CATEGORY

Mushrooms

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Mushrooms.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoMushrooms Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Mushrooms category is 5.83%

Payment Terms

(in days)

The industry average payment terms in Mushrooms category for the current quarter is 72.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

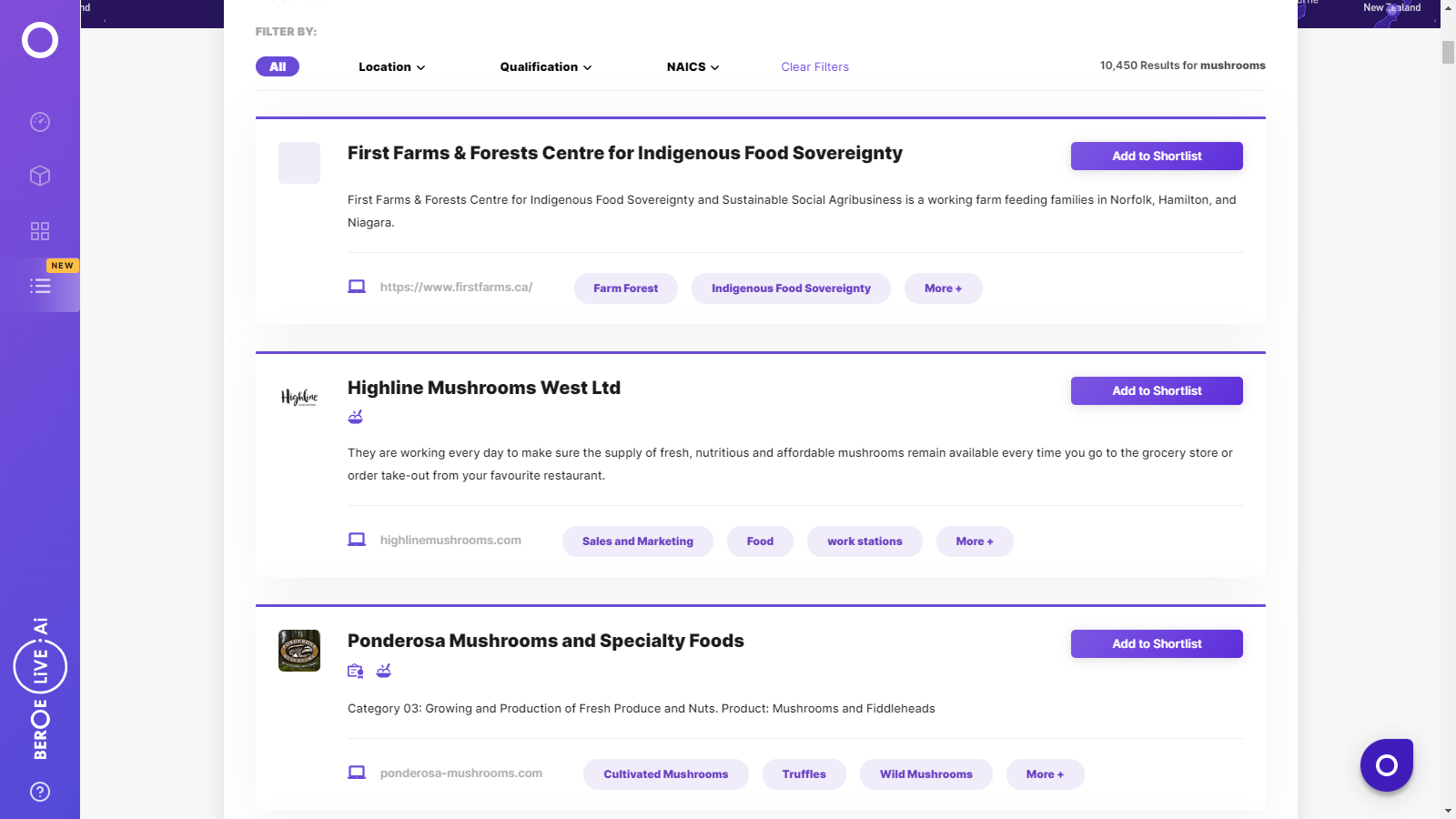

Mushrooms Suppliers

Find the right-fit mushrooms supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Mushrooms market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMushrooms market report transcript

Mushrooms Global Market Outlook

-

Mushroom growth figures in 2020–2021 is forecasted to be slightly higher compared to 2019–2020, due to the increasing demand and production potentials in many regions.

-

China and Japan are the top two producers and China is the leading exporter while Japan produce relative volume, do not export, due to internal demand

Impact of COVID-19 on Mushrooms Industry

-

Prices of mushrooms are stable, due to stable production in major regions like China, other Asian countries, and Europe. However, demand is expected to increase by processing industries and quick serving food chains.

-

Although major supply countries, China, the Netherlands and Poland, are not under lockdown, supply disruptions can be expected due to the transport costs and increasing energy prices concern.

-

Major suppliers are facing challenges, owing to labor shortages. However, most suppliers are focusing on restoring their supply chain activities, thus supply has seen great recovery.

Procurement Centric Five Forces Analysis on Mushrooms Industry

The suppliers have better negotiation power, as they are fragmented players and volumes are at risk. The intensity of rivalry is medium to high in the mushroom industry, and the players are increasing in the processing sector.

Supplier Power

-

The suppliers have higher negotiation power than buyers, as the demand is high

-

The suppliers are fragmented and volume is small from each buyer

-

The suppliers also have the advantage of less production cost owing to cheap raw materials used for cultivation

Barriers to New Entrants

-

Barriers for new entrants in fresh mushrooms may be lesser owing to the large-scale availability of raw materials but higher in the processing sector due to higher capital requirements

-

The major firms create and maintain competitive advantage through quality, customer service, and consistent supply

Intensity of Rivalry

-

Mushroom is mainly used in domestic consumption and processing industries. The supply of mushrooms also depends on the weather.

Threat of Substitutes

-

The threat of substitutes for mushrooms by other foods is medium. There are wide variety of food substances that can be used in place of mushrooms

-

Cottage cheese or Indian paneer, processed form of condensed milk is an effective alternative to mushrooms used in food in Indian sub continent. As the diary industry is growing, cottage cheeses have huge scope to easily use as substitutes for mushrooms

-

Soybean chunks are another substitutes for mushrooms

Buyer Power

-

The buyers are the food companies. They do not influence the prices as much as the suppliers. The prices are driven by seasonal and fundamental factors as well

-

Based on preferences for specific varieties, prices may vary among the varieties of mushrooms

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now