CATEGORY

Apple and Apple Juice Concentrate

Although Argentina is the most cost-effective destination to source AJC; however the best sourcing countries for AJC are China and Poland; considering the raw material availability, lead time, exports of AJC, and country’s risk ratings.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Apple and Apple Juice Concentrate.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

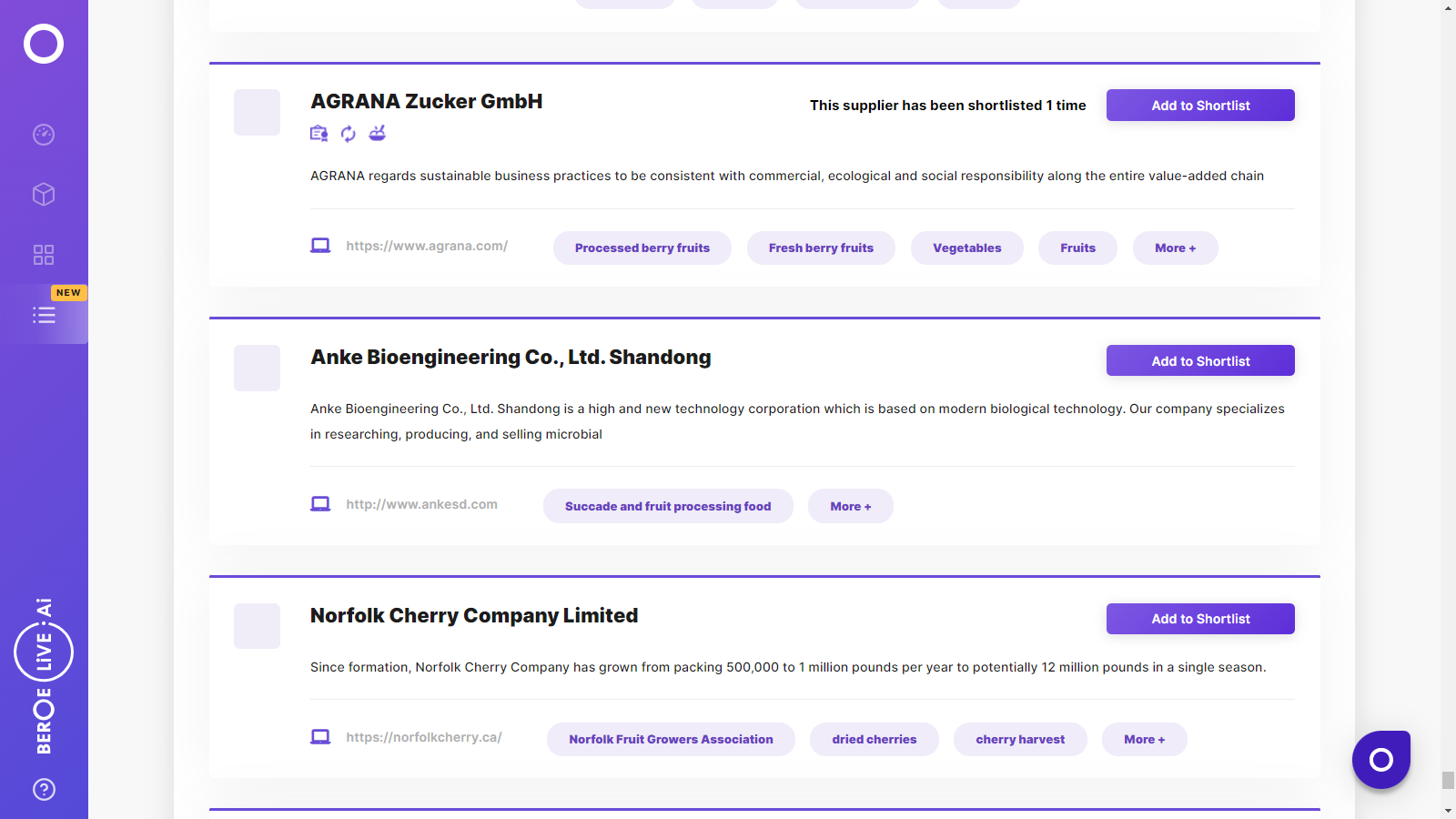

Apple and Apple Juice Concentrate Suppliers

Find the right-fit apple and apple juice concentrate supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Apple and Apple Juice Concentrate market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoApple and Apple Juice Concentrate market report transcript

