CATEGORY

Management Consulting

Management consulting is an advisory and/or implementation service provided to the organisations with the aim of improving the effectiveness of the firm's business strategy, organisational performance and operational processes.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Management Consulting.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

EY US all set to cutdown workforce by 5%

April 20, 2023ECG Management Consultants makes leadership changes

April 19, 2023Oceanic Consulting Group launches a new Business Resiliency practice

April 18, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Management Consulting

Schedule a DemoManagement Consulting Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoManagement Consulting Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Management Consulting category is 9.60%

Payment Terms

(in days)

The industry average payment terms in Management Consulting category for the current quarter is 59.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Management Consulting market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoManagement Consulting market frequently asked questions

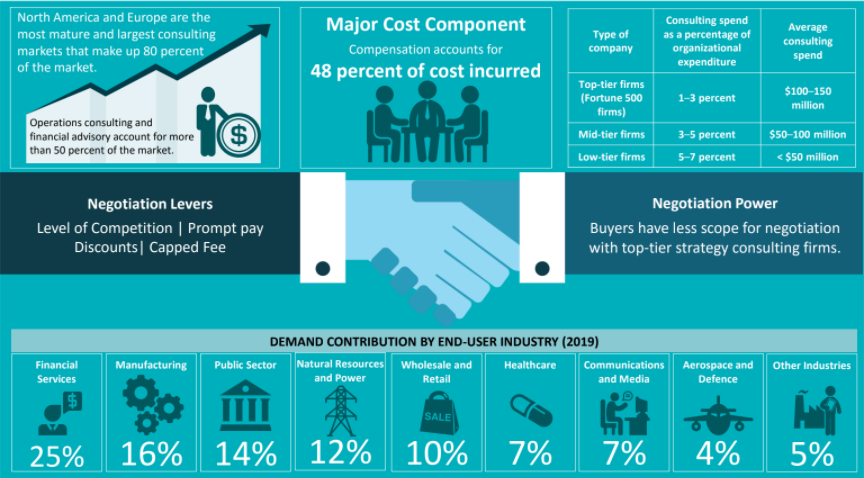

As per Beroe's industrial report, the market size of each continent varies. For North America it's $109 Bn, for Europe, it's $107 Bn, for Asia Pacific region, the market size is $44 Bn, and for Latin America, it's just $8 Bn.

There are 3 key players in the management consulting industry - Deloitte, Accenture, McKinsey & Company as they have high-profit margins. If we look at it from the perspective of management consulting market share, we find that North America and Europe are highly mature markets contributing to nearly three-fourth of the global market share, while the APAC region has relatively less market share.

As per Beroe's management consulting market research report, the management/business consulting market size is expected to grow nearly by 4-5 percent to reach $295 Billion by 2020. As per the report, in the next 5 years, industrial profitability is expected to remain stagnant, as rising business sentiment and profit will drive in more business.

The onset of technology skill sets like Agile, Machine Learning, etc. are forcing the MNCs to seek consulting advice. They're trying to minimize their costing and focus on efficiency to stand at par with their competitors. This need for operational efficiency, compliance with company regulations, and tech advancements are driving the entire global management consulting industry.

Management Consulting market report transcript

Global Market Outlook on Management Consulting

-

The global management consulting industry witnessed a rapid rise in demand in 2022, as companies focused on various transformation initiatives to navigate the pandemic

-

The global management consulting market has recorded a revenue of $300 billion in 2022 and is growing by a rate of 8- 10 percent in 2023 to reach $324 billion. In 2023 the global consulting market would be driven by an increase in demand for consulting services, especially ESG services, digital transformation, supply chain and operations consulting services, etc.

-

Billing rates are recording a growth of 2–5 percent in 2023, driven by an increase in demand across various service lines

Global Management Consulting Market Maturity

-

North America and Europe are highly mature markets contributing to three-fourth of the consulting revenue. Supplier capabilities to serve complex client requirements in these regions are high. The APAC consulting market has relatively lesser market maturity.

Global Management Consulting Drivers and Constraints

Digitization, need for operational efficiency, restructuring, and cost reduction initiatives are driving the demand for consulting services.

