CATEGORY

Maintenance Repair and Overhaul Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Maintenance Repair and Overhaul Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Maintenance Repair and Overhaul Australia Suppliers

Find the right-fit maintenance repair and overhaul australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Maintenance Repair and Overhaul Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMaintenance Repair and Overhaul Australia market report transcript

Regional Market Outook on Maintenance Repair and Overhaul

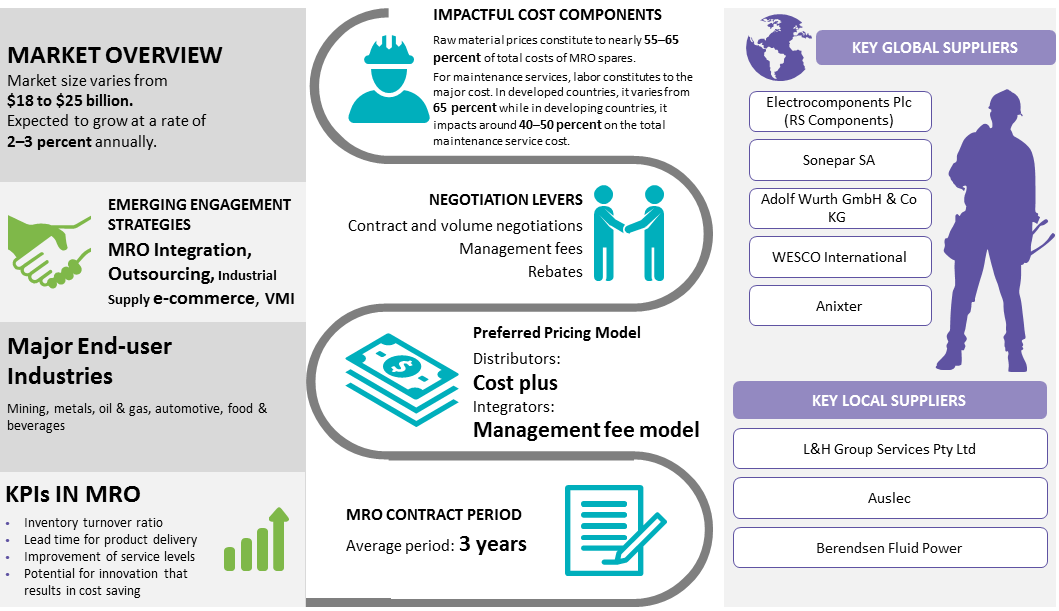

- The Australian MRO market is valued to be worth $18–25 billion in 2019 and is expected to grow at a rate of 2–3 percent annually

- The Asia-Pacific region accounts for approx. 37 percent of the global MRO market and is expected to remain in the similar range until 2020

- The MRO industry is extremely fragmented and competitive, catering to a variety of industries with vast end-user segments and suppliers

Penetration of Global Distributors/Integrators

- The supply base in Australia is emerging with more distributors, but pure Integrator presence in this region is low

Preferred Engagement Partners

- Distributors are the most preferred sourcing partner in Australia, and manufacturers are the second preferred sourcing partner

Maturity of Service Providers

- Australia is still an emerging market compared to North America and Europe. MRO providers are common, with dozens of vendors specializing in one product line or category, selling wares from small specialty shops

Maturity of Buyers

- Australia has high maturity in mining activities. Most major miners in the region, such as BHP, Rio Tinto, and Anglo American, are seeking to extend the existing capacity in the region

MRO Industry Drivers and Constraints

- MRO sourcing not being a core competency of most buyers, mature markets are increasingly seeing adoption of MRO outsourcing and integrated supply solutions and are reaping the benefits, in terms of hard cash savings and manpower reduction. The awareness of the same is low currently in Australia

- The mining and metals industry is the largest contributor to MRO demand in Australia, followed by oil & gas extraction and refining corporations

Drivers

Increase in Industrial Production:

