CATEGORY

Office Furniture

Includes market overview of office furnitures market, key industry trends, rebates and refund structures and key global & regional suppliers

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Office Furniture.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Countries like Vietnam are emerging as the top wooden furniture exporters in Australia

February 08, 2023Chinese suppliers finding a way to shift their production facilities to Mexico

July 26, 2022Countries like Vietnam are emerging as the top wooden furniture exporters in Australia

February 08, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Office Furniture

Schedule a DemoOffice Furniture Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Office Furniture category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Office Furniture category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

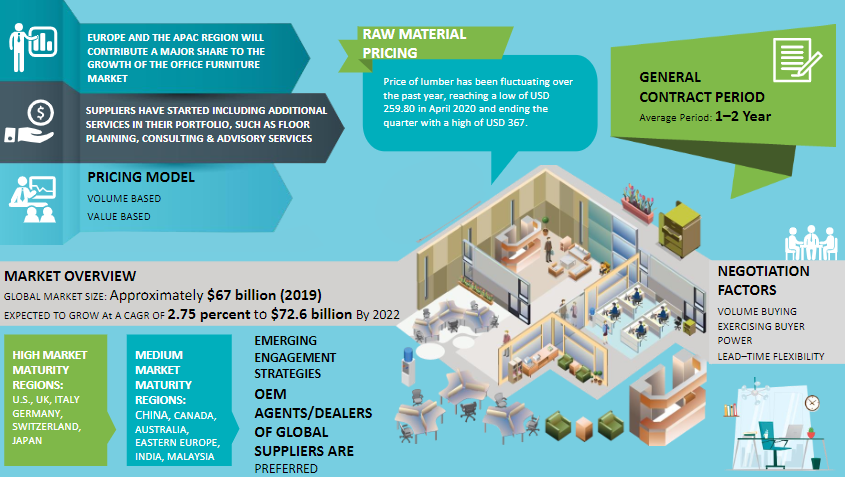

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

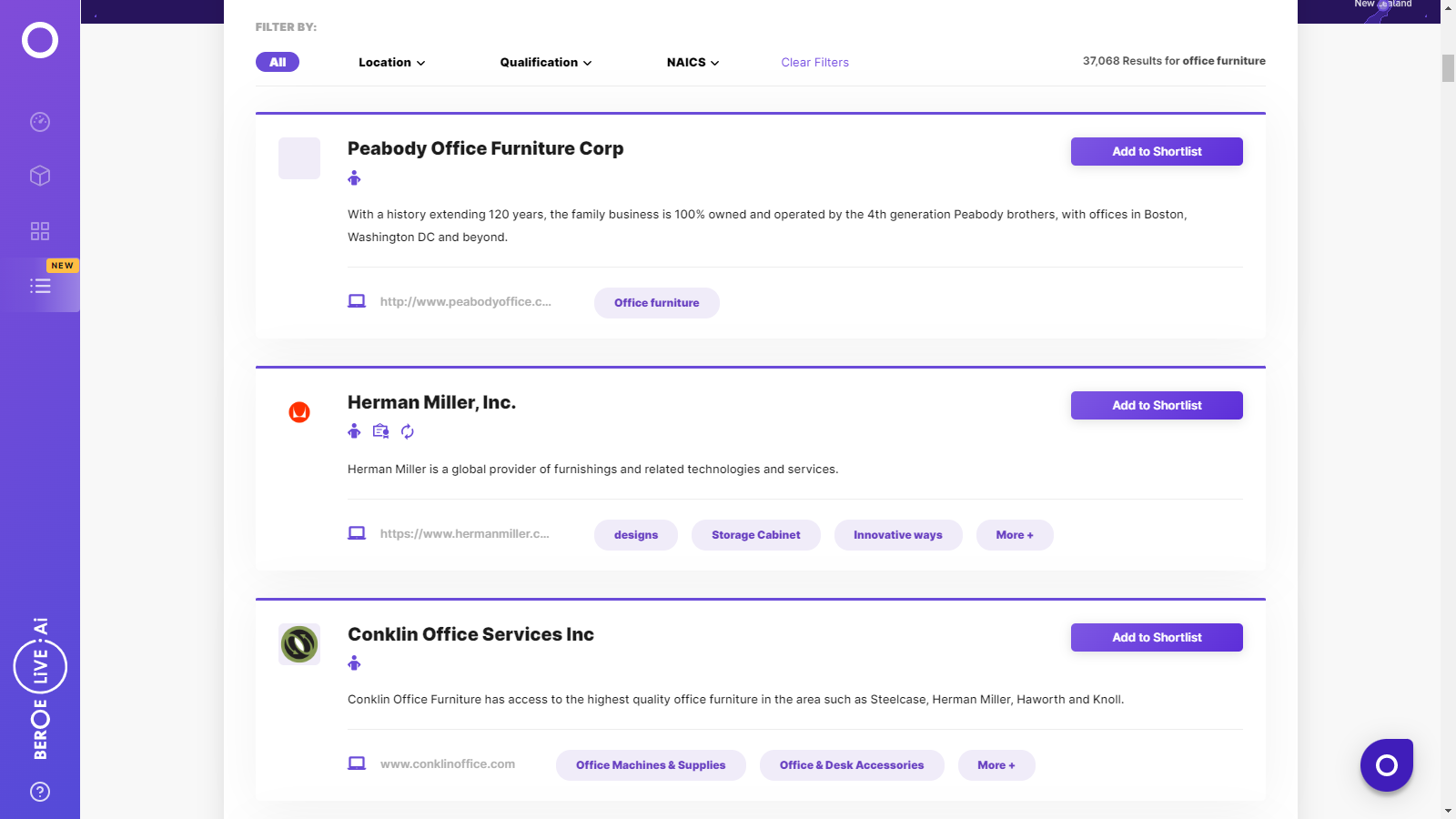

Office Furniture Suppliers

Find the right-fit office furniture supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Office Furniture market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoOffice Furniture market report transcript

