CATEGORY

Lockbox Services

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Lockbox Services .

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoLockbox Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Lockbox Services category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Lockbox Services category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

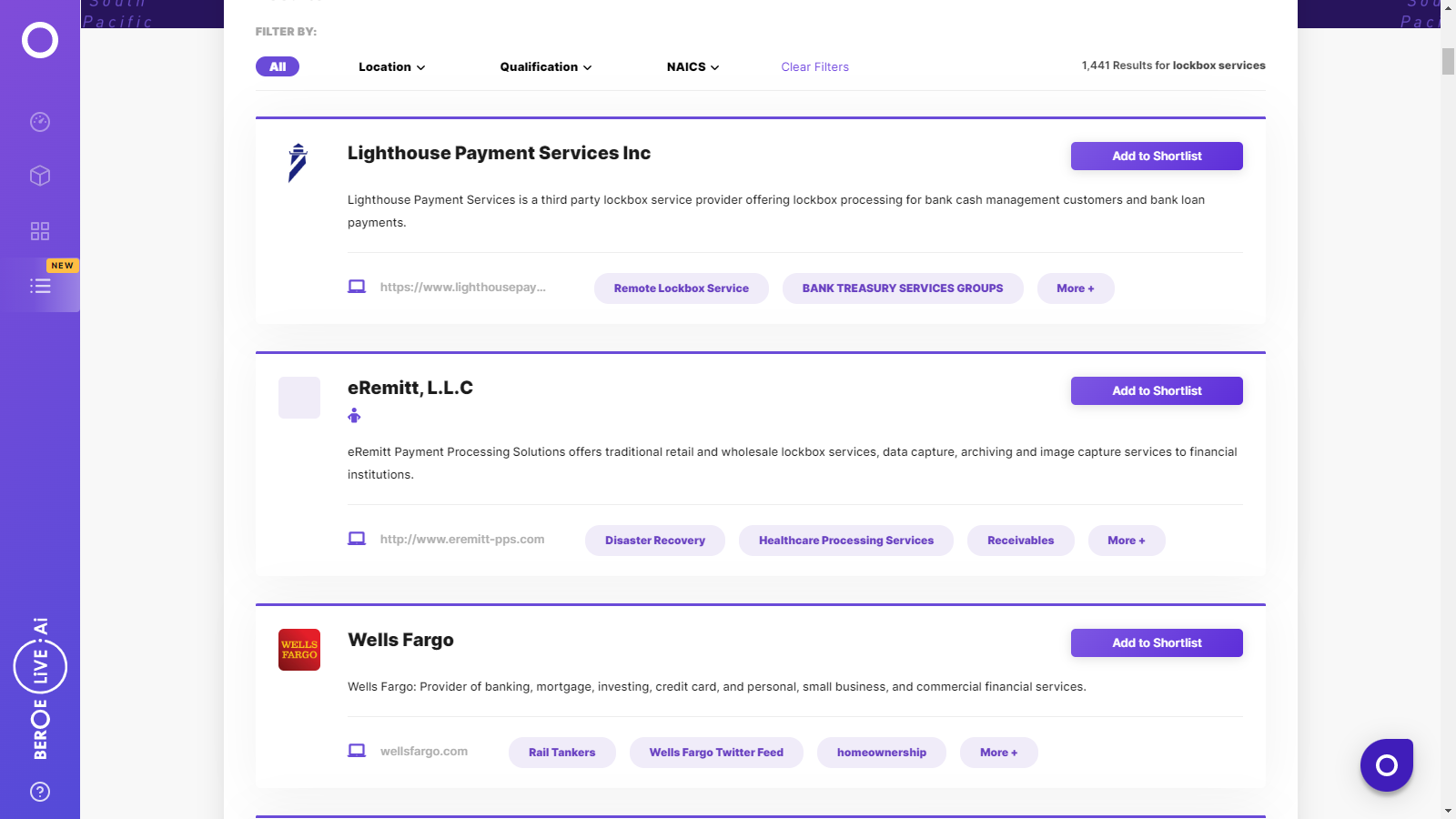

Lockbox Services Suppliers

Find the right-fit lockbox services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Lockbox Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLockbox Services market report transcript

Lockbox Services Global Market Outlook:

