CATEGORY

Non-Woven

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Non-Woven.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Albaad to invest on Bio- Degradable Non-woven

August 24, 2022Corpus Christi Polymers To Commission PTA-PET Integrated Plant In Texas.

July 27, 2022Sinaatec Plans Two New Plants in Algeria

July 19, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Non-Woven

Schedule a DemoNon-Woven Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoNon-Woven Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Non-Woven category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Non-Woven category for the current quarter is 30.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Non-Woven market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoNon-Woven market report transcript

Global Market Outlook on Non-Woven Market

-

The global non-woven market is estimated to grow at a CAGR of 3.3 percent during 2023-2026

-

The largest market for converted non-woven products will be in hygiene end uses, which is expected to grow at a CAGR of 3.5-4.0 percent during 2023-2026

Industry Best Practices : Non-Woven Market

-

The preferred contract duration is 2–3 years, though five-year contracts are also prevalent. This is considered to be a negotiation tool for the buyer

-

The length of a buyer’s commitment to buy from a supplier should be reflected in a better price structure

-

Working closely and strategically with suppliers is crucial to ensure value addition to any firm

Global Market Size: Non-wovens

-

Global market size of non-wovens is estimated to reach approx. $53.8 Billion by 2026. It is further estimated to grow at a CAGR of approx. 2.3 percent during 2023–2026. Bearish market sentiments from construction, automobile, furnishings, apparels, and other non-hygiene segment is likely to result in slower market growth in 2023 amidst higher global recessionary pressure.

-

Raw Material: PP overall (approx. 48 percent), whereas PP Spunbond (approx. 40 percent), Polyester (20 percent), Wood Pulp (approx. 10 percent), PE (approx. 9 percent)

-

The top 42 companies account for approx. 49 percent of the overall non-wovens market revenue in 2019. They had a total revenue of about $20.1 billion in 2018

-

Global consumer spending, GDP, and other macro-economic factors are likely to have an effect, due to the Coronavirus pandemic. Hence, it will have an impact on the overall market revenue growth of non-wovens. It will largely be impacted, due to reduction in demand, due to the Coronavirus pandemic from the non-medical and hygiene segment. Segments, like hygiene and personal protective equipment, are likely to drive the market revenue during this time period

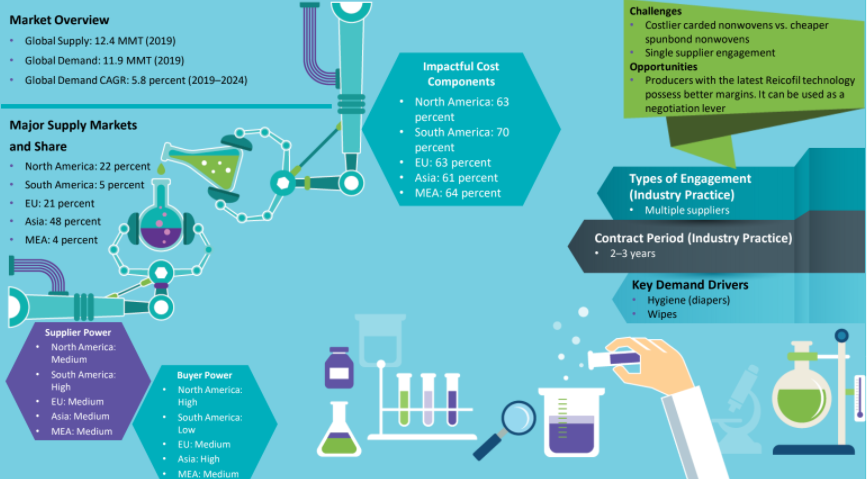

Global Capacity–Demand Analysis

-

The global demand for non-wovens has reached approx. 17.1 MMT in 2022. It is further estimated to grow at a CAGR of 3.5 percent during 2023–2026; leading global technology is spunmelt, i.e., about 7.3 MMT in 2022 (approx. 43 percent of the capacity share)

-

Major non-wovens users, like K-C and P&G, are the major demand drivers of the global non-woven market

Market Outlook

-

Demand: The global demand for non-wovens has reached about 17.1 MMT in 2022. It is further estimated to grow at a CAGR of 3.5 percent during 2023-2026

-

Supply: The global non-wovens supply has reached about 17.0 MMT in 2022. The growth in supply is expected to be in line with the demand’s requirement. Major non-woven users, like K-C, P&G, are the major demand drivers of the global market

-

Developed/Mature Nations: North America, Europe, and Japan

-

Developing/Growing Nations: China, India, and Middle East

-

Spunmelt: The global capacity share for Spunmelt has reached about 7.3 MMT in 2022. It will further estimated to cross 8.1 Million MT by 2026. The growth rate has slowed down across developed nations

-

The melt blown only suppliers have very small capacity that focus on sorbents (bottom of the barrel market) and filtration. However, it has increased significantly in 2020-2023 due to production of face mask. The market is unlikely to see any major capacity addition in the coming years

Engagement Outlook

-

Buyers should indulge with the forward integrated global suppliers. It will result in high profitability, less lead time, and ease in handling

-

Medium to long-term contract is the preferred mode of engagement with suppliers. However, option of sourcing with multiple suppliers should be checked to ensure lower risk

Cost Structure Analysis : Non-Wovens

-

Raw material is the major cost driver of non-wovens, and hence, Asia and the Middle East have great control over its pricing, due to its low cost

-

Reicofil 4-based SMS producers have a margin of approx. 30-40 percent in 2022.

-

Raw material cost accounts for 63 percent of the overall cost (which is inclusive of the wastage cost of the raw material while changing spin pack and trimming the edges of the roll)

-

Increase in producer’s margin for PP Spunbond Non-woven in 2022, due to stable demand and decrease in fibre prices during H2 2022

-

The arrival of Reicofil technology will further boost the overall margin of the producers. Hence, it can be used as a negotiation tool while engaging in a new contract

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.