CATEGORY

Egg and Poultry

Global poultry and egg production and consumption witnessed a steady growth in the last decade and expected to continue in the coming years. Poultry and egg supply is mainly driven by feed cost, increased protein consumption and also growing population.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Egg and Poultry.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

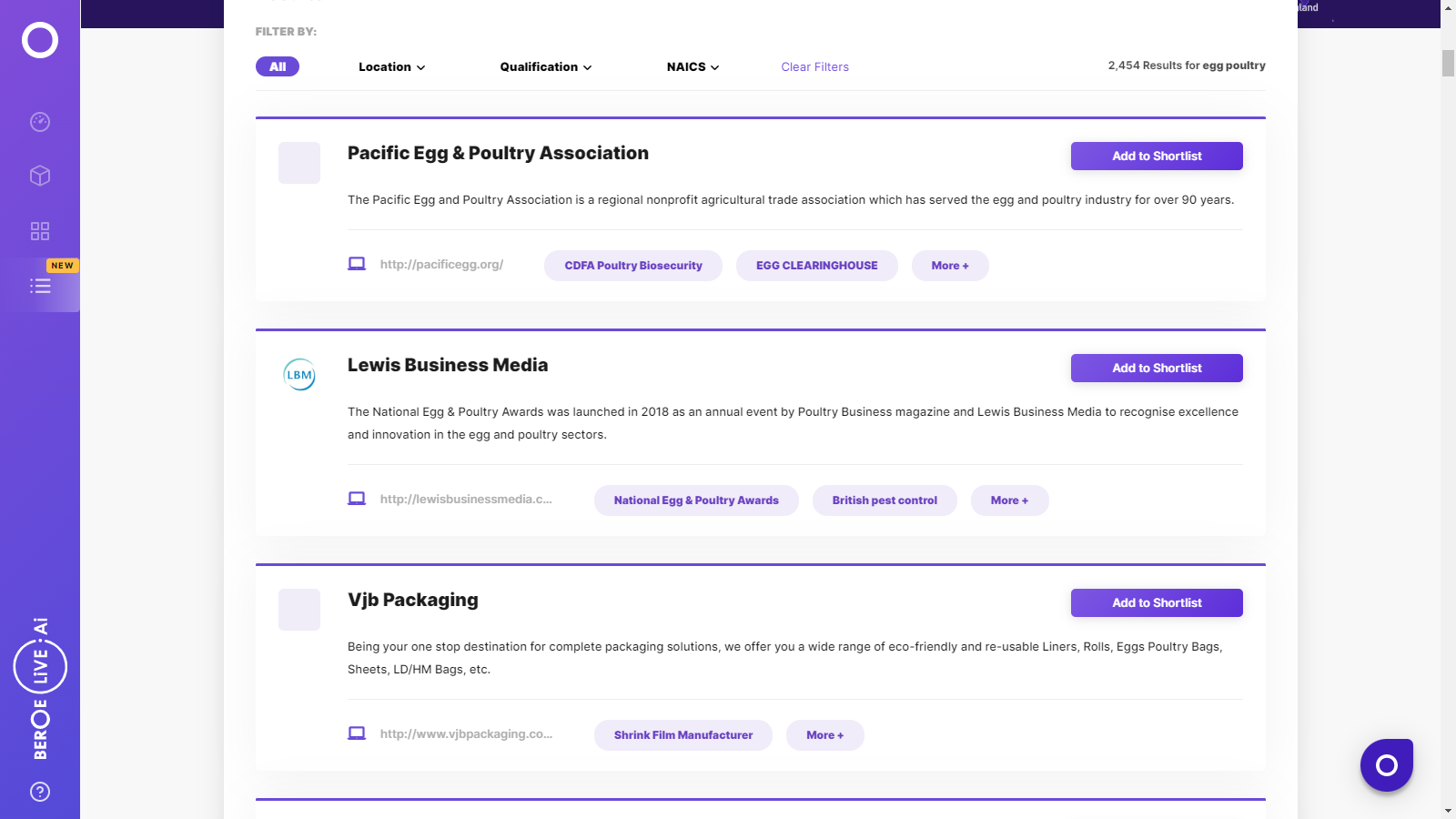

Egg and Poultry Suppliers

Find the right-fit egg and poultry supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Egg and Poultry market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoEgg and Poultry market frequently asked questions

The U.S. produces the highest poultry globally accounting for 20.66 percent of the total market share, while China contributes to 39.2 percent of the global egg production. The key exporting countries for poultry and egg are Brazil (38.5 percent) and the U.S. (5.4 percent) respectively.

The poultry prices are affected by seasonality due to their dependence on biological and climatic conditions. During spring and early summer, the scope of higher fast-food sales results in an increase in the poultry prices, whereas, low fast-food sales in the winter may weigh on prices. Besides, cold conditions may also affect the egg production cycle.

As per the egg poultry market report by Beroe, the market complexity is considered to be low due to low variation, predictability, and a majority of the products finding applications in the food and beverage industry.

' Increased income and lower meat prices lead to increased growth of poultry consumption. ' The demand for poultry was driven by lower feed cost, increase in preventive disease control, genetic developments, biosecurity factors, better margins on the supply side, urbanization, etc. ' The global demand for eggs in major economies has tripled in the 20th century. ' The increasing demand for cage-free eggs and poultry products will cause a shift in the global supply and demand. That's because free-range eggs and poultry require large areas for the chickens to grow which can be a challenge for the existing players.

Egg and Poultry market report transcript

Global Market Outlook on Egg and Poultry

The global production of poultry grew at a CAGR of 2.6% and consumption by 2.3% during 2012–2017. Increase in supply is driven by lower feed cost, which lowers the production cost, in turn, providing a higher margin in the economies of scale. Whilst rising protein consumption and growing population are majorly driving the demand for poultry eggs.