Global Furniture Industry Outlook

-

In 2022, the global office furniture market was valued at $60.7 billion. By 2027, the market is forecasted to reach $74.7 billion at a CAGR of 4.1 percent

-

North America, Western Europe, and some parts of APAC, such as Australia, Japan, Hong Kong, Singapore, have a high market maturity

-

Due to boost in construction of residences and commercial buildings, the office furniture has seen an increase in demand

Global Office Furniture Market Maturity

-

The global office furniture industry is a modestly fragmented industry led by a selective group of global suppliers, who contribute roughly 7–8 percent of the total market size for office furniture globally

-

Asia and Europe contribute almost 60 percent of the total market size for global office furniture

Global Office Furnitures Industry Trends

-

Office furniture contributes up to 15 percent of the global furniture sales, wherein seating, panels, and storage contribute the majority of the overall office furniture sales.

-

Office furniture is a labor-intensive industry, and this industry is adopting increased automation and mechanization to increase efficiency and product standardization

-

The top players of office furniture make around 9–11 percent of the APAC market size and this market is highly unorganized in pockets across APAC. Low–cost furniture producers, such as China and Vietnam, are also anticipated to drive the growth of the furniture market

-

There is a high level of mergers occurring between global players of office furniture and the local level manufacturers and dealers, who act as the distribution channels for these global firms

-

Users of office furniture have begun to opt for rental services in office furniture to avoid the initial cost of investment, leading to a fall in the need for new furniture

Global Office Furnitures: Drivers and Constraints

-

Manufacturing of office furniture is being outsourced to emerging markets like China and Indonesia owing to the rising costs of manufacturing

-

There is increased competition from regional/local players for office furniture and this has driven larger suppliers to provide value–added services like space planning, consulting and furniture solutions by providing architect and interior design services

Drivers

Recycled Products:

-

In the developed markets, such as the U.S., there is an increased demand for customized and made–to–order furniture from recycled materials

Demand for Office Aesthetics:

-

Large buyers require innovative or elegant design aesthetics for their office facilities. This leads to procurement of new office furniture that suits the aesthetic dynamics of the facility

-

With an increase in the growth of co–working spaces, demand for modular and designer furniture and visual fit outs has increased

-

Refurbishment of office space or purchase of new office space drives large buyers to adapt fresh design themes, which may be aimed at increasing the productivity of the employee workforce

Constraints

Increase in furniture rentals/adoption of old furniture:

-

The practice of purchasing furniture has come down and consumers are preferring to rent–out furniture or adopt old furniture than purchase new furniture

Demand vs. Buyer Aspiration:

-

Although there might be an increase in demand for office furniture for large buyers, this demand may not be realized by the buyers, who may choose to cut costs owing to the pressure of cost optimization

Rise in Pricing:

-

As a result of trade escalations between the U.S. and China, the manufacturing costs from China is expected to increase, due to sanctions levied by the U.S. on the Chinese government

Dynamic User Preference:

-

Buyers request variety and innovation in office furniture depending on the requirement and this makes it difficult for suppliers to forecast and manufacture the product lines

Global Office Furniture: Key Insights

Supply chain shortages

-

Shortage of raw materials owing to the Russia-Ukraine war and shortage of labor due to strikes at the German port have also affected the production processes for a few office furniture manufacturers. This has led to longer lead times and has also put an upward pressure on the prices of office furniture products.

Consulting and Advisory Services Getting Offered as Value–Added Services

-

Rising competition from local as well as new emerging players, downturn in economic scenarios, decrease in demand by the buyers for the furniture items have compelled manufacturers to offer value added services such as consulting, designing and furniture planning by hiring interior designers and architects.

Mergers and Acquisitions to Expand and Gain Synergies

-

The office furniture companies are getting aligned with other players to gain from synergies and strengthen their supply chain by getting add–on capability in terms of geographical presence, technology and innovation. With the availability of bank credit, strategic acquisitions have become easier and a notable trend in the industry

Example:

-

Global OEM player was acquired by a family-owned company, as part of its strategic planning

Production Capability Expansion by Suppliers

-

Office furniture, being a labor intensive industry, is increasingly moving towards mechanization and automation to bring efficiency, standardization, production of the required design and quantity of the product.

Sustainability Requirements Followed and Advertised by Suppliers

-

There is new standard, BS ISO 24496:2017 office furniture, assessing office seating in Europe. Unlike Europe Standards (EN), this standard is, however, not implemented in all European countries

-

Most of the global brands and regional players follow minimum LEED and ANSIBIFMA standards

-

With buyers having environmental concerns and sustainability targets, manufacturers are using environment friendly materials modified bio–composite sheet made from renewable natural resources is used in the production of office furniture instead of using petrochemicals and advertising the environmental benefits through a number of certification programs

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now