North America Bank Lockbox Service Volume/Items Forecast (In Billion $) (2022 Estimate) -- $65 billion

North America - Annual Growth Rate (2022 Estimate) -- 1.5 percent

-

North America has the most mature lockbox service until today. The services started early here and has consistently matured in terms of expansion and technological improvements

-

Advance in technology in most European and APAC countries have made them jump from cash/cheque payments to EFTs and card modes of payment. Germany, Sweden, Norway, Finland, Poland, Denmark, and the Netherlands have absolutely stopped issuing/accepting cheque payments

-

Some developing countries are still using traditional cheque pickups/drop and clear method. This is widely due to lack of service capability by service providers and unawareness among the users

Lockbox Services: Market Overview

-

About 70 percent of US-based companies make more than half of their payments to other companies by paper checks. Nevertheless, as the number of check payments businesses receive declines, the fixed costs force the per-item costs of processing to increase for companies’ own accounts receivables and for banks providing lockbox services. The industry is engaged in re-evaluating the value proposition of lockbox solutions to determine how they could reduce the overall payments processing.

Lockbox Services: Adoption Trends in the Market

-

The wholesale lockbox services are majorly adopted in the market, followed by retail and wholetail lockbox services, the other type of lockbox services is also gaining traction, such as remote lockbox services, white/private label lockbox services, etc.

Type of Lockbox Service/Products Adopted in the Market

-

Wholesale lockbox is widely adopted/accepted by both banks and the clients, followed by other type of Lockbox Services like Retail, Lockbox Services and Wholetail lockbox Services.

-

Wholesale lockbox processes complex payments, such as business-to-business and business-to-government (and vice versa)

-

Wholesale lockbox solutions offer the most customized approaches and value-added services compared to other lockbox categories; they address companies’ major challenges with regard to their receivables processes, such as payments not matching invoices

Type of Lockbox Processing Methods Deployment Adopted in the Market

-

Banks cite the following reasons for outsourcing the lockbox processing, such as declining check volume, mail delivery delays, to avoid investments in emerging technologies, expanding geographic coverage, and to gain the competitive offerings that are not currently available

-

In the recent years, banks of all sizes considering to outsource partially or completely their lockbox services because of declining margins, such as about 70 percent of retail lockbox banks, 74 percent of wholesale lockbox banks and 69 percent of Wholetail lockbox banks, considering to outsource partially or completely their lockbox services in North America

Porter's Analysis on Lockbox Services

Supplier Power

-

The supplier here would be the banks/non-bank institutions, providing the lockbox service

-

Determining the lockbox fees (monthly, maintenance, per transaction) remains in the hands of the supplier

-

The decision to waive/provide a discount on fees remains with the supplier

-

With businesses switching to faster and cheaper modes of payment, the bargaining power of the lockbox service providers are low

Barriers to New Entrants

-

The barriers for new entrants are high in the market, as it is unlikely for a new entrant to succeed against the current major players who have a large customer base in the market

-

Heads-up cost for setting up lockbox services around a country or continent is higher when compared to setting up other modes of payments. So, new entrants have a lot to think about investing in a system that has a very minimal annual growth rate and is becoming widely unpopular

Intensity of Rivalry

-

Intensity of rivalry is medium in North American regions, as they are the only region with mature lockbox service providers

-

Only a small number of banks and non-banking institutes offer lockbox services in Europe, APAC, and LAMEA countries. So, the intensity of rivalry ranges from medium to low in these regions

-

SMEs and other industries with smaller inward transfers, take advantage of Card, EFTs, and mobile payment systems, over cheque payments

Threat of Substitutes

-

The threat of substitutes is expected to be high in the market in the near future, as the world is moving towards a cashless economy model

-

There are several alternate payment modes, such as mobile wallets, fund transfer through bank websites, and with checks and lockbox models, ready to replace traditional lockbox services

Buyer Power

-

Buyers look for the best deals on the services and subscribe to the company, which gives the best deals (smaller fees and better service capability)

-

The bargaining power is high, as the buyer can easily switch to other suppliers or faster electronic transfers if they feel the cost of lockboxes is high

-

Buyers can ask for detailed remittance statements on cheques received and processed from the supplier, at any time and the supplier must oblige

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now