- The global production and consumption of poultry products in 2018 stood at 95.5 metric million tons (MMT) and 93.6 MMT respectively, while that of eggs was 70.4 MMT and 62.12 MMT respectively. Further, the global production and consumption of eggs were expected to grow at 2% CAGR by 2020.

- Poultry prices exhibit seasonality due to the dependency on biological and climatic conditions. Chickens spend most of their time in houses until aged for slaughtering. The extreme cold conditions during that period may affect the weight of the chicken.

- Scope for higher fast-food sales during spring and early summer can push poultry prices higher. In turn, low fast-food sales in the winter may weigh on prices. Buyers can make use of such price seasonality to secure better prices.

- Furthermore, tech advancements are anticipated to contribute to the egg products market size over the projection period. Poultry egg producers are gradually banking on new poultry and egg storage solutions. Moreover, they are likely to integrate the Internet of Things (IoT), big data analytics, robotics, and others, into their existing practices. Case in point, agriculturists have begun leveraging robots for egg packaging to boost efficiency.

Global Egg Market: Drivers and Constraints

Drivers

Rising Usage of Immune Modulators

Immune modulators are seeing huge adoption in animal production as they allow producers to shift toward no-antibiotic animal farming. They are a drug category that activates or improves an animal's defense mechanism to better check the progression of diseases in animals and their infection to humans.

Organizations involved in animal farming often utilize antibiotics to promote growth as well as for therapeutic reasons. However, the rising pressure from animal activists is compelling these organizations to turn to immune modulators which preserve consumers' health. As per a report, immune modulators are efficient against a wide array of pathogens as they boost the immune response in a way that is less reliant on the pathogen causing the contagion.

Furthermore, a wide array of antibiotics substitutes have been created for different executions. For instance, egg-yolk antibodies in immune modulators have significantly curbed the threat of necrotic enteritis in chickens. The efficacy of the same antibodies in swine helps in the prevention of diarrhea caused due to various pathogens. In the US, scientists have developed an immune modulator to avoid udder infections in dairy animals after birth. The modulator has been approved by the Food and Drug Administration (FDA) for usage.

Rising Popularity of Private Label Brands

Retailers manufacture and sell private label products. To capitalize on the increasing demand for poultry eggs, retailers have begun rolling out their brands of eggs. As these products are sold at a competitive price compared to the products from leading companies, consumers, especially those who are price-sensitive, are showing an increased preference for private labels.

Constraints

Volatile Climatic Conditions

Climate fluctuations and global warming are significantly impacting the egg market rate over the projection time frame. The tropical climate decreases the quality and size of eggs in poultry farms. In addition, the extreme conditions not only hamper the egg production of hens but also makes the hens prone to different diseases.

Poultry & Egg Value Chain

The market complexity is considered to be low in the poultry and egg market due to low variation, predictability (except during epidemic outbreaks) and majority of the products finding applications in food and beverage industry.

Poultry: Supply–Demand Analysis

The US is the major producer, while China is the major consumer of poultry. Both these regional markets witnessed a flat production and consumption during the second half of 2018 due to the US-China trade war that affected the poultry industry by affecting the supply of pork.

Market Outlook (2018)

-

Poultry consumption witnessed consecutive growth owing to increased income and lower meat prices.

-

Lower feed cost, increase in preventive disease control, genetic developments, bio security factors, and better margins supported the supply side, along with an increased protein consumption and urbanization to drive the demand.

-

Asian producers are likely to increase their competitiveness by increasing integration, more consolidation. Mainly, cooperatives are expected to gain efficiency in producing poultry products.

-

Low cost for high sources of proteins and nutrients have favored the steady increase in egg demand in major economies. Global demand has tripled in the 20th century.

-

Average global egg supplies witnessed consecutive increases above 8 kg per person in the last five years, driven by lower feed cost, better demand, and better profitability.

-

Egg production in the developing countries, such as China and India, witnessed a double-digit growth of more than 15% over the last decade.

-

Increasing demand for cage-free egg and poultry products will trigger a shift in the global supply and demand numbers in the next decade as free range eggs and poultry require large areas for the chickens to grow. This is a challenge to the existing players, where the demand for free range eggs exceeds the supply.

-

Short production cycle enables producers to make use of low risk and higher profitability. Factors, such as rapid improvement in genetics, feeding practices, and animal health have also supported the global supplies.

-

Currently, the poultry market is oversupplied, even with increasing global demand, the market is likely to be oversupplied in the coming years, as producers are building larger houses to increase the number of heads.

-

The egg price forecast is strongly driven by the interaction of supply and demand over time.

Poultry Market: Trade Dynamics

-

The US poultry industry, being affected by avian flu, witnessed a drop in exports to major markets.

-

Import into China has increased owing to the increasing shift from other meat, which resulted from the trade war between the US and China.

-

Strong growth in the value and diversity of export markets keeps local egg prices/egg rate steady.

-

Exports: Global exports in 2018 witnessed an increase since 2012 owing to an increase in demand from Japan, Mexico, South Africa, and China.

-

Imports: Thailand’s import of poultry has increased by 3% over the last six years given the rising consumption of poultry.

Why You Should Buy This Report

-

The report on the poultry eggs market offers insights on the global and regional market size, industry trends, market outlook, and value-chain analysis.

-

This research study lists out the market drivers and constraints and a comprehensive Porter’s five forces analysis for the emerging and developed regions.

-

It underlines the agency billing rates across the globe and provides a SWOT assessment of key players.

-

Furthermore, the egg market report provides the best procurement practices, sourcing and pricing structures, and end-user industry update.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now