CATEGORY

Office Supplies

Office supplies are broadly defined as day-to-day supplies used on a recurring basis in general business functions and office operations, and are typically non-technical consumables with a singular/limited usefulness and life

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Office Supplies.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoOffice Supplies Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Office Supplies category is 10.00%

Payment Terms

(in days)

The industry average payment terms in Office Supplies category for the current quarter is 55.7 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

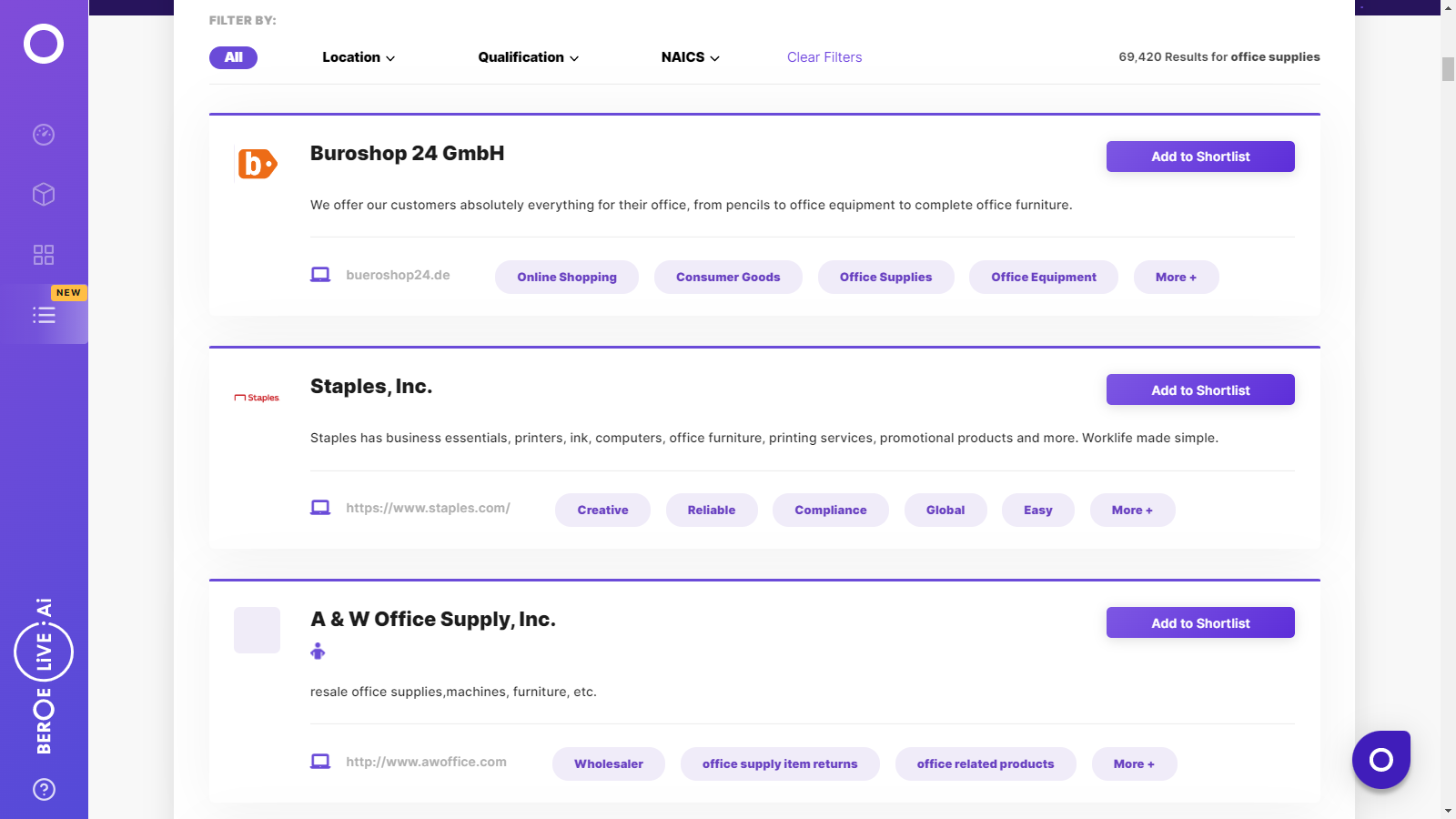

Office Supplies Suppliers

Find the right-fit office supplies supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Office Supplies market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoOffice Supplies market frequently asked questions

