CATEGORY

Maintenance Repair & Operations (MRO)

MRO depicts the industry that handles spares and industry supplies that are needed for segments such as bearings and power transmission products, electrical supplies, fasteners, lubricants, filters, PVF, fluid power, safety supplies, HVAC, plumbing etc. used in multiple industries.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Maintenance Repair & Operations (MRO).

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Avnet expands in Germany

July 05, 2022Avnet expands in Germany

July 05, 2022Avnet expands in Germany

July 05, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Maintenance Repair & Operations (MRO)

Schedule a DemoMaintenance Repair & Operations (MRO) Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Maintenance Repair & Operations (MRO) category is 13.10%

Payment Terms

(in days)

The industry average payment terms in Maintenance Repair & Operations (MRO) category for the current quarter is 79.3 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Maintenance Repair & Operations (MRO) Suppliers

Find the right-fit maintenance repair & operations (mro) supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Maintenance Repair & Operations (MRO) market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMaintenance Repair & Operations (MRO) market frequently asked questions

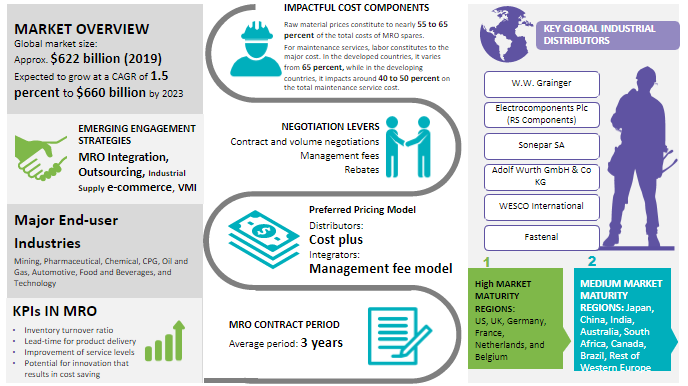

The MRO market share was valued at $605 billion as of 2018.

The MRO industry overview by Beroe shows that the high maturity market regions are US, UK, Germany, France, Netherlands, and Belgium. The medium market maturity regions are Japan, China, India, Australia, South Africa, Canada, and Brazil.

The current MRO trends based on Beroe's analysis are inflation of MRO spare part categories from 8-12% due to trade war and lack of target of any specific MRO category with dependence on raw material usage specific categories such as power transmission, tools, and fasteners. These changes are expected to kick in by 2020.

As per Beroe's MRO market analysis, the MRO market share is expected to increase at a CAGR of 1.72 percent and reach $660 billion by the end of 2020.

One of the key drivers of the MRO market is the fact that MRO outsourcing is not a core competency for many buyers which is increasing adoption of MRO outsourcing in mature markets. This awareness is found to be low in less mature markets such as APAC, MEA, and LATAM. A huge scope for the MRO market lies in the shale gas processing equipment market.

Maintenance Repair & Operations (MRO) market report transcript

-

The global MRO market is valued at $629.2 billion

-

The global market is forecasted to grow at a CAGR of 2.19 percent and reach $701.3 billion by the end of 2026

-

Mature Markets: North America, Western Europe

-

Fast Maturing Markets: APAC, LATAM, and Australia

Global MRO Market Maturity

-

The global MRO market was valued at $629.2 billion in 2022 E* and is expected to grow at a CAGR of 2.19 percent until 2026. The MRO industry is fragmented and competitive, catering to a variety of industries with vast end-user segments and suppliers.

Global MRO Industry Trends

-

Increasing levels of MRO outsourcing and adoption of Integrator model for MRO sourcing in developed regions like North America and Western Europe signal increasing buyer maturity and willingness to partner with suppliers

-

Global suppliers are entering new geographies in developed regions through mergers and acquisitions, thus offering multi-location solutions to global buyers

-

Customers expect MRO integrated suppliers to provide highly tailored solution, with real-time access to information and just-in-time delivery for products and services

-

Additionally, due to increased information access, the demand for transparency is consequently increasing

-

The fragmented MRO market in APAC and the MEA has produced a big opportunity for global distributors and integrators to tap this market

-

These regions are considered to be developing regions, in terms of MRO Sourcing maturity, with OEM and Distributors being the preferred souring channels

-

E-procurement is gaining popularity in Asian regions, like India and China. Increased purchase of low-value, high-volume spend is driving the B2B platform in these regions

-

MRO consolidation is steadily being implemented by mature Indian buyers. Companies, such as, TATA Steel, BASF, Shell, PepsiCo, etc., engage in consolidation activities through established MRO distributors

Global MRO Industry Drivers and Constraints

-

MRO sourcing not being a core competency of most buyers, mature markets are increasingly seeing adoption of MRO outsourcing and integrated supply solutions and are reaping the benefits in terms of hard cash savings and manpower reduction. The awareness of the same is low in maturing/less mature markets, such as APAC, the MEA and LATAM

-

Large scope for MRO market lies in the shale gas processing equipment market, by component type, which includes compressors and pumps, internal combustion engine, heat exchangers, electrical machinery, and measuring and controlling devices

Drivers

Increase in Industrial Production:

-

The MRO industry is propelled by industrial production. While the global industrial output is gradually increasing, so is the MRO market

Focus on Cost Reduction and Stock Optimization:

-

With the pressure on manufacturers to reduce costs, they are looking for specialist MRO suppliers for solutions to reduce costs both internally and through optimized procurement strategies

E-procurement:

