CATEGORY

Maintenance Service Providers For Pharmaceutical Industry

Service provides who offer correctve, preventive, scheduled and predictive maintenance activities for pharmaceutical industry

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Maintenance Service Providers For Pharmaceutical Industry.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

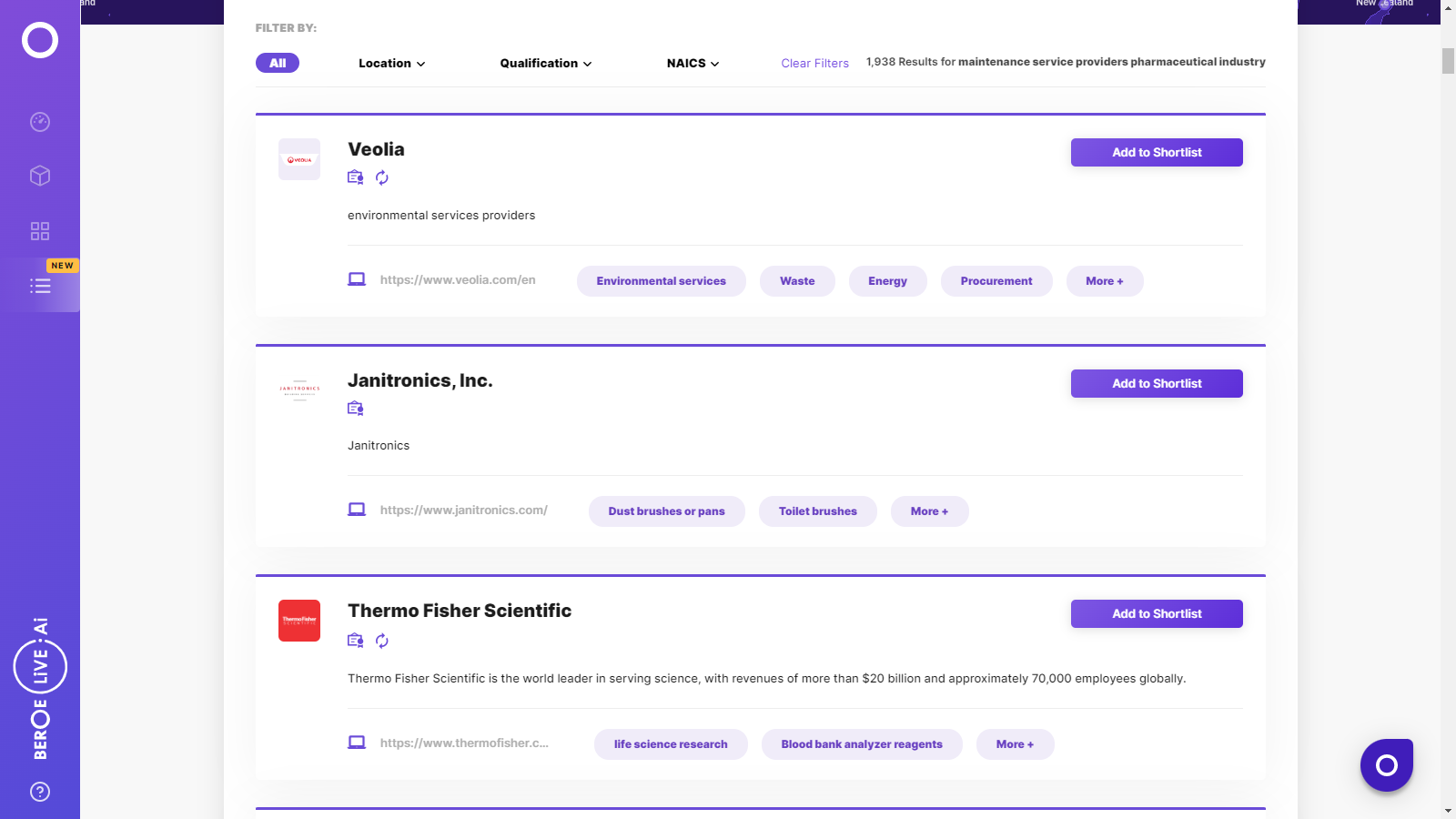

Maintenance Service Providers For Pharmaceutical Industry Suppliers

Find the right-fit maintenance service providers for pharmaceutical industry supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Maintenance Service Providers For Pharmaceutical Industry market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMaintenance Service Providers For Pharmaceutical Industry market report transcript

