CATEGORY

Methanol

With increasing evidence that global methanol sector is closely connected to the energy complex through its emergence in Chinese MTO industry, methanol is projected to be one of the fastest growing petrochemical products

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Methanol.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Air Products exits Indonesian coal-to-methanol project.

March 28, 2023Zagros Petrochemical Company resumes its methanol plant operations.

March 28, 2023Henan Zhongyuan Dahua resumes its methanol plant operations

March 28, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Methanol

Schedule a DemoMethanol Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoMethanol Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Methanol category is 5.00%

Payment Terms

(in days)

The industry average payment terms in Methanol category for the current quarter is 49.3 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Methanol market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMethanol market frequently asked questions

According to Beroe's analysis report, methanol global demand tracks GDP on an average ratio of 1.7 times. It is dominated by China which is the largest producer of methanol, and nearly 10-percent of its demand is met through imports. According to the methanol market data, the major demand center is in Asia (China) accounting for ~74 percent, followed by Europe and North America

As per the methanol market report, the global methanol market is expected to grow at a CAGR of 11.81 percent by 2025. The market is driven by factors like ' increasing demand for methanol in China from the olefins market (acceptance of the MTO technology), which is driven by the increasing demand for petrochemicals for the APAC region. Another contributing factor that drives the market is the need for alternatives to conventional transportation fuels and strong demand from traditional markets like adhesive, paints, and plastics.

According to Beroe's analysis report, Methanex | Ar ' Razi | MHTL | Zagros | Shenhua | Ningxia Coal are some of the biggest methanol producers on a global scale.

Methanol market report transcript

Global Market Outlook on Methanol

-

An expansion in a methanol producing capacity in the US and the entry of Iranian methanol into the market would shift the trade flow

-

This trend has increased the pressure on high-cost producers, who have started to rationalize

-

Key regions driving growth: Global methanol demand, tracks GDP on an average ratio of 1.7 times

-

China is likely to have the highest growth, driven by the increased demand from MTO developments

-

The ME and the US are likely to witness capacity surge, with the ME strengthening its position as a major exporter

Demand Market Outlook for Major Methanol Markets

-

Demand market of methanol is dominated by China. Although it is the largest producer of methanol, close to 10 percent of its demand is met through imports

-

Derivative capacity additions in China would spearhead the demand levels over the next three years [MTO (5.5 MMT/y), CTOs (4.2 MMT/y), MTGs (1.2 MMT/y)]

Methanol Industry Best Practices

-

In the Atlantic Basin arena, methanol price “premiums” existed over the last several years

-

Premiums are narrowing and China is becoming demand centric, while the mature markets requirements are fading away

Global Market Size: Methanol

-

The global methanol market is anticipated to grow at a CAGR of 4-5percent between 2022 and 2025. The methanol market is primarily driven by the following factors: Increasing demand for methanol in China from the olefins market (acceptance of the MTO technology), which is driven by increasing demand for petrochemicals in APAC

-

In addition to this, need for alternatives to conventional transportation fuels and strong demand from conventional markets like adhesives, paints, and plastics

-

The global methanol sector is now closely connected to the energy complex, through the emergence and growth of Methanol-to-Olefins (MTO) industry in China

-

Methanol would compete with naphtha as a feedstock for ethylene and propylene production through MTO

-

These products have high correlation to crude, thus making crude oil a proxy feedstock for methanol and hence the Chinese market and crude are the major drivers of global methanol prices

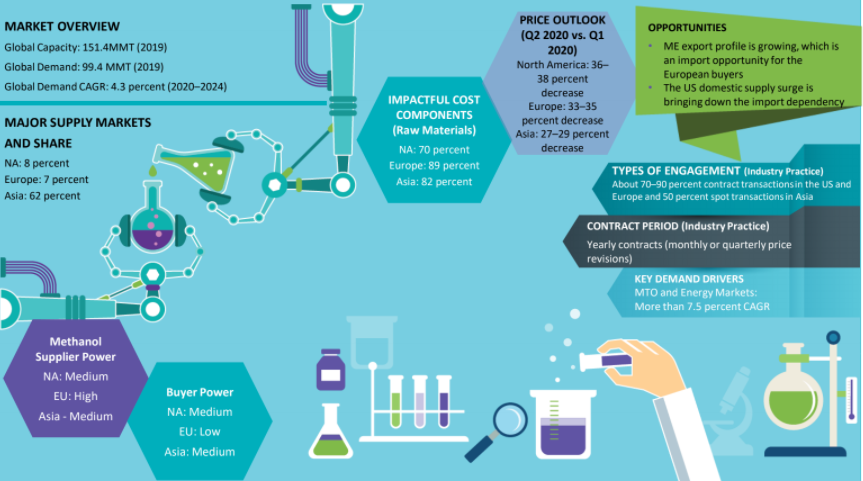

Global Capacity–Demand Analysis

-

Global methanol capacity and demand would be dominated by China

-

Global market is well-balanced with global demand growing at a CAGR of 4.3 percent, until 2025

-

Substantial capacity additions that are planned would suffice the growing demand, particularly from the Chinese market

Market Outlook

-

Methanol market fundamentals are expected to remain robust with China dominating the demand market through MTO developments

-

On the supply side, there will be a surge in capacity in the US and China, which will be primarily absorbed by China

Engagement Outlook

-

The Chinese methanol market’s dominance and derivatives (such as direct gasoline blending, MTO, and capacity additions) in the US would be driving significant shifts in the methanol landscape

-

Sourcing decisions will be exposed to new trade flows

-

The US market is expected to be attractive, as their low cost position in methanol production, along with the capacity additions might turn the region to a net exporter by end of 2022

Global Demand by Application : Methanol

-

Regional Demand Share: Major demand center for methanol is Asia (China), which accounts for ~67 percent, followed by Europe and North America, each accounting for 10 percent

-

MTO/MTP is the fastest growing derivative segment: It is likely to become the largest derivative of methanol in terms of value and volume by 2025.

Cost Structure Analysis : Methanol

Negotiation Lever: Methanol plants with efficient CO2 recovery unit incur low utility costs

-

Methanol production is accompanied by the release of Carbon dioxide (CO2) gas

-

About 0.9– 1 MT of CO2 is released in a typical plant, while plants with improved efficiency release about 0.54 MT of CO2

-

Built in CO2 recovery units in methanol plants bring down the utility costs by 60 percent

-

Producers in the ME are taking steps to incorporate CO2 re-use technologies in their facilities to further strengthen their profit margins, which are already at high levels, due to low cost feedstock

Why You Should Buy This Report

- The report provides information about the global methanol market size, outlook, methanol demand and supply trends, trade dynamics, import and export dynamics, etc.

- It gives the regional methanol market outlook and Porter’s five force analysis of North America, China and Europe and lists out the industry drivers and constraints, important industry events, innovations etc.

- The report gives a breakdown of the cost structure and does a pricing analysis and methanol price forecast.

- It does a SWOT analysis of key players such as Methanex, Ar–Razi, Methanol (Holdings) Trinidad Ltd. (MHTL), etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.