- The MRO industry is propelled by industrial production. While the global industrial output is gradually increasing, so is the MRO market

Focus on Cost Reduction and Stock Optimization:

- With the pressure on manufacturers to reduce costs, they are looking for specialist MRO vendors for solutions to reduce costs both internally and through optimized procurement strategies

E-procurement:

- E-procurement offers a win–win solution to both the buyer and seller by reducing the paperwork, manpower, transactions, etc., thus providing for a quicker turnaround and hassle-free invoicing

Constraints

Volatility in Oil & Gas:

- Oil price volatility serves as a challenge to MRO buyers in establishing long-term plans and delays their engagement with MRO suppliers

Technological Barrier:

- Although most large buyers have the systems in place to support the solutions provided by MRO integrators, such buyers and systems are only restricted to the mature markets of North America and Europe (Western). It thus becomes very difficult and complex to apply the same solution on a global level

Porter's Five Forces Analysis: Australia

Supplier Power

- Negotiation opportunities for distributors with large suppliers are low, as their suppliers sell to customers directly

- Local suppliers/manufacturers have more bargaining power in the region compared to global players, as they understand the locality, language, and the requirement.

- Large players tie up with the local players to supply the parts

Barriers to New Entrants

- Speed to market, diversity in product portfolio, and network infrastructure across regions require high capital investment, a barrier to smaller new entrants, but not to global players

- As the market is developing, many global players have started supporting their customers in these countries. However, local players are more powerful, as they understand the locality and language of the region

Intensity of Rivalry

- The distributor growth has risen tremendously, which attracts more competition among existing suppliers to deliver more savings

- Existing players are fighting to provide differentiation

Threat of Substitutes

- Local manufacturers/distributors have threat from global distributors/integrators. Hence, many local distributors are trying to provide value-added services to retain the customer

- Distributors and integrators providing value-added services do not face threat of substitutes by pure play distributors or manufactures

Buyer Power

- There are a lot of local manufacturers and distributors in these regions. Each suppliers serve to a certain few categories, hence, consolidation of the entire MRO spend with the local players is not feasible. Therefore, buyers rely on the regional/local players and timely delivery and quality are their major concern rather than cost reduction

- Global suppliers are trying to enter into the emerging market

Australian MRO Market Overview

- MRO market in Australia varies from USD 18–25 billion with a growth rate of 2–3 percent annually, the presence of a moderate number of local as well as global distributors, which offer supply consolidation opportunities

- Major End-user Industries: The mining and metals industry is the largest contributor to MRO demand in Australia, followed by oil & gas extraction and refining corporations. The food & beverage industry is another key demand driver for industrial MRO in Australia

- Product Category Demand: Hydraulics, PVF, power transmission, and automotive spares account for major demand categories in Australia’s industrial MRO market

- Safety & Test Equipment, PPE, and certain consumables are the other major demand driving product categories in Australia.

- Market Trends: Acquisition of small and local distributors by major global distributors is increasing, in order to gain a wide footprint in Australia

- Preference for value-added services, such as on-site technical expertise and suppliers with product as well as proven industry expertise is a major trend in Australian MRO

- Currently, there is no pure play integrator present in Australia, however, research shows certain major distributors and suppliers (NOV Wilson, L&H Group, Wesco) willing to play the role of an acting integrator.

- E-procurement is mostly used in countries, like Australia, Japan, China, and India. Other countries in the Asia Pacific region still prefer issuing paper-based POs.

- MRO sourcing in the Asia Pacific region is mostly handled by internal teams, and it is expected to be the same in the coming few years, except for countries, like Japan and Australia.

Why You Should Buy This Report

- Information on the Australian maintenance repair and overhaul market outlook, industry drivers and constraints, M&As, and Porter’s five forces analysis of the MRO market.

- Supply trends and insights, production capabilities, etc.

- Cost structure analysis, pricing analysis, cost models, etc.

- Sourcing models, pricing models, engagement models, KPIs, upcoming MRO trends.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now