CATEGORY

Milk Powders (Skim)

Global Skim Milk Powders market witnessed oversupplied scenario and skewed trade dynamics in recent times. This trend in turn is expected to drive high price volatility in milk and milk powder segment.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Milk Powders (Skim) .

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Farm-gate milk prices in Europe witness a decline

March 02, 2023Projected fluid milk decline in EU

April 06, 2023Global Dairy Trade index climbs up after three consecutive declines

November 17, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Milk Powders (Skim)

Schedule a DemoMilk Powders (Skim) Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoMilk Powders (Skim) Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Milk Powders (Skim) category is 7.00%

Payment Terms

(in days)

The industry average payment terms in Milk Powders (Skim) category for the current quarter is 15.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Milk Powders (Skim) market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMilk Powders (Skim) market report transcript

Milk Powders (Skim) Global Market Outlook

-

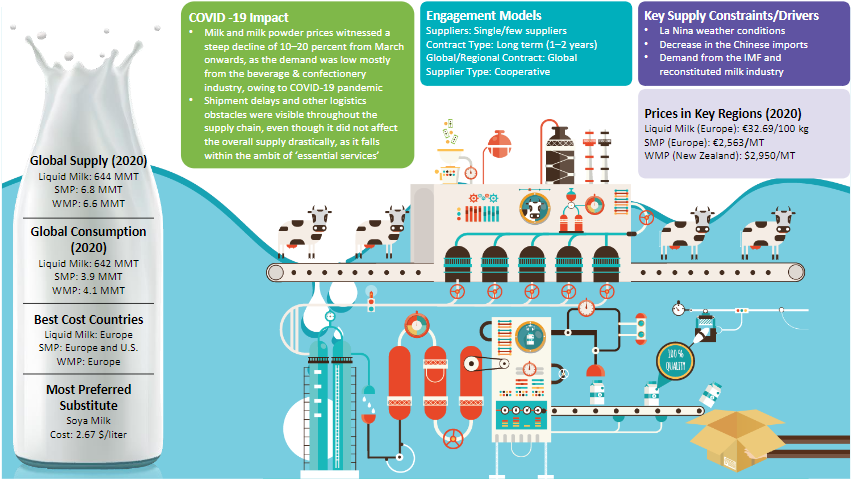

The global supply–demand dynamics scenario is currently driven by strong demand and tightness in fluid milk supply across the major producers in addition to COVID-19 related supply disruptions and labor shortage issues

-

Oceania is a key market, as it produces only 5 percent of the global milk, but contributes to more than 40 percent of the milk derivatives export market

Liquid Milk - Value Chain

-

The market complexity is considered to be high in the milk and milk powder market, due to standardization and multiple co-products in the value chain (nearly, 38 products in the tier-2 and 3 levels), with majority of the products finding applications in the food & beverage industry.

Milk Powders: Value Chain

-

SMP is a standalone product from low-fat milk, with no co-products/by-products, while WMP is produced along with various other tier-3 co-products

-

91 liters of low-fat milk, with 0.5 fat, yield 9 kg of SMP and 4.88 kg of butter (80 percent fat)

-

87 liters of standardized milk, with 3.5 percent fat, yield 13 kg of WMP and 2.85 kg of butter (80 percent fat)

Liquid Milk - Supply–Demand Analysis

-

The global liquid milk market landscape is dominated by the top 5–6 regions, accounting for 80–85 percent of the production share. The growth in supply is driven by demand from the downstream sectors is likely to witness a CAGR of 1.6 percent over 2021-2026

-

In 2022, 661 MMT of liquid milk was supplied globally, increasing marginally by 0.3 percent on a Y-o-Y comparison, on the account of lower-than-expected supply in Oceania

Market Outlook

-

Global supply tightness of fluid milk in 2022 is poised to improve in 2023, supported by higher production prospects in the US and the EU

-

The factory use consumption for processing liquid milk holds the bulk market share of about 70 percent for the liquid milk supply

-

Though the global dairy herd contracted by 0.6 percent since 2016, due to the consolidation of dairy farms, increased productivity of the herd has led to a gradual increase in milk output to cater to rising domestic and international demand

Liquid Milk - Trade Dynamics

-

The European production quota lift and Russian ban resulted in an increase in European exports, majorly to China. Weak cold chain logistics drive China’s liquid milk imports. The Chinese dairy firms have purchased foreign dairy companies for the purpose of re-exporting back to China, which aids the growth of UHT imports.

Production and Manufacturing Technologies of Milk Powder

-

Separation is the processing of milk with separators to create a skim and cream portions. Separation produces a skim portion that is less than 0.5 percent fat and a cream portion that is usually 40 percent fat.

Liquid Milk: Cost Structure Analysis

Raw material (50 percent) is the key cost factor. Weather impact in major feed grain or pasture growing areas is also expected to impact the international milk prices. Among the processors, co-operatives operate with better raw material sourcing dynamics and optimized input cost maximization

Key cost factors and feedstock that impact the materials

-

Raw material is the key cost factor, which constitutes around 49 percent of the total production cost. Overhead cost accounts for nearly 30 percent, which includes machinery, equipment & land rental costs

-

Any flood or drought affects the pasture lands and influences the feed cost

Key factors tracked for pricing estimations

-

Total annual production, capacity utilization, cost components (fixed cost, operating cost, overhead cost), and profit margins

Cost factors between co-operative and private dairies

-

In large producing countries, such as India, co-operatives, like Amul, dominate the organized dairy industry (80 percent of revenue), as raw material sourcing dynamics favor them

-

Dairy farmers own the shares in co-operatives, whose objective is sustainable input cost maximization and co-operatives work on a no-profit no-loss principle, thus benefitting farmers

-

Indian milk producers for co-operatives retain a large share (77 percent) of the price that consumers pay for the milk

Why You Should Buy This Report

- This dairy powder analysis report gives information regarding the milk and milk powder value chain analysis, demand-supply analysis, trade dynamics, etc.

- It gives the regional market outlook of North America, Australia, Oceania, etc.

- The report gives the Porter’s five force analysis and major trends of the global milk powder industry.

- It gives the cost structure and pricing analysis and details the key profiles of companies like Murray Goulburn Co-operative Co. Limited, Saputo, Fonterra, Arra Foods, etc. that are major players in the milk powder market.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.