CATEGORY

Off The Road Tires

Off-the-road tires are utilized for large-scale machinery at construction and mining and other sites

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Off The Road Tires.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Tatneft pays for Nokian Tyres' Russian operations

March 21, 2023Bridgestone undertakes solar power generation at Tire Plants in Japan

February 16, 2023Nokian Heavy Tyres granted usage of the 'Key Flag' symbol as Finnish Pride

January 17, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Off The Road Tires

Schedule a DemoOff The Road Tires Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoOff The Road Tires Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Off The Road Tires category is 7.30%

Payment Terms

(in days)

The industry average payment terms in Off The Road Tires category for the current quarter is 100.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Off The Road Tires market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoOff The Road Tires market frequently asked questions

The APAC region will continue to dominate the OTR tires market in terms of growth prospects until 2020.

The shift of market focus from product to service is a key emerging trend in all the major regions which will also optimize the buyer's total cost of ownership.

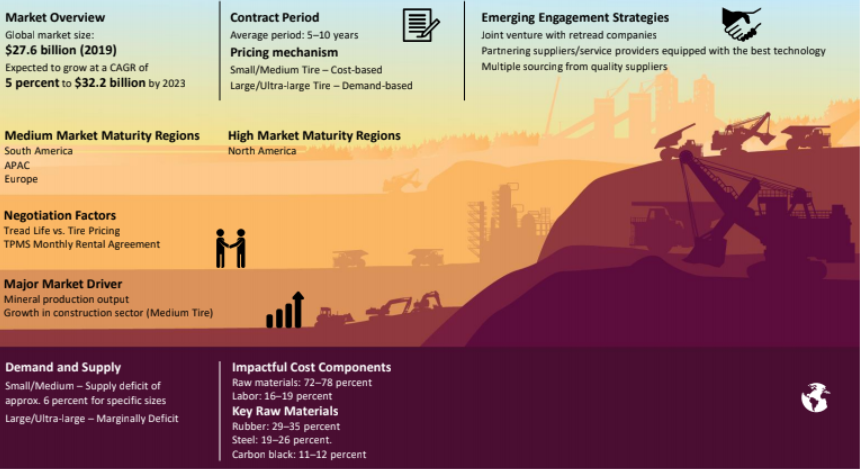

The market regions with medium maturity are South America, APAC, and Europe, while North America has high market maturity.

The major market drivers for the OTR tires market are mineral production output and growth in the construction sector.

The top players in the global off-road tire market are Michelin, Bridgestone, Goodyear, Yokohama, and Titan. These five suppliers constitute for about 83 percent of the total global OTR market share.

From the 2016 tire market study reports by Beroe, the global off-road tire market was valued at $24.8 billion in 2017

According to Beroe's off the road tire industry forecast, the market is expected to grow at a CAGR of 5 percent to reach a market value of $28 billion by 2020.

The key raw materials for the off-road tire market are rubber accounting for 29-25 percent, steel accounting for 19-26 percent, and carbon black accounting for 11-12 percent.

Customer's reliance on distribution network is the key trend which is expected to influence the OTR tire market maturity. The mining and construction customers are increasingly looking for additional services, such as tire tracking while procuring tires.

Owing to the reduced commodity demand, the mining share in OTR tire sales has been plummeting since 2012 from 20 percent to 15 percent by volume.

The off the road tire industry forecast from Beroe shows that the on-going development in new technologies is expected to bring a major shift in the way the OTR tire industry is doing business thereby discarding the old model of selling and servicing such tires.

Driven by the increasing demand in small and medium OTR tire from the construction sector, the OTR tire is demand is expected to grow at a CAGR of 5.5 percent to reach $30 billion by 2022.

Off The Road Tires market report transcript

Off-road Tires Market Analysis and Global Outlook

MARKET OVERVIEW

Global Market: 31.8 billion (2023 E)

Expected to grow at a 4.8 percent to $34.9 billion by 2025

-

The APAC will continue to dominate the market, in terms of growth prospects, until 2025

-

Shift of market focus from product to service has been witnessed as an emerging trend in all the major regions to optimize buyer’s total cost of ownership

Global OTR Tire Market Maturity

-

Key trend, which is expected to influence OTR tire market maturity, would be the customer’s reliance on the distribution network. Both mining and construction customers are increasingly looking out for additional services, such as tire tracking, while procuring tires.

