CATEGORY

Nylon

Nylon is widely used across several industries like automobiles, electricals/electronics, films and coatings, consumer goods etc. Beroe estimates nylon market to reach $21 million by 2021 driven by the growth in emerging economies like Asia.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Nylon.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoNylon Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoNylon Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Nylon category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Nylon category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Nylon market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoNylon market frequently asked questions

The global nylon market size is forecasted to reach $32 million at a CAGR of 5 percent until 2022.

Emerging economies, such as LATAM, India, and other Southeast Asian countries, are expected to drive the growth of the global nylon market. Furthermore, the growth of the nylon market will be triggered by the demand drive from the automotive, plastic product, electronics, packaging, and CPG industries.

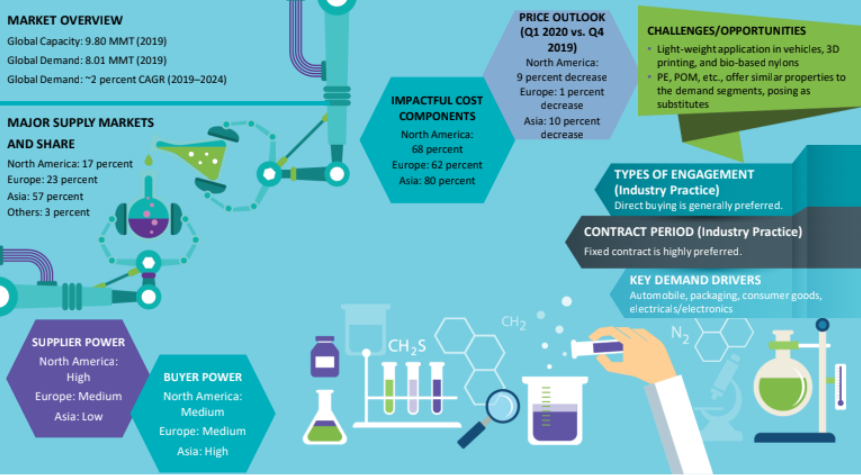

BASF, Ascend, Libolon (Li Peng), Li Heng Chemical, Invista dominate the supply space in the nylon market. The supplier power is quite high in the North American market followed by Europe and Asia with medium and low supplier power respectively.

Asia dominates the global nylon 6 market with 57 percent of the market share followed by Europe at 23 percent and North America at 17 percent. The remaining 3 percent belong to other players in the market.

The nylon industry faces challenges from light-weight applications in vehicles, 3D printing, and bio-based nylons. PE, POM, etc. offer similar properties to the demand segments posing as substitutes.

Nylon market report transcript

Global Market Outlook on Nylon

-

The global nylon market is forecasted to reach $29 billion at a CAGR of 3 percent for the forecasted period until 2025

-

The key sectors, such as automobile and electronics, faced demand destruction, due to the US–China trade war and COVID-19 impact

-

The medical and packaging sectors continued to remain healthy. A gradual recovery in automotive, electronic durables, etc., would likely to drive the future growth

Nylon Demand Market Outlook

-

Rising inflationary pressures, the Russia–Ukraine war, rising energy prices in Europe, fear of a global recession, the semiconductor shortage issue, rising inventory levels, and higher producer's margins/all-time high PA 6 prices in Q2 2022 will keep global PA 6 demand bearish in H2 2022 and H1 2023. The arbitrage window between Asia and other regions is rapidly expanding. Hence, buyers are advised to procure spot offers from the Asian region to maximize profitability in H1 2023.

Industry Best Practice : Nylon

Engagement Models

-

Direct and consortium buying are the two relevant engagement models in the industry

-

Direct buying is highly preferred, as consortium buying (group buying) is:

–Still in the beginning stages in the nylon resins industry

–Practiced more by metals and automobile industries

Contract Models

-

Market Price Contract: The commodity is supplied at a market price or benchmark price

-

Fixed Contract: The buyer can decide to have a fixed margin (the margin of supplier is fixed throughout the contract period) or fixed price (prices are locked for the contract period)

Pricing Formula

Resin Producer–Converter

-

Monomer Based

Nylon Price = Monthly Nylon Contract Prices + Fixed Component (Costs from Overhead, Freight, Conversion) + Premium

