CATEGORY

Methyl Ester Sulfonate

The global market size for MES is expected to grow at a CAGR of 18 percent Y-o-Y, which is used as a biodegradable substitute for LAS Powder detergents consume approximately 88 percent of the global MES demand, followed by dishwashing

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Methyl Ester Sulfonate.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoMethyl Ester Sulfonate Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoMethyl Ester Sulfonate Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Methyl Ester Sulfonate category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Methyl Ester Sulfonate category for the current quarter is 70.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Methyl Ester Sulfonate market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMethyl Ester Sulfonate market report transcript

Global Market Outlook on Methyl Ester Sulfonate

-

Powder detergents consume approximately 88 percent of the global MES demand, which is expected to be the major demand driver for MES, followed by dishwashing

-

Increasing demand for powder detergents and dishwashing paste from growing economies, like China and India, is expected to drive the demand of MES until 2025

Methyl Ester Sulfonate Demand Market Outlook

-

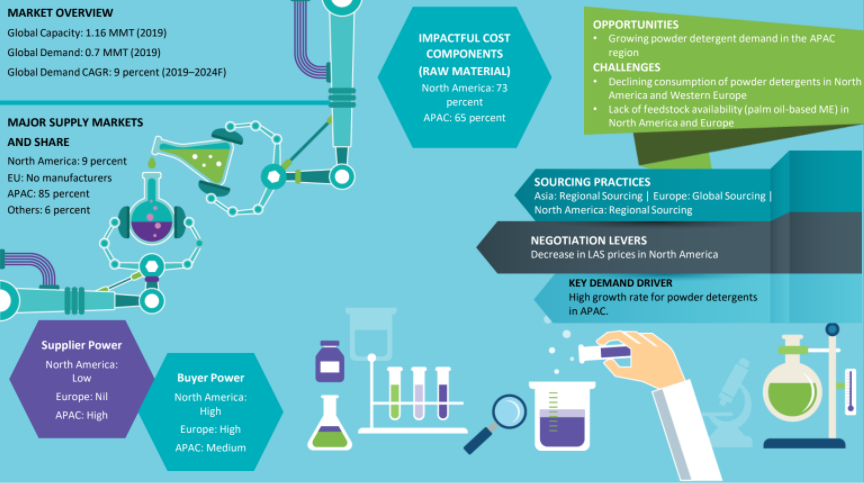

MES demand is expected to grow at 8.5 to 9 percent until 2025. The APAC will be the major demand-driving region for MES, due to high growth rate of more than 8–10 percent for powder detergents in China and India

-

MES demand in Europe and North America is expected to be low, due to high maturity of powder detergents, as consumers have shifted toward liquid detergent

Global Market Size: MES

-

The global market size for MES is expected to grow at a CAGR of 10 to 11 percent Y-o-Y, which is used as a biodegradable substitute for LAS, which is driven by the increasing powder detergent consumption in the APAC

-

The market size in witnessed a decrease during Covid-19 pandemic outbreak, due to poor economic performance across the key demand sectors and only a slight decrease in the consumption volume by the rubber production and powder detergent industry

Global Capacity–Demand Analysis

-

MES is a biodegradable surfactant derived from palm oil, which has evolved as a successful substitute for petrochemical-derived LAS

-

The MES market is expected to grow at a CAGR of 8.5 to 9 percent until 2025, mainly due to the increasing detergent consumption and as a potential replacement of LAS.

Global Demand by Application : Methyl Ester Sulfonate

The detergents industry is expected to be the major demand driver for MES, due to the increasing disposable income in developing economies, like China and India in the APAC.

Downstream Demand Outlook

Powder detergents: The major end-use application

-

MES is mainly used in the production of powder detergents, which occupies the major demand. The growing powder detergent demand in APAC helps to drive the demand of MES

Dishwashing paste is the next major application

-

Approximately 6–7 percent of MES finds application in dishwashing paste, which has a growing demand in developing regions, such as Asia, which is expected to grow by 3–4 percent until 2025

MES in other applications

-

MES is also used in industries, such as agricultural industry as dispersant, leather technology as de-fattener, plastic industry as emulsifier, rubber production as release agent, etc. These applications are expected to have negligible influence on MES demand

Supply–Demand Trends and Outlook: APAC

Demand Trends

-

The demand for MES is expected to grow at 9.3 percent CAGR until 2025, due to an increase in MES consumption in this region, as an alternative to LAS. The detergent industry exhibits a high growth rate in the APAC of more than 8 percent CAGR, mainly due to the increased consumption of powder detergents by India and China

-

APAC dependence on the Middle East to source LAB for the production of LAS has increased in the recent times, due to cheaper price of LAB in the Middle East. Increasing crude oil prices have influenced the increase in price of LAS in the Asian region, which will make the manufacturers to shift to cost effective and biodegradable surfactant MES

Supply Situation

-

MES is well supplied, and the manufacturers in this region are running their plants at low operating rate, due to lack of technical expertise in spray-dry

-

Top suppliers have implemented Chemithon technology and are able to operate their plant at a higher operating rate

Capacity Additions

-

No major upcoming capacity additions

Impact to CPG Industry

-

Rising demand from the CPG industry in China and India will be met by the regional suppliers, which has enough capacity to cater to the MES demand

-

Increasing powder detergent demand in APAC countries will be the key demand driver of MES until 2025

Industry Drivers and Constraints : Methyl Ester Sulfonate

Drivers

Per capita income growth and increasing disposable income

-

Per capita income growth and increasing disposable income in Asia are expected to have a direct impact on the CPG. This will subsequently drive the demand for MES until 2025

Increasing eco-friendly products

-

Raising awareness about usage of eco friendly products and increasing use of biodegradable raw materials will be the major driver for MES

Increasing LAS price in APAC

-

LAS prices are expected to increase in upcoming years due to raise in crude oil price. As, MES is a cheaper and a potential substitute for LAS, the raising price may influence manufacturers to move towards the adoption of MES

Constraints

Matured powder detergent market

-

North American and European downstream markets are more mature which may hinder the demand growth rates

Lack of feedstock availability in North America and European regions

-

The North America and European region lacks feedstock palm oil based ME availability due to which the manufacturers are forced to import the raw material from Asian region which hinders the supply of MEA in these region

Why You Should Buy This Report

- Information about the methyl ester sulphonate market size, demand analysis, market outlook and trade dynamics of the global and regional methyl sulphonate market.

- Industry drivers and constraints and Porter’s five force analysis of APAC and North America regions.

- Methyl ester sulphonate supplier analysis, capacity share, SWOT analysis of players like KLK Oleo Chemicals, Wilmar International, Sun Products, etc.

- Best sourcing strategies, contract lengths, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.