Off-road Tires Industry Overview

-

The OTR tire market of around $30.3 billion has a high value from the mining industry, the majority of which comes from the surface/opencast mining sector.

-

Electrification of mines is expected to be a major OE demand driver for OTR tires during 2022–2024. Mining companies are actively engaging in HME manufacturers to deploy electric vehicles at their mine sites to reduce on-site mine reductions

-

The market witnessed an increase in demand across all end-use demand during 2022. A similar trend is expected to continue during 2023 in the mining and agricultural segments.

-

Demand from construction is expected to slowdown, due to weak macroeconomic indicators

Global OTR Market Size and Trend

-

The market is expected to grow by 4.8 percent Y-o-Y growth until 2025, owing to an anticipated increase in demand from the mining and agricultural segments.

-

In addition, increasing demand in small and medium OTR tires from the construction sector is expected to further support the demand between 2022 and 2024

-

Original equipment (OE) demand is expected to surpass the replacement demand by 1–2 percent. The OE demand continues to grow in the mature market, as demand for tires used in infrastructure is at a constant rise.

-

Demand for large/ultra-large OTR tires is expected to grow between 3 percent and 6 percent annually until 2023, fueled by increased demand from commodity, such as gold.

-

Significant decline in coal mining is anticipated in the upcoming years, due to the growing dependence on alternative energies, coupled with environmental/regulatory pressure. This would drive down the OTR tire demand from coal miners, thus providing opportunities for other miners to lock their capacity for the upcoming years and develop an upper hand in negotiation with the suppliers

Global OTR Market: Drivers and Constraints

Commodity demand is the major market driver to forecast OTR tire demand growth; cyclical condition may result in an unpredicted estimation.

Drivers

Commodity Demand:

-

Commodity demand is a result of the global economic situation. Increase of commodity demand and commodity prices is expected to drive the demand for OTR tires

OEM Sales/Demand:

-

Increase in demand for haul truck/mining truck drives up the OTR tire demand. Mining truck, especially the sales of 110 tons truck-class, and higher versions of the same class are expected to witness a gradual growth until 2022

Constraints

COVID-19 Pandemic

-

Covid-19 pandemic has disrupted the global supply chain thus making transportation of raw materials and finished goods a challenging task to reach the destination.

Cyclical Market Condition:

-

The manufacturers usually show considerable constraint in terms of tire pricing, as the industry faces an unpredicted demand fluctuation in a short span of time

Currency Fluctuation:

-

Fluctuations in currency exchange rates are adversely affecting the margins and financial performances of OTR tire manufacturers

Market Analysis –Demand and Supply

-

In order to mitigate the financial impact of the recession, suppliers are tracking the supply–demand dynamics closely on a periodic basis to keep the inventory under control. Thus, the market will not remain in a supply surplus situation until the medium term

-

Supply in China is anticipated to be affected during late Q4 2022 and early 2023, owing to regional lockdowns, due to a rapid spread of the COVID-19 variant

-

Growth in the mining sector and major mine expansion projects in Australia and the South American region are expected to drive the demand of OTR tires in the upcoming quarters

-

Surging demand from construction in the APAC region is expected to bring new suppliers to the market in the medium and large OTR tire segment, thus expanding the choices for end-user and making it critical for them to choose their supply partner

-

Capacity expansion, restart activities of OTR, and heavy-duty tires across the globe by major suppliers are expected to ease supply tightness in the upcoming quarters

Why You Should Buy This Report

- The report explains the off-the-road tire industry forecast, cost structures, pricing models and key price drivers.

- It details the sourcing models, recent technology development and innovation such as how the transformation from product-focused to service-focused approach will be the emerging trend.

- The report provides key supplier profiles and SWOT analysis of top suppliers in the off-road tires market such as Yokohama, Titan, and others.

- The report offers information about matured, global drivers and constraints and developing markets and regional market outlook.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.