CATEGORY

Mining Support Equipment

Support Equipment are used in mining site as auxilliary equipment for operations such as grading, levelling, etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Mining Support Equipment.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoMining Support Equipment Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoMining Support Equipment Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Mining Support Equipment category is 5.60%

Payment Terms

(in days)

The industry average payment terms in Mining Support Equipment category for the current quarter is 105.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Mining Support Equipment market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMining Support Equipment market frequently asked questions

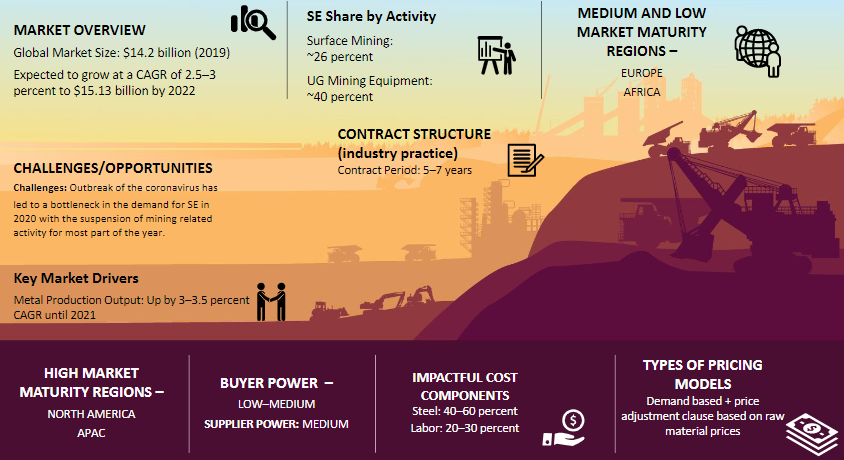

According to Beroe's report, the global SE market will grow by 3 ' 3.5 percent CAGR reaching a valuation of $14.9 Bn due to the rise in mineral production output. Considerable growth will improve the overall economic scenario in China and increase commodity prices.

The net supply contract tenure is between 5 ' 7 years and it's determined using the formula: Demand-based + price adjustment clause based on raw material prices

As per the mining support equipment market size shared by Beroe, both Europe and Africa happen to fall in the category of being the medium and low maturity market regions. However, the high maturity market is being dominated by North America and the APAC region.

The top global supplier names from the industry are ' Caterpillar, Komatsu, Sandvik, Joy Global, and Hitachi.

The metal production output (2 ' 3 percent) and commodity price (5 ' 6 percent) drive the entire mining support equipment market.

Following the insights of the mining support equipment market research report, surface mining holds a market share of 34 percent while UG mining equipment holds a share of 15 percent.

As per the report, the steady upswing of demand from regions like India and China followed by the adoption of smart technology by Australia (major production region) will lead to the unparalleled growth of the support equipment market.

As per Beroe's analysis report, both Caterpillar and Komatsu supply nearly 11, 500 mining dozers, while the number of active wheel loaders (with payloads) vary from 2 ' 15 MT and are provided by Caterpillar, Komatsu, and Joy Global/P&H (LeTourneau).

The primary factors that would contribute to the faster growth of SE equipment in the UG sector compared to that in the surface mining category are: Increasing adoption of UG mining methods due to falling ore grades at open cast mines Global economic growth Considerable increase in exploration activities Increase in the mechanization of the mines The decrease in the ore grades in surface mines

From a global perspective, UG wheel loader/LHD holds nearly 85 percent of the SE market in the UG equipment category. Beroe's mining support equipment market news report also indicates that it can be the fastest-growing sub-segment in the SE category for the UG equipment in the coming years.

Mining Support Equipment market report transcript

Global Market Outlook on Mining Support Equipment

-

The global mining support equipment market is expected to value $49.51 billion in 2023 (E), and it is expected to grow at a CAGR of 5.5–6 percent between 2022 and 2027, primarily driven by rapid industrialization and significant growth in the infrastructural activities undertaken by the public institutions in emerging markets

-

Mature markets Europe and North America collectively account to more than 40% of market share since pre-covid and still forecasted to grow at a CAGR of 5-6.5% by 2026. The market is been dominated by Asia-Pacific, which alone occupies 40-50% of market share

Mining Support Equipment Market Overview –Global

-

The global SE market is expected to grow by 5.5-6% percent CAGR between 2022 and 2027, owing to the expected rise in mineral production output along with infrastructure developmental projects by both developing and developed economies, coupled with the increased demand for commodities.

-

Adoption of technological advancements in key features of critical mining support equipment are observed in India, China and Australia.

Market Overview : Supply Landscape (Jackhammer)

-

Europe is the major market for jackhammer equipment, followed by North America, Asia-Pacific and LAMEA region.

-

In Europe, the top players include Germany, UK, France, Spain and Italy.

-

The jackhammer market is estimated to value at approx. $0.44 billion in 2022, and it is expected to grow at a CAGR of 5.50-6 percent during the next 4-5 years. So, it remains as the largest market for the support equipment, due to the presence of emerging economies, such as India, China, and Japan.

-

The three types of jackhammer include pneumatic, hydraulic and electric jackhammers. Pneumatic jackhammers hold a market share of 45-50 percent which is approx. estimated to value at $0.22 billion in 2022. Electric and Hydraulic jackhammers hold a market share of 25-30 percent and 15-20 percent respectively and are estimated to value at $0.13 billion and $0.09 billion accordingly.

Industry Drivers and Constraints : Mining Support Equipment

Drivers

Increase in Mining Activity

-

The long-term demand for Mining Equipment is anticipated to be supported by a gradual expansion in mining activity in the key markets, including India, Indonesia, China, and Australia, by 2026.

Declining Ore Grade in Open Cast Mines

-

Mining companies are utilizing UG mineral extraction as a result of declining ore grades in surface mines. This results in an increase in underground mining operations, which raises the need for support equipment in certain applications.

Increase in Commodity Price

-

Higher profit margins from metal/commodity pricing will encourage the development of new mines and the expansion of existing ones, like greenfield or brownfield expansion, which will support the need for equipment.

Adoption of new technologies/ growth in electronics industry

-

With companies focusing on shift from diesel engines and remote working may drive up the demand for electrical and automated equipment especially in developed economies.

Constraints

Government Regulations on Mining

-

Regulations on environmental and safety hazards in underground mining are in place by governments in both developed and developing nations, this would remain a market restraint for support equipment.

Resource Nationalism

-

Resource nationalism poses the biggest threat to mining companies and OEM manufacturers alike.

-

Resource nationalism is a potential risk in various regions, including Canada, and is a constraint against capital investment adversely impacting SE suppliers.

Lower Spending in Developing countries

-

Developing countries mostly prefer used mining machinery since they have a reliable life cycle if maintained properly and lower cost which is an hindrance to new sales.

Cost Drivers : Mining Support Equipment

-

Raw material constitutes 50-60 % of the cost structure of the Mining Support Equipment categories namely Jack Hammer, Pumps, and Ventilation fans

-

The prices of carbon steel, copper, stainless steel, tungsten and natural rubber are expected to increase during Q1 2023, owing to increase in restocking activities.

-

Energy prices are expected to increase 4-6% owing to the increase in industrial power demand in the US and EU whereas in China energy prices are expected to relax due to reduced consumption by the mills as a result of lockdown activities

-

Industry players recorded higher sales in Q1 2022 and anticipate that there will be uptrend after Q3 2022. The market outlook remains uncertain as prices are likely to be greatly impacted by global geopolitical, macroeconomic, and supply chain issues associated with the COVID-19 shutdown, particularly in China

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.