CATEGORY

Maintenance Services

Maintenance service deals with servicing and maintaining production & packaging equipments,repairing,mechanical & electrical installation services,managing overall industrial facilties in production and associated areas which are required for the steamless running of the plant

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Maintenance Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

KBR awarded automated fuel handling equipment contract

September 12, 2022Northern Industrial expands into Mexican Market

July 26, 2022KBR awarded automated fuel handling equipment contract

September 12, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Maintenance Services

Schedule a DemoMaintenance Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Maintenance Services category is 7.00%

Payment Terms

(in days)

The industry average payment terms in Maintenance Services category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

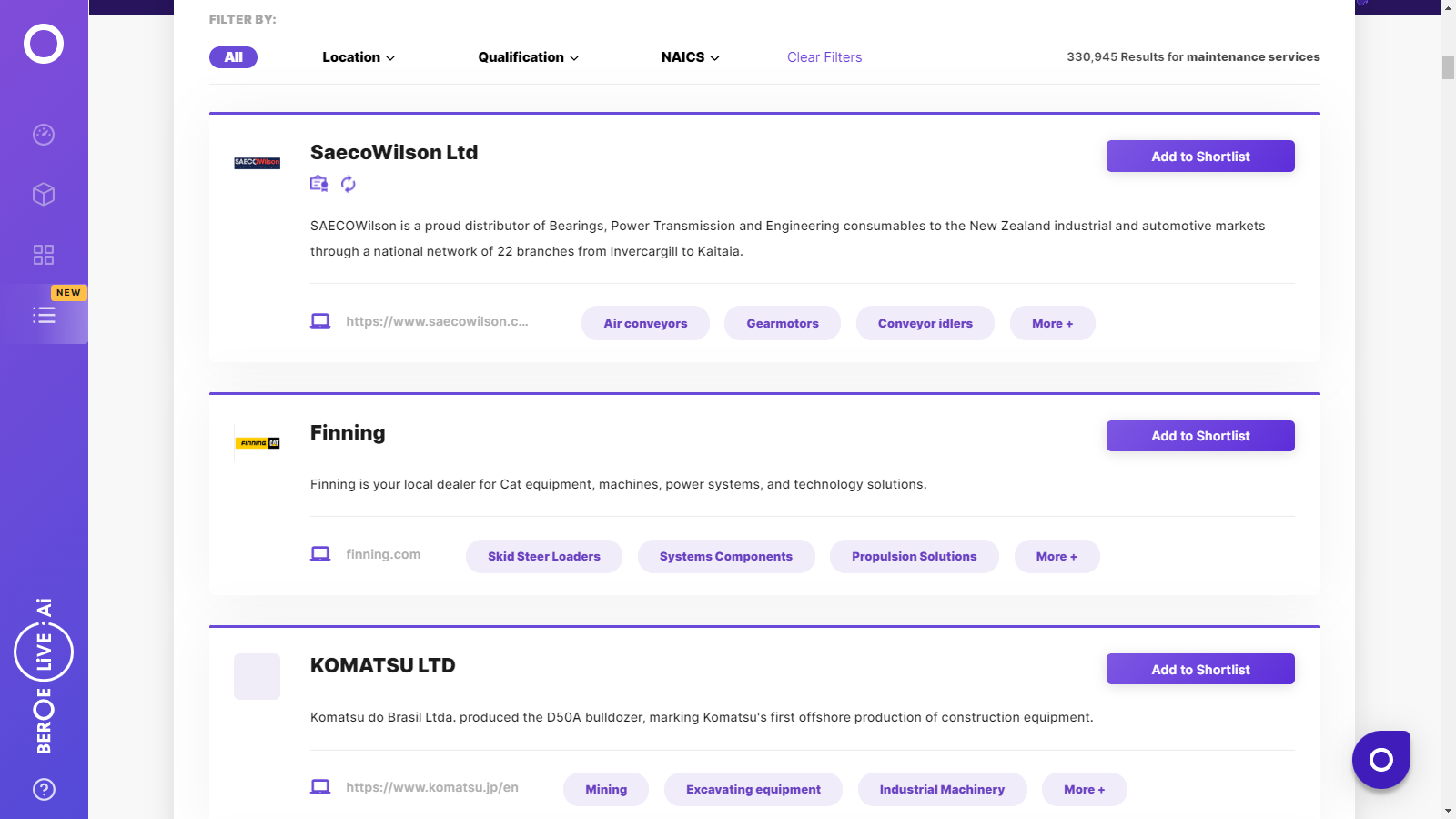

Maintenance Services Suppliers

Find the right-fit maintenance services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Maintenance Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMaintenance Services market report transcript

Maintenance Services Regional Market Outlook

-

The total global mining equipment maintenance service market is expected to be at $200.9 billion in 2022 (E) and forecasted to be at $ 207.9 billion in 2023 and expected to be valued at $222.7 billion in 2025

-

The equipment service market is highly fragmented, however, for mining equipment, the OEMs and its authorized dealers constitute to the majority of the market share

-

North America, Australia, Chile and South Africa are the major regions for mining activities and dominates the mining maintenance service market