Global Market Outlook on Maintenance Service Providers For Pharmaceutical Industry

The global maintenance services market is estimated to be around $800 billion in 2016. It is expected to continue to grow at a CAGR of ~3–4 percent until 2022

Global Maintenance Service Market Size (in Billion USD)

- Demand for the machinery maintenance and heavy equipment repair services industry is steadily recovering from severe losses during the recession in last decade

- The equipment repair and maintenance service industry is extremely fragmented and competitive catering to a variety of industries with vast end-user segments and suppliers. Hence, it provides opportunities to lower costs in every market where a business operates

- The countries contributing to major demand are emerging market, such as Australia, China, India, Chile, Brazil, Ghana, Nigeria and other African countries.

Maintenance Services Market Share by Region (2017)

- The aftermarket demand for chemicals, oil and gas and mining equipment declined in North America and Europe with the after effects of the global recession while Asia witnessed steady increase in after market demand

- Service portfolio of equipment service providers are not diversified covering all range of equipment categories, mostly suppliers specialize in particular range of equipment

- OEMs have the major hold on the service market followed by the OEM authorized service providers and then the third party vendors

- The spur in the growth of industrial services are also contributed by increase in focus on core competency by the clients and the requirement of technical expertise for these services

- Service providers are expected to involved in more M&As to increase their geographical presence and further vertical integration in their operation

Global Market Trend

Major Trends in Maintenance Services

- Buyers are increasingly outsourcing majority of the non-core maintenance works and are looking forward for innovation in asset management and investment optimization in collaboration with maintenance service providers

- As the demand for integrated services and collaborative engagement is increasing, any supplier, providing multiple services, would enjoy a competitive edge

- Buyers are moving from a single service contract to integrated service contract that bundles various functional activities

- Many industries are adopting predictive maintenance approach with lifecycle assessment for healthy and reliable system, driven by the requisite for greater productivity and efficiency

- Organizations are adopting advanced technologies to provide effective communication between the manufacturing site and the enterprise, allowing to gain a competitive edge in the global market

- Local players are broadening their quality and service portfolio to stay competitive with their international counterparts

- Increasing competition from low-cost service providers and slow adoption rate at the buyer's side for change management are some of the major challenges in the market

- Buyers are interested towards consolidating their service providers, so as to maximize their benefit out of contracts

- Buyers interested in flexibility, in terms of choosing services and defining KPIs for the same

- Global suppliers and service provides are involved in M&As with smaller and regional players to increase their geographical footprint

- Big players are taking advantage by collaborating and expanding with the regional players to increase their service network

Market Trend and its Implication

Extensive Outsourcing

- Increasing number of buyers are adopting options to outsource maintenance services, so as to focus on core activities and leverage the expertise and experience of external service providers

- The approach is believed to create value to the maintenance. Leveraging the best expertise in maintenance services, based on the supplier's experience of handling other large clients and various trouble shooting.

Focus on Predictive and Reliability-based Maintenance

- Maintenance services market is moving toward improved plant reliability through precision skills, which is bringing significant change in attitude and thinking at all levels in the maintenance organization.

- Additionally, the maintenance organization invests significantly to add value through good engineering & maintenance experience, staff's accumulated plant knowledge, proven technologies, systems & services.

Focus on Advanced Technology, Automation, Mobile Technology

- With growing penetration of smartphones in the market, service providers are leveraging on technology to have access to real-time data anywhere, anytime.

- Provide advanced analytics and intelligence tools to help predict plant performance and equipment health using KPIs.

- Monitoring performance, setting targets and optimizing resources are highly enabled, thereby delivering the plant costs benefits.

Acquiring Skill and Technology to Improve Service Capability

- Many of the large maintenance service providers are improving their hard services capabilities to provide their buyers with a holistic supply portfolio.

- Increased number of M&As of specialist hard service providers in the recent times has enhanced the service providers' capabilities and opened new service markets for them.

Sourcing Parameters for Pharma Equipment Maintenance Services

- The prime drivers of pharmaceutical industry such as newer regulatory guidelines making mandatory use of latest technologies for improving quality and efficiency, increasing outsourcing activities etc. are putting continuous pressure to cut costs, improve efficiency, bring in quality and increase productivity etc.

- All the above factors together have imposed important concerns to develop newer technology acquisition strategies , procure new equipment, ink more exclusive MRO deals etc. with the OEMs or third-party service providers

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now