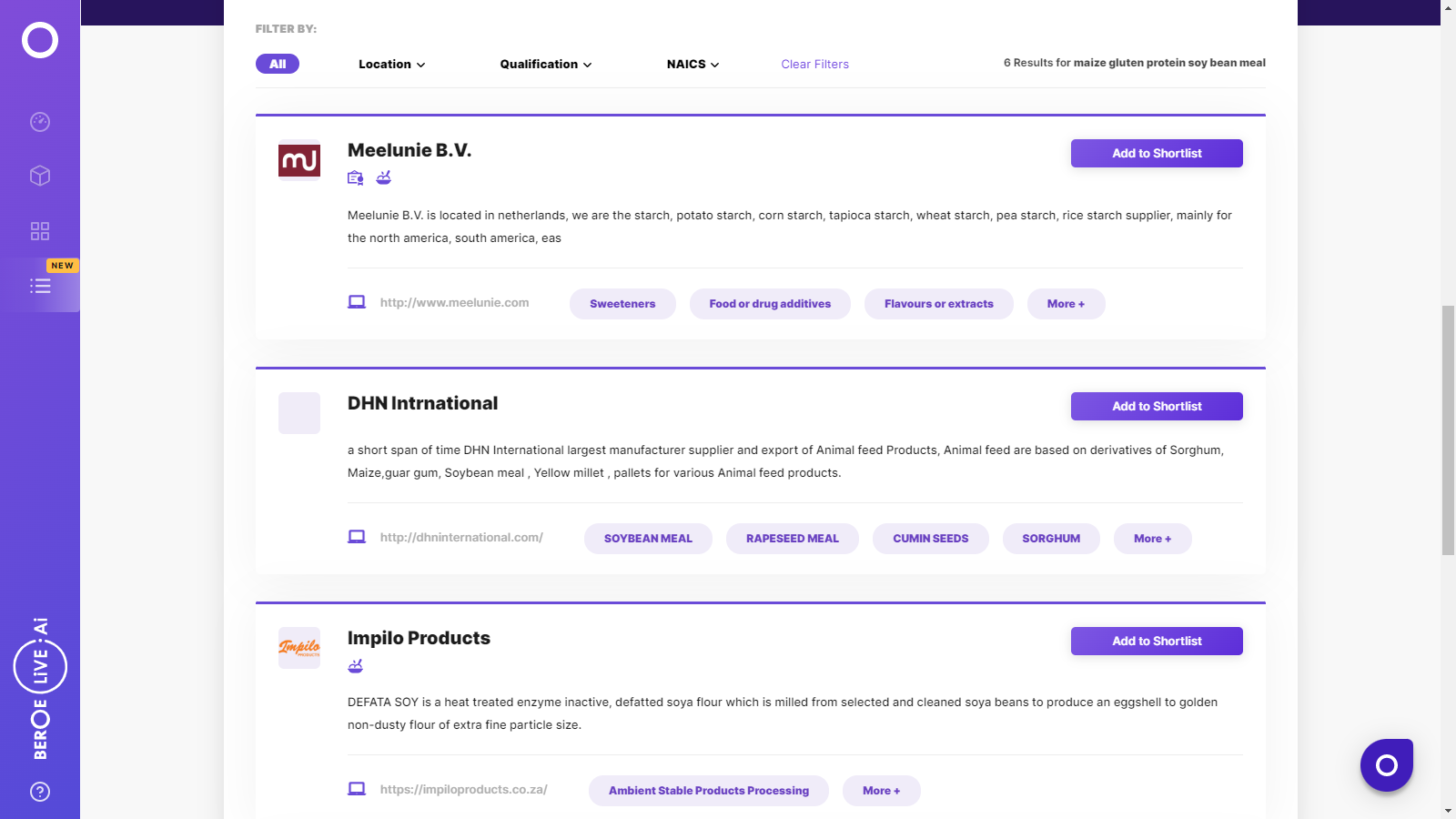

Maize Gluten Protein and Soybean Meal Suppliers

Find the right-fit maize gluten protein and soybean meal supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Maize Gluten Protein and Soybean Meal market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMaize Gluten Protein and Soybean Meal market report transcript

Global Market Outlook on Maize Gluten Protein and Soybean Meal

- Most of the animal compound feed sold commercially contains soybean meal, corn gluten meal or other oil seed meals as a predominant protein source. Prices of spent grains are fixed based on the prices of these protein sources. Hence, value generated out of spent grains is largely dependent on market conditions of other protein sources used in animal feed.

- Prices of soybean meal are expected to witness a decline, whereas prices of corn gluten meal is expected to witness an increase. Hence, buyer could realize better returns in regions, where corn gluten meal is a predominant protein source.

Supply Analysis

Owing to the US–China trade conflict, China's imports of Argentina imports continue to witness a rise. However, due to the lack of supplies currently in Argentina, imports of soybeans from the US are expected to continue for crushing.

- Soybean export from Argentina to China is expected to witness a boost in the coming months. The higher availability of domestic stock and a drop in demand from China could cause the US to scout for alternate markets and increase potentials in the feed sectors

- Despite the 25% import tariff, the US soybeans have been displaying higher competitiveness for trade to China, owing to record supplies and stocks

- The Netherland imports soybean meal from their neighboring European countries, where Germany account for more than half of their imports

Price Trend Analysis

The increased prospects for 2019 for the US soybean and expanding acreage in Argentina and Brazil are likely to maintain a downward price pressure on soybean meal market through the next year, barring any short-term price volatilities, owing to supply risks in South America and trade-related fluctuations, which are likely to be reflected in the future prices.

The increase planting intentions in South America and increased crushing also contribute to the depressed prices.

- The average price of soybean meal in September 2018 dipped by 4.41 % from the previous month. The downtrend in prices continue, supported by the ample supplies of soybeans globally, in addition to the arrival of new harvests

- The low price trend for soy meal is likely to increase attractiveness for feed buyers, who are currently impacted by high prices of other feed grains, like wheat and barley

- Soy meal remains the weakest member in the complex. However, the prices can be expected to recover slightly, supported by demand recovery and strong raw material prices, due to weather-related crop risks. A short-term price rally can be anticipated in the Chinese soybean market, due to the cancellation of trade talks between the US and China, which would curb soybean arrivals in the Chinese markets and increase cost

Corn Gluten Meal Analysis

Supply Analysis

Increasing demand for corn starch from the food sector is witnessing an uptrend trend in the production of corn gluten meal.

The US and China account for more than 50% of the global production of corn gluten meal.

- Global volume of corn gluten meal is estimated at 10.22 MMT based on the wet milling carried out across the globe

- The US and China lead the global production of corn gluten meal, as they are the leaders in production of corn starch by wet milling, and corn gluten meal is a by-product from that process

- Increasing demand for corn starch from the food sector is witnessing an uptrend trend in the production of corn gluten meal

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now