Global Market Overview for Mining Equipment

-

The global mining equipment market is expected to be approximately $141.6 billion in 2022 and forecasted to grow to $149.6 billion in 2023 and is expected to grow at a CAGR of 5.5 percent and reach $185 billion by the end of 2027. The APAC accounted for over 58 percent of global mining equipment demand in 2021, and demand is expected to grow at an estimated CAGR of 8.6 percent during the forecast period

-

Surface mining equipment accounts for approximate 26 percent of the global mining equipment market and is expected to remain in the similar until 2027

-

Coal continues to be the top mining metal which stood at around 40 percent in the year 2020 globally

-

The market for drills and breakers is expected to grow at the fastest rate due to their varied applicability and increase in demand from developing regions

-

Depleting ore grades in surface mines have influenced miners to perform deeper mineral extraction, which has marginally decreased the demand for surface mining equipment

Global Market Overview for Mining Equipment Maintenance Services

-

The global maintenance services market is estimated to be around $1172 billion in 2021. The maintenance services for mining equipment market is expected to be at $200.9 billion and forecasted to be at $207.9 billion in 2023.It is expected to continue to grow at a CAGR of approx. 7–8 percent until 2025. Mining industry captures around 15 to 19 percent of the services market share and expected to grow at a CAGR of 3 to 4 percent until 2025

-

Demand for the machinery maintenance and heavy equipment repair services industry is steadily recovering from severe losses during the recession in last decade

-

The equipment repair and maintenance service industry is extremely fragmented and competitive catering to a variety of industries with vast end-user segments and suppliers. Hence, it provides opportunities to lower costs in every market where a business operates

-

The countries contributing to major demand are emerging market, such as Australia, China, India, Chile, Brazil, Ghana, Nigeria and other African continent due to increasing mining activities to support market demand

-

The aftermarket demand for mining equipment declined in North America and Europe with the aftereffects of the global recession while Asia witnessed steady increase in after market demand

-

Service portfolio of equipment service providers are not diversified covering all range of equipment categories, mostly suppliers specialize in particular range of equipment

-

For mining sector OEMs have the major hold on the service market followed by the OEM authorized service providers and the third-party vendors

-

The spur in the growth of industrial services are also contributed by increase in focus on core competency by the clients and the requirement of technical expertise for these services

-

Service providers are expected to be involved in more M&As to increase their geographical presence and further vertical integration in their operation

Global Equipment Maintenance Service Market Drivers and Constraints

Drivers

-

Customers’ focus on core competencies and outsourcing maintenance activities

-

Environmental and legal requirements drive the market for modernization and upgrades of production processes at mines. Ever rowing technical complexity of installed plant/equipment automation, data management, etc.

-

The demand for repair and maintenance for existing machinery is high in order to adhere to standards and safety norms. Growing demand for integrated services from a single supplier favors large-scale providers

-

Standardization of integrated services offers room for leading players to define quality standards

-

Global players are expanding their footprint in developing economies and require industrial service levels comparable to established economies, while local players in developing countries are expanding service capabilities and require high quality services to compete with bigger players

Constraints

-

Global demand of metals and coal affects the price of the commodity, and thereby affecting the investment in equipment and maintenance

-

Conservative mindset among buyers will lead to slow technology adoption

-

Increased competition from low-cost service companies, industry shall hinder the global companies, as they cannot compete against cost offered by lower companies which has lower overheads

-

Mobility, flexibility, and agility are the important factors to focus on. There is no coherent approach towards MRO, not only in regards to legal issues, but also on skills integration and skills harmonization

-

Local cultures and differences: A culture of change has to be embraced and to be made sustainable

Global Mining Equipment Maintenance Service Market Maturity

-

The repair and maintenance market is fragmented, since service portfolio of equipment service providers is not diversified, covering all range of equipment categories

-

Maintenance services demand is not much affected by slowdown in mining industry and the falling commodity prices. To improve the equipment life and performance by reduced the down time, mining companies have to keep up the maintenance activities on

Cost Break-up : Maintenance Services

-

Labor constitutes the major cost in any maintenance service contract

-

The management fee for the services is one of the areas for negotiation for the buyer, which contributes around 5 to 7 percent of the total costs

-

The supplier charges for the spares and consumable cost along with the cost of tools and instruments used for maintenance in the contract

-

Out of total cost, labor cost comprises of 60–65 percent, approximately 15–20 percent of the cost goes in taxes and overheads to the employer

-

Other costs include tools and infrastructure required for the services along with licenses and other overheads

-

Electrical contractors’ material costs are typically much less than other mechanical contractors (as generally standard materials are used and no fabricated materials required for E&I repair services)

-

The management fee for the services is one of the areas for negotiation in the contract for the buyer

Why You Should Buy This Report

- The report gives information about the industrial maintenance services market size, market maturity, trends, overview of the mining maintenance services market, to name a few.

- It lists out the major drivers and constraints and gives Porter's five force analysis of the global IT maintenance market.

- It provides supply trends and insights and does the SWOT analysis of major players such as Caterpillar, Sandvik, and Atlas Copco.

- The report gives the cost structure breakdown, price trends, and drivers analysis.

- It further lists out the best industry practices, engagement models, and KPIs.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now