-

E-procurement offers a win-win solution to both the buyer and seller by reducing the paperwork, manpower, transactions etc., thus providing for a quicker turnaround and hassle-free invoicing

Constraints

Volatility in Oil and Gas:

-

Oil price volatility serves as a challenge to MRO buyers in establishing long-term plans and delays their engagement with MRO suppliers

Technological Barrier:

-

Although most large buyers have the systems in place to support the solutions provided by MRO integrators, such buyers and systems are only restricted to the mature markets of North America and Europe (Western). It thus becomes very difficult and complex to apply the same solution on a global level

Awareness Regarding MRO Outsourcing:

-

There is also a low level of awareness among buyers in the developing markets about the opportunities presented by outsourcing of MRO procurement with respect to the cost savings and operational efficiencies

Global MRO Cost Structure Analysis

The cost of products are primarily driven by fluctuations in raw material and oil prices.

Complexity of Design

-

Variation and increased complexity of design increase the cost of a product

-

Costs involved in designing and testing would also add to the final cost of the product

Labor Cost

-

Labor cost varies from region to region. In order to keep the cost of the product low, Global suppliers try to get the products manufactured in low cost regions like China, India etc.

Raw Material

-

Stainless steel, iron ore, copper, and rubber forms majority of the raw material price

-

Fluctuations in these raw material prices have a direct impact on the final cost of the products

Oil Price Fluctuation

-

It is directly linked to the raw material price hikes. It affects highly on indirect transportation cost as well

-

Energy contributes almost 20 percent of the production costs of the parts

Proprietary vs. Non-proprietary

-

If the product is proprietary (exclusively manufactured by the OEM), it costs very high, and generally, manufacturers start producing the spare part after receipt of the order.

-

Non-proprietary carry lesser cost, due to availability of multiple sources of supply

Cost Model

-

The cost structure of MRO spares is directly proportional to the volatile raw material prices, which are heavily dependent on global economy and crude oil prices.

-

The should cost model (given above) will also add up profit margins of around 10 to 15 percent in the total cost of the product. The usual areas of negotiation are the overhead, logistics and profit margins component.

-

Most of the suppliers avoid the labor cost benefits by using more contracted labor than permanent employees. Usage of automation technology and multi skilled employees reduces the labor cost

Market Overview

The MRO industry is propelled by industrial production. While the global industrial output is gradually increasing, the same holds true for the global MRO market. The cost of products is primarily driven by fluctuations in raw material and oil prices, labor cost, raw proprietary vs. non-proprietary, and complexity of the design.

The major cost components include:

Raw Material (Costs associated with the various materials used for manufacturing the parts), Labor (Prevalent market wage rates for labor), Administrative costs & overheads (Costs associated with the office supplies, sales office cost, accounting fees, MRO marketing, insurance, interest, legal fees, rent, repairs, supplies, taxes, etc.)

MRO buyers relish the online experience of e-procurement, mainly from tier-1 MRO B2B suppliers. Moreover, e-commerce enables them to focus more on tail spend and ensures that c-part sourcing is streamlined into Spend Under Management (SUM). This eventually helps them to save cost.

Summary

MRO stands for maintenance, repair, and operations and it refers to the supplies consumed such as industrial equipment, consumables, furniture, and plant supplies required for upkeep. The MRO market was valued at over $600 billion in 2018 and by 2020, it was expected to surpass $660 billion. The high maturity markets include the UK, the US, France, Belgium, the Netherlands, and Germany. The medium maturity markets include Canada, India, Japan, China, Africa, Brazil, and some parts of Western Europe. The major end-use industries include food and beverages, CPG, mining, automotive, technology, pharmaceutical, and oil and gas.

According to the MRO industry trends, a trade war is predicted which can cause inflation of up to 12% in MRO spare parts. The categories that make use of raw material will be affected as a result. If measures are taken to avoid this, market players can lower the impact by a high level. Experts have recommended that those products which are OEM-driven or critical ones should focus on long-term contracts. This can help provide big discounts and can save from tariff effects to a certain level. One of the expert recommendations is to focus on locally sourced spare parts.

The global MRO trends include global suppliers focusing on developed regions and making an impact there with the help of mergers and acquisitions. This has given an opportunity for global buyers. Buyers are more aware and so they require high transparency from MRO suppliers. Buyers are expecting customized solutions and they require information access and timely delivery of products and services. Due to the fragmented market, integrators and distributors have lots of opportunities. The MRO spend analysis shows that some KPIs include lead-time for product delivery, innovation for potential, inventory turnover ratio, and service level improvements. The MRO stock is important to understand too.

Experts state that industrial production is leading to an expansion of the MRO market. In Asia, one of the trends is e-procurement. India and China are particularly focused on this. Some companies in India such as PepsiCo and TATA Steel are engaged in MRO consolidation with the help of MRO distributors. The benefit of e-procurement is enjoyed by B2B suppliers who are in the Tier-1 category. E-commerce has many benefits and one of them is that it enables buyers to focus on tail spend. This helps in streamlining the C-part sourcing into the SUM. This can help cut down on costs.

MRO Market analysis shows various drivers and constraints. MRO outsourcing is on the rise whereby high-cost savings and lower need for labor are some of the benefits. At present, medium and low maturity markets such as LATAM, APAC, and MEA are not immune to this and, as such, have not leveraged this opportunity. There is potential in the shale gas processing equipment market for MRO. There are many cost drivers for products including oil prices and raw materials. The main cost drivers for manufacturers include design, labor cost, oil price fluctuation, and raw materials.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now