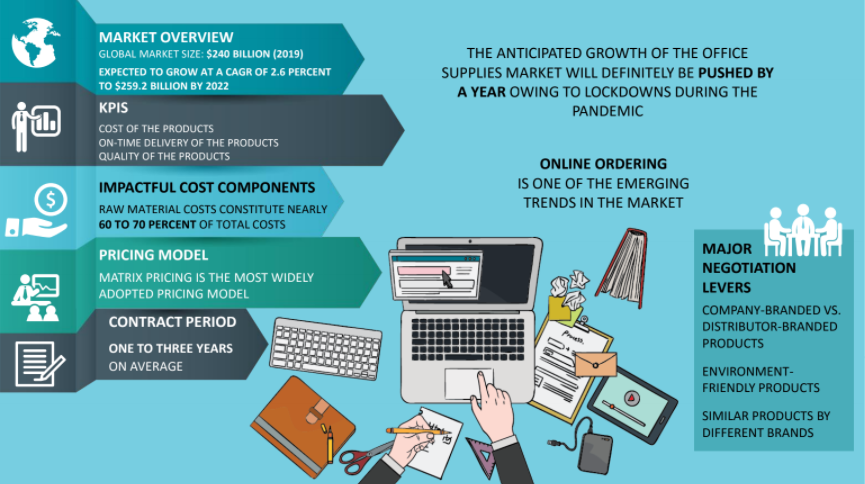

According to Beroe's market analysis data, by 2020, the global office supplies market was estimated to reach a valuation of $247 billion growing at a CAGR of 2.4%.

Items in the office supplies market include paper-based products, storage and equipment, and writing and marketing instruments. Other non-core supplies like office furniture, kitchen supplies, cleaning supplies, workwear safety, computer accessories also form a part of the office supplies market.

Raw materials, wages, profit margins, rent, and utilities are the major cost components of the global office supplies market.

As per Beroe's market report, the office supplies market size in North America and Europe grew at a rate of 1-3% reaching $82 billion and $46.8 billion respectively.

Regions with high maturity in the global office supplies market are the U.S., Western Europe, and the Nordics, which include Germany, U.K., France, Belgium, Hungary, Italy, Spain, Sweden, Netherlands, Norway, and Ireland. On the other hand, regions with low market maturity include major parts of Asia, Africa, and South America, e.g., Vietnam, Sri Lanka, Egypt, and Indonesia.

The growing demand for computer or printer supplies was the result of IT integration and industrial automation.

The office equipment suppliers in the industry are witnessing a decline in their profit margins as well as significant price competition. Besides, due to digitization, many retail stores of office supplies have closed down over the years. Price, geographic coverage, and supply assurance continue to be the key deciding factors for the office supplies industry.

M&As allow global suppliers to enhance their service capabilities and secure office supplies contracts from large buyers. One of the major mergers happened between Office Depot and Office Max in the year 2013 that led it to become the second-largest player in the office supplies industry.

The maturity level of the buyers and suppliers is low outside the market regions of Europe and North America. Besides, the office supplies market is highly fragmented. The global office supplies providers don't have a strong presence in these regions, and therefore, buyers are finding it tough to consolidate their supply base in APAC, Africa, and the Middle East.

The key global suppliers in the office supplies industry are Staples, Office Depot, Lyreco, and Amazon.

Office Supplies market report transcript

Office Supplies Market Size and Global Outlook

-

The global office supplies industry market size was around $257.7 billion in 2022. By 2027, the market is forecasted to reach $318 billion at a CAGR of 4.3 percent

-

The US and Europe are the major matured markets for office supplies. For APAC and LATAM, there is a vacuum in the supply landscape as the major global suppliers have no strong presence in these regions.

-

The global office supplies market is expected to grow at a CAGR of 4.3 percent between 2022 and 2026

Office Supplies Industry Trends

-

Suppliers in this industry have declining profit margins and are facing tight price competition. Digitization has led to many retail store closures of office supplies suppliers over the past five years. Price has become a key deciding factor, followed by geographic coverage and supply assurance.

-

Suppliers are also improving their supply capability by adding more products and investing more in their online portals and are also trying to increase their geographical scope.

-

Suppliers are looking to stock products, such as reusable notebooks, dry erase boards, etc., developed from recycled materials, as it has high market growth in the near future

-

Buyers can make use of the current market scenario and can increase their buyer power by consolidating their demand

-

As the suppliers are expanding their portfolio of services, buyers can consolidate their supplier base resulting in cost savings

-

IT integration and industry automation has led to the growing demand for computer/printer supplies.

