CATEGORY

Natural Rubber

Natural Rubber is one of the major commodities that finds applications in tires, latex goods etc. The report here analyses the drivers of the market based on global and regional market scenario (current and outlook), market trends, trade dynamics, and cost and pricing analysis etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Natural Rubber.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Indian Prices Declined

July 19, 2022Indian Prices Declined

July 19, 2022Indian Prices Declined

July 19, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Natural Rubber

Schedule a DemoNatural Rubber Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoNatural Rubber Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Natural Rubber category is 5.30%

Payment Terms

(in days)

The industry average payment terms in Natural Rubber category for the current quarter is 82.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Natural Rubber market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoNatural Rubber market frequently asked questions

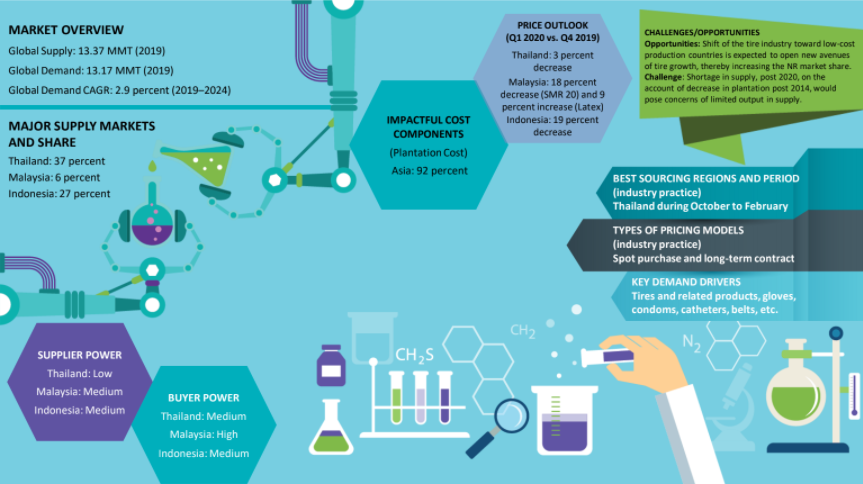

The key players in the global natural rubber market are Thailand with a market share of 37%, Malaysia with a market share of 6%, and Indonesia with a market share of 27%. As it can be seen, Asia dominates the global rubber market.

According to Beroe's rubber market analysis report, the market is expected to grow at a CAGR of 4.8%. The rubber industry outlook report also states that the production amount is set to reach 17 MMT (million metric tonnes) by 2020. Moreover, the automobile industry is expected to increase the demand for rubber production in Thailand and Indonesia. The rubber price forecast shows that there may be a decline in prices due to losses in TOCOCM markets as well as the termination of the ITRC export curb scheme.

The global rubber industries are expected to witness a 4.8% growth by 2023.

The key demand drivers for the global rubber market are tyres and associated products, gloves, condoms, catheters, belts, etc.

Natural Rubber market report transcript

Natural Rubber Global Market Outlook

MARKET OVERVIEW

Global Supply: 14.2 MMT (2022 E)

Global Demand: 14.0 MMT (2022 E)

Global Demand CAGR: 3 percent (2022–2025)

KEY DEMAND DRIVERS

Tires and related products, gloves, condoms, catheters, belts, etc.

-

The NR market witnessed a lack of strong growth catalysts in 2022, with a decline in sales of autos and tires and higher global inflationary pressures, amid Ukraine–Russia war. Market sentiment is expected to improve in H2 2023, as inflationary pressures ease

-

Asia continues to be the dominant supplier of NR, due to the increase in yielding area, and the average yield in the top producing countries, like Thailand, Malaysia, and India. Emerging NR producers, such as Ivory Coast, Cambodia, etc., are likely to showcase competition in the future

Natural Rubber Global Market Size

-

The weakness in key downstream automobile and tire operations, combined with downtrend in oil prices and buying momentum due to COVID-19, the US–China trade war, and other macroeconomic factors, demand had waned down in 2021

-

The NR market had witnessed a decreasing trend from 2014 to early 2016, due to lack of support from downstream demand from major consumers, such as China, the US, etc.