Drivers

Demand for management consultants is mainly driven by:

-

Companies looking to improve productivity and operational efficiency

-

Cost reduction initiatives by companies, amidst COVID-19 and workforce planning

-

Digital Transformation Strategy, Business Transformation, etc., to navigate the technology advancements

-

Compliance requirements to regulatory changes, such as BREXIT, EU GDPR, US Tax Reforms, etc., requiring advisory support

-

Companies focusing on business model re-inventions and exploring growth opportunities

-

Companies seeking advisory support for Mergers and Acquisitions

Constraints

Key constraints faced by management consulting firms are:

-

Rapid expansion of independent/freelance consultants, due to lower fees and flexibility offered

-

Large organizations are setting up in-house consulting groups and recruiting former consultants into management positions, thereby reducing the usage of external consultants

-

Knowledge commoditization, which is availability of consulting firm’s intellectual property in secondary sources

-

Most organizations, including Big Four firms, are facing talent shortage across the globe and the battle for talent getting challenging, in terms of cost, as well as employee retention. Consulting firms are therefore identifying key skills required and are upskilling their employees

Cost Drivers of Management Consulting

Compensation accounts for major portion of the consulting firm’s cost structure. Geographic presence of the staff, regulatory changes and other overhead costs are the major cost drivers in consulting industry.

Demand for Senior Resources

-

There is significant competition for senior resources who bring specialized expertise due to scarcity of supply

-

Consulting firms need to continuously invest in hiring and retaining the best experienced talent

Geographic Mix

-

Compensation varies based on location of staff

-

Use of junior resources in low-cost countries for non-client facing roles can lower staff cost

Consultant Fees

- For consulting firms having offshore locations in developing nations of Asia and Africa, as well as for advisory clients located in developing countries, the consultant fees is paid in local currency (and not USD), hence the consultant fees tend to be lower

Utilization rate

-

Demand for consulting and capacity in terms of number of employees drives the consulting cost

-

Lower utilization rate increases the operating cost and reduces the profitability of a consulting firm

Others

-

Inflation, legal fees arising due to any law suits, regulations, market conditions etc. drives consulting cost

-

Costs of compensation, benefits and office rent generally tend to increase over the period

Supply Trends and Insights : Management Consulting

Global/Regional Supplier

New Operating Model in Consulting

-

As virtual consulting model evolves, significant amount of consulting work is expected to take place remotely with limited onsite travel, even after the pandemic ends

-

The new operating model consists of local consulting specialists supported by SMEs across the globe, who reports to engagement partner travelling to client location at regular intervals and work remotely during the course of the project

Managed Services

-

There is a growing demand for managed services model in consulting, as companies look to reduce costs

-

This model consists of consulting firms, implementing proprietary solutions for repeatable consulting processes to ensure efficiency and cost reductions

Tier-3/Local Supplier

Service Expertise

-

Tier-2 suppliers are differentiating by improving their domain expertise in niche areas to provide deep domain consulting and through investment in marketing to improve brand perception

Small Players Carving Out Niche Market Share

-

The top consulting firms, such as the Big Fours, McKinsey, Bain BCG, etc., continue to hold a significant market share

-

Small firms are changing the market dynamics by carving out the share in niche markets with specialized services

-

The firms that are fast growing (small and big) are witnessing a triple-digit growth rate

Engagement Trends

-

Most Adopted Model Globally: Single supplier sourcing strategy

-

Why: To achieve better implementation and better negotiation on price

-

Pricing Strategy: Shift from fixed-fee to value-based or performance-based pricing

Why Should You Buy This Report?

- Gather a global perspective with the most extensive research study available on the category management consulting market covering several geographies.

- Understand the impact of the COVID-19 pandemic on the market and how it will emerge and grow as the pandemic subsides.

- Develop strategies at a regional and national level based on the local insights and assessment.

- Outpace industry competitors with the help of projection data and the consulting industry trends and drivers.

- Recognize growth segments for investment.

- Understand consumers as per the recent consulting industry report findings.

- Utilize the relationships between key data sets for superior strategizing.

- Determine performance against leading market players.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.