CATEGORY

Legal Services

Legal services includes service rendered in the conduct of proceedings before any court or other authority or tribunal and the provision of advice on legal matters

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Legal Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Dentons finalizes Cooperation with Link Legal

October 18, 2022DLA Piper announces its next London Managing Partner

October 17, 2022DLA Piper bolsters its Dubai IP Bench

October 13, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Legal Services

Schedule a DemoLegal Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoLegal Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Legal Services category is 12.80%

Payment Terms

(in days)

The industry average payment terms in Legal Services category for the current quarter is 64.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Legal Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLegal Services market report transcript

Legal Services Global Industry Outlook

-

In 2022, the global legal industry is expected to reach approx. $785 billion, and it is expected to rise at approx. 4-6 percent to reach $815 billion in 2023

-

Growth Drivers for the global legal market are practice areas like M&A, Litigation, Patents Law, Patent Litigation, Insurance, etc.

-

Constraints for the market growth have been in-house adoption of Legal technology to optimize outside counsel spend, and hence a check on average billing rates, and also insourcing simpler legal subtasks.

Legal Services Global Market Maturity

-

The maturity of legal suppliers in North America and Europe is high, as they command the highest market share. More than 60 percent of the legal spend is concentrated in the developed legal markets of North America and Europe. The APAC region has the highest potential for growth, with many global legal suppliers entering the fray.

Legal Services Global Drivers and Constraints

Increasing demand for practice areas, like Litigation, patent litigation, corporate work, real estate and tax work, is driving the demand for legal services. There is a mounting pressure to adopt AFAs and usher in transparency to billing models.

Drivers

Law firms (outside counsel)

-

Increasing demand for practice areas, like litigation, patents law, contract law, brand protection and employment law, has been driving the global legal market over the past few months.

-

Increasing demand from the mature markets, like the US (has experienced a slight dip in the past month, but has a stable overall demand levels) and UK, has been driving demand

LPO

-

Cost reduction and the need for better utilization of internal legal staff for strategic services have led to more work being outsourced to LPO units in low-cost destinations.

-

Favorable government policies, measures taken to liberalize and deregulate policies, reduced licensing requirements and the prospective removal of restrictions on Foreign Direct Investments (FDIs) are driving the need for work to be outsourced to low-cost offshore destinations.

Constraints

Law firms (outside counsel)

-

The pandemic situation, though has affected the usual pace with which the market revenues grew, has propelled law firms to adopt technology to overcome constraints. However, corporate legal departments adopting tech with equal gusto, has put a check on the law firms increasing their billing rates too much.

-

Mounting pressure to adopt alternative fees to bring transparency to billing models is acting as a constraint in the legal service industry, in terms of market revenues.

-

More number of lawyers are moving from private practice to in-house positions, thus reducing the information asymmetry and resulting in the domination of ‘price pressure’

-

Insourcing parts of litigation work, along with less critical work in other practice areas, like IP, employment, etc., are dampening the revenues of the law firm market

LPO

-

Lack of consistent service quality and data security issues have acted as constraints when work is being outsourced to LPO offshore locations.

Why You Should Buy This Report

- It provides information about the global legal market size, market maturity, industry trends, regional and global market outlook, etc.

- It lists out the industry drivers and constraints and provides the Porter’s five force analysis of the legal market.

- It provides insight into supply trends, supply landscape, tiering of law firms, etc. and does a SWOT analysis of key players like Latham & Watkins, DLA Piper, Baker & McKenzie, etc.

- The report provides the pricing structure, pricing analysis and legal spend benchmarking in the global legal services market.

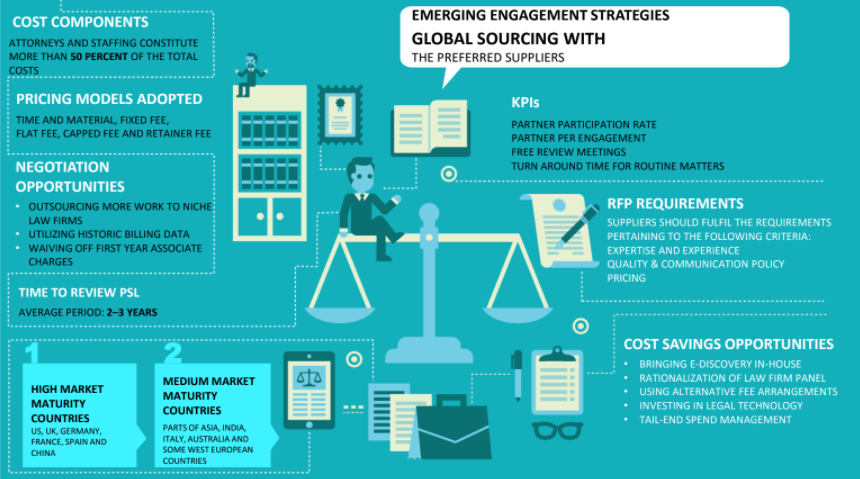

- The report shows the best legal market engagement, pricing and sourcing models, PSL strategy, KPIs, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.