-

The NR market witnessed a lack of strong growth catalysts in 2018 to H1 2019, with a decline in sales of auto and tires

-

The implications from US–China trade, especially in rubber end products and subdued downstream sentiments due to COVID-19 and fall in crude oil prices have impacted the market growth in 2021

-

Latex grades that goes into gloves, condoms, etc., had witnessed a rise in demand sentiments, especially during the pandemic, which gave Malaysia a recovery edge

-

Positive outlook from 2023 to 2025 would be supported by the expected recovery in automobiles and tires sectors, medical and gloves sector, durables, etc.

Global Capacity–Demand Analysis

Asia will continue to be the dominant supplier of NR, due to the increase in yielding area and the average yield in top producing countries, like Thailand, Indonesia Malaysia, and India. However, non-Asian countries, such as Ivory Coast and Liberia, have become potential alternative sourcing destinations.

Market Outlook

-

The global NR demand is projected to increase at a CAGR of approx. 3 percent

-

Production is expected to be around 15.5 MMT by 2025, from the current level of 13.8 MMT in 2021

-

Production output could decline post 2022, due to the low rate of tapping experienced during the low-priced years of NR

-

During the low-priced NR period (from 2015), farmers and producers did not encourage tapping or planting trees when the margins were low

-

The decline in plantation and cultivation from 2014 would result in a supply crunch, post 2021, in the NR market*

-

The demand sentiments were hit hard by the weakness in automobiles and tire sectors, due to the fall in crude oil prices and COVID-19, US–China trade war, etc.

-

Latex segment had witnessed a heathy rise on the account of the demand surge from dipped goods, such as gloves, condoms, etc.

-

Vietnam and China made extensive NR investments in countries, like Laos and Cambodia

-

Market participants are worried the weakness in buying sentiments and low margins could force plantations owners, tappers to discontinue new planation process

Engagement Outlook

-

Vietnam has increased its market share in the NR industry through high production numbers and rise in Y-o-Y exports. Vietnam is emerging as another prospective destination for sourcing

-

Indonesia is another strong option, aligning with abundant supply, lower prices, and export-friendly options

-

Non-Asian producers, such as Ivory Coast, have been showing promising supply outlook in the future from Africa nations

Natural Rubber Market - Drivers and Constraints

Drivers

Emerging nations to drive demand: The tire industry is shifting toward low-cost production countries, such as China, India, and other emerging economies, as they will be driving the total tire demand growth.

-

There is a huge untapped potential in the auto sector in emerging regions, especially for small cars

-

Increased consumer preferences for SUVs in countries, like India and China, will require increased composition of NR in their large tires

-

The rise in health awareness and personal hygiene in developing economies are expected to drive the need for gloves, condoms, etc.

Improved GDP linked to growth in the NR market

-

The growth in GDPs of major global economies, such as the US, China, India, and in general, the world, was checked with the NR demand growth

-

A strong co-relation was found between the NR demand and the world’s GDP growth

-

Every 4 percent increase in the world’s GDP was seen to have increased NR demand by 1 percent

Constraints

Substitution by SBR

-

The opportunity for synthetic rubber substitution depends on the major segment that the tire manufacturer caters to. For example, the biggest supplier of passenger car tires has a higher substitution opportunity for synthetic rubber

-

Other NR application areas, such as gloves, are also witnessing high substitution by synthetic rubber, in the manufacture of nitrile latex. The major consumers of nitrile gloves are developed markets, such as the US and Europe, accounting to 70–80 percent of demand

Reduction of NR share in the global rubber industry

-

NR vs. SR relative share has been falling for the past 15 years, which can be attributed to increase in percentage share of total passenger car vehicle tires in the overall tire production, and it is expected to continue in the near future

Supply shortage post 2020

-

Most of the major NR producing regions had witnessed an increase in plantation and cultivation when the rubber prices were very high, leaving better margins for the producers

-

This trend had drastically declined when the producers did not resume the rate of plantation from 2014 onwards. This could lead to supply constraints from 2020

Why you Should Buy This report

This industry report on the natural rubber market offers quantitative and qualitative insights and a comprehensive assessment of market size and growth rate for all segments. In tandem with this, the research study offers a detailed evaluation of natural rubber price and competitive landscape. Different important data presented in the industry report include market dynamics, ongoing trends, Porter’s Five Forces analysis, macro and microeconomic factors, and company profiles.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.