Global Market Outlook on Apple and Apple Juice Concentrate

- The total landed cost of AJC is lowest from Argentina

- The cost of procurement from Argentina is 10% to 15% lower than local sourcing from South Africa

- Although Argentina is the most cost-effective destination to source AJC, best sourcing countries for AJC are China and Poland, considering the raw material availability, lead time, exports of AJC, and country's risk ratings.

Historical Apple Supply and Market Analysis

The minimum impact of dry weather pattern on water availability, during this current season, will result in apple production similar to the previous year.

Fresh Apple Supply – South Africa

- Apple occupies 28.5% of the area in the total delicious fruit planted area, and 90% of the fruit is grown in the Western Cape Province

- The 2012/2013 apple production was at 9,00,000 tons, highest since 2002/2003

- Unseasonal hail and rainfall damaged apples, during 2013/2014, had reduced the fruit production by 13% from 2012/2013

- In 2015/2016, based on the normal growing conditions, the apple production is forecasted to 865,000 tons, similar to the previous year

Trade Analysis – Apple

South Africa is a net exporter, with respect to fresh apples, and it leads the other apple exporters in the African continent.

Major Markets for Apples – South Africa

- South Africa is one of the leading exporters of apples

- 5.84% of the growth has been recorded in the exports between 2010 and 2014

- The UK has been the leading importer of South African apples since 2002. Nigeria and Angola are the leading African markets

- Over the last 10 years, the country has recorded a 198% of growth in apple exports

- Attractiveness of South African apples is because of its big size

Historical Price Analysis – Apple

Prices of apples sold to processors and local market for fresh consumption are 88% and 32% lower than the export market price, revealing the fact that the main revenue for the South African apple industry is through exports.

Price of Apple – South Africa

- Quantity of apples supplied to processors depends upon the demand from export and local markets, which determines the price directly

- Owing to the reason that only unsold apples are sent for processing, prices of apples that are sold to the processors are lower than the price of apples at export and local markets

- Price in the local market for fresh consumption is determined by the supply and demand dynamics, and it is ~34% lower than the export price of apples

- Increase in export demand, along with an increase in the cost of production, increased the prices of apple in the international market since 2010/2011

- In 2010/2011, 18% and 6% increase in export and local market price against the previous year were recorded, respectively

Trade Analysis – AJC – South Africa

- South Africa is not among the leading apple processing countries in the world

- Apple juice and grape juice are the two major fruit juices imported by big fruit juice companies

- Apple juice import occupies nearly 26% in total imports of processed fruits and vegetables

- South Africa does not levy import duties on AJCs

Industry Analysis of AJC

Barriers to New Entrants

- Medium cost of investment and economies of scale

- No product differentiation

- Easy access to technology

- Low switching cost

- Access to raw material is medium

- There are no strict government policies

Buyer Power

- Top two manufacturers in the industry occupy the major market share

- Big manufacturers have their own orchards

- Buyers within South Africa have wide options of importing AJC

Threat of Substitutes

- Apples are the only source for AJC

- There are no substitutes for cider production

- For flavored alcohol production, artificial flavors are the substitutes

Intensity of Rivalry

- Ceres fruit processors are the leading player in processing AJC

- Ceres and AFP together occupy over 70% of the total AJC market

- Switching cost is less, as AJC standards are globally the same

- Product differentiation is very low

Supplier Power

- Only 27% of apples produced are sent for processing, and the apple producers mainly focus on exports of fresh apples

- There are many apple producers, still apples that are low in quality are sent for processing

- Importance to supplier of apples is medium, due to the less available capacity of AJC processing

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now