-

Index Based

Nylon Price = Price of the Nylon Resin Quoted in the Index for the Particular Month (based on indices, such as CMAI/CDI/Platts/IHS/ICIS) + Additional Costs (based on volume, time, and clauses in purchase)

Converter–End User

Nylon Price = Nylon Resin Index Price for the Particular Month + Conversion Cost (from utilities, labor, additives, specific grade) + Margins

Global Market Size: Nylon

-

The global nylon market is forecasted to reach $29 billion at a CAGR of 3 percent for the forecasted period until 2025. The key sectors, such as automobile and electronics, faced demand destruction, due to the US–China trade war and COVID-19 impact

-

Medical and packaging sectors continued to remain healthy. Gradual recovery in automotive, electronic durables, etc., would likely drive the future growth

-

The nylon market portrayed a strong growth in 2021, taking in the support of higher raw material prices, tight supply conditions, and healthier demand trends after witnessing lackluster market sentiments during 2020

-

Concerns of supply tightness had arisen, especially in Europe and the US, for Nylon 66 had lessened, as the weak demand compensated for the gradual rise in supply

Global Capacity–Demand Analysis

The market has remained constrained globally since 2018, due to very limited capacity additions. During 2021–2022, it is operating at 85–86 percent of its capacity.

Market Outlook

-

The global nylon market is growing at a CAGR of approx. 2 percent, with Asia being the top regions for the demand growth

-

In terms of two main grades in the industry (nylon 6 and nylon 6,6), the capacity of nylon 6 is more and stands at approx. 7.8 MMT/year compared to nylon 6,6 at approx. 2.7 MMT/year in 2022

-

Major demand driver for nylon 6,66 is from the automotive and engineering plastics industry, while the textile industry leads the demand from nylon 6

-

The impact of US–China trade issues, demand destruction, due to higher inflationary pressures in 2022, and higher crude oil prices has been witnessed during 2021–2022

-

Medical and packaging sectors continued to remain healthy

Engagement Outlook

-

The emerging Asian regions, such as South Korea, Japan, Malaysia, etc., could be favored as sourcing destinations, due to their healthy additions and strong supply base

-

To avoid future supply risk, a diversified supplier base among different countries is preferred

Industry Drivers and Constraints : Nylon

Drivers

Nylon application in the automobile industry

-

Nylon with its superior mechanical and physical properties at lower cost offers the innovation seen in light-weight vehicles in the recent market

-

For every 10 percent weight reduction in vehicle, the fuel efficiency is increased by 5–10 percent. Nylon is a major contributor to the innovation of light-weight parameters, especially in the automobile industry

-

With the advent of light-weight and fuel-efficient vehicles bringing in cost reduction as well, the nylon market is looking at the collaboration of nylon producers, tier-1 suppliers, and OEMs to gain better market share

Nylon in 3D printing

-

With the recent interest in 3D printing innovation, PLA and ABS were some of the resins used. However, nylon is gaining attention, due to its superior strength and durability

Constraints

Fluctuation in raw material chain

-

Tier-1 raw material caprolactam and tier-2 benzene market dynamics can impart strong changes to nylon. Any disruption in the caprolactam and a benzene supply chain can translate into the supply constraints for nylon

-

Caprolactam finds its major use in the nylon industry, so, any disruption in the supply chain network can mirror the same effect in the nylon market

Threat of substitutes

-

For regions with focus on promoting environment-friendly products, PET, POM, and PC are some of the attractive options against nylon

-

PET and other resins are currently more in demand with their varied applications in most CPG industries. Hence, with low-priced raw materials, these substitutes do have a better edge as substitutes

Why You Should Buy This Report

This report provides information on the global nylon market, demand, trade dynamics, imports, exports. It gives the regional market analysis of North America, Europe, Asia and the Porter’s five force analysis of these regions.

It lists out the nylon industry drivers and constraints and the major innovations in the nylon market. The report breaks down the cost structure, does the pricing analysis and gives the nylon 66 price trend and nylon market price. It gives nylon procurement intelligence, details the supplier landscape and does a SWOT analysis of suppliers like DowDuPont, Lanxess, Libolon (Li Peng), etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.