Office Supplies Industry - Global Market Maturity

-

The office supplies market is highly fragmented, and the maturity level of the buyers and the suppliers is very low outside Europe and North America

-

The buyers are looking to consolidate their supply base in APAC, Africa, and the Middle East but are finding it difficult as the global suppliers still do not have a strong presence in these regions

Office Supplies Industry: Global Drivers and Constraints

Drivers

-

Emphasis on self-branded products: Large suppliers still bet on their self-branded products, as they have higher margins than other branded products. A tier 1 supplier, has generated 30 percent of its revenue in recent years from these types of products and significantly increased the number of similar products being launched

-

Era of Online Ordering: These days, buyers prefer to order online, as it saves time and energy. Tier 1 supplier already shifted its investments in its online portal to make online ordering easier and more convenient for its customers. Amazon Business and eBay have entered the office supplies market, as office supplies category fits into their existing sets of products offered

-

Increasing Service Capabilities of Suppliers: Suppliers in this industry are expanding their product portfolio by including non-core office supplies such as janitorial supplies, technical equipment and break room supplies in their product list

-

Increasing Number of Offices and Job Opportunities-Mainly in the Emerging Markets: Focus on education, increasing literacy rates and increasing job opportunities, coupled with MNCs increasing their geographical capabilities across the globe (especially in the emerging markets), are the major drivers of the demand for office supplies products (e.g. the Digital India Campaign in India, and industrial development in LATAM, mainly in Mexico, Brazil, etc.)

-

e-Auctioning: Buyers prefer procurement through e-auctions, as they get clear visibility and can access supplier capabilities. Global suppliers have the ability to participate in e-auctions, and the local suppliers are also focusing on participating in them, as it gives them the scope to bid on and participate in huge tenders.

Constraints

-

Decreasing Demand for Core Office Products and Increasing Competition: The demand for paper-based products has reduced, along with increased competition from Online Retailers, Warehouse Clubs, and Supercenters. These factors together have caused overall price stagnation and reduced profitability

-

Pricing Pressure: The level of differentiation between products is very low and hence, the competition is primarily based on pricing. This drives down the profits of the suppliers, leading to exit from the market or being acquired by a larger company, resulting in consolidation.

Office Supplies Market Trends

-

The office supply market has consolidated and there are fewer physical store locations, leading to more competition among office supply brands and retailers.

-

Technology will continue to shrink the necessity for traditional office supplies. Adoption of e-auctions and ERP integration is expected increase which might affect the small retailers with less technological capabilities.

-

Demand for the industry’s core products such as pens, paper and toners will continue to reduce as we further transform to a digitized environment.

-

Specialty office supply stores will face increased competition from discount department stores like Walmart, Costco, etc. and e-commerce websites like Amazon.

-

At-home office supplies and digital solutions are expected to gain speed, as most companies have moved to work from home and the demand is shifting towards home offices.

Category Intelligence on Office Supplies from Beroe covers the following:

- Information relating to market, supply, cost, and pricing analysis

- Hard to find data on cost and TCO models, supplier details, and performance benchmarks

- Macroeconomic and regional trends impacting cost, supply, and other market dynamics

- Category-specific negotiation and sourcing advice

Why should you buy this report?

The office supplies market report scrutinizes the regional markets of North America, Europe, LATAM (Brazil, Mexico, Argentina), APAC (India, China, Singapore, Malaysia, Thailand, South Korea, Australia, Vietnam, New Zealand), and MEA(Saudi Arabia, UAE, South Africa, Egypt, and Nigeria), as well as their growth potential. Analysts have utilized Porter's Five Forces Framework to examine both these developed and developing regions.

The report looks into the reasons for the declining profit margins of the suppliers, the resulting price competition they are facing and hence, the various strategies they are implementing to overcome these challenges. Readers will find detailed profiles of global suppliers such as Amazon, Staples, Office Depot and Lyreco and their SWOT analysis in this report.

In order to analyze the market competition, the research report provides cost structure analysis with detailed spend categorization and benchmarks that will assist in optimal decision-making. To understand the evolving nature of the market, the report reviews the engagement models at the local and global levels, as well as their pros and cons, e-commerce business models, pricing models (matrix pricing vs single discount) and impact of contract length. On the basis of the exhaustive review of the above parameters, the report provides a host of cost-saving strategies, negotiation levers and questions for optimal results.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now