CATEGORY

Labels

This report covers different label types, largely pressure sensitive labels across the globe

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Labels.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Resource Label expands its digital printing capabilities in US

March 15, 2023Avery Dennison Acquires Thermopatch

January 25, 2023Fortis Solution group acquires two more label supplier in US

September 08, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Labels

Schedule a DemoLabels Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Labels category is 5.40%

Payment Terms

(in days)

The industry average payment terms in Labels category for the current quarter is 105.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Labels market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLabels market frequently asked questions

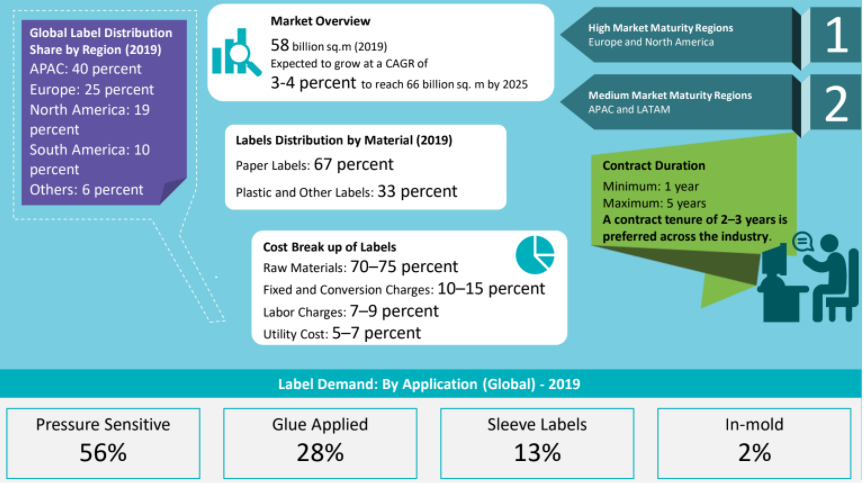

The global labels market was valued at 55 billion sq. m in 2016 and is expected to grow at a CAGR of 4 to 5 per cent and to reach 63 billion sq. m by 2020.

The global labels market is propelled by innovation in the print laminated labels market and laminated labels market which reflects the growth. To stay competitive, suppliers are innovating in face stock and printing, which drive the demand for labels in the future.

Regions of Europe and North America have high market maturity. Factors impacting this global labels market maturity primarily are innovations and technological advancements like - digital printing, linerless labels, and sustainable labeling solutions.

The largest market is the Food and beverage sector, contributing to ~30 percent of the print laminated labels market, Consumer durables market contributes to ~20 percent, followed by the pharmaceutical industry which currently occupies ~18 percent of the global labels market. This share of the pharmaceutical industry is ~7 percent of the global pharma packaging market.

As per Beroe's industry analysis reports, the factor which drives the demand for global labels is the type of application. The label demand as per the application is the Pressure sensitive labels, which are the most preferred label constituting 56% of the global labels market, followed by Glue applied labels (28%), which is mostly driven by the growth in food and beverage; followed by Sleeve labels (13%) and in-mold labels (2%).

As per Boreo's expert Industry reports, PSL is one of the largest segments expected to grow globally at around 5 to 6 percent from 2016 to 2020. This sector is expected to remain the largest label segment across the globe with the highest contribution, owing to its ease of use, versatility in designing and graphical options. The superior performance characteristic of PSL, makes it a popular choice for the CPG industry.

Increasing demand from food and beverages, one of the major end-use segments, is forecasted to grow ~3 to 4 percent annually and the pharmaceutical market is forecasted to grow at ~4 to 5 percent, which are set to fuel the demand for labels.

Labels market report transcript

Global Labels Industry Outlook

-

The global labels market size, in terms of volume, is about 60.6 billion sq. m. in 2023 and is set to grow at 3–4 percent, to reach 70 billion sq. m. by 2027

-

2023 is anticipated to be a promising year for labels market growth from increasing label demand

-

Growing consumer preference for labelled products, rising demand from non-essential end-use industries, increase in e-commerce activities are the driving factors of label market in 2023

-

Paper shortage, coupled with UPM Finland strike, sanctions against Russian trade, have impacted the price of label products. Label prices are anticipated to stay elevated in 2023

Labels Demand Market Outlook

-

Sustainable material and innovative product features are the prime factors, which brand owners look for in engaging with suppliers

-

The pandemic situation has increased the operating cost of suppliers, which led most of them to focus on cost cutting than on product innovations. Suppliers are expected to resume their label innovations spend in 2023

Global Labels Industry –Drivers

End-use Demand

-

Increasing demand from major end-use segments, such as food and beverages, is forecasted to grow by about 3–4 percent annually and the pharmaceutical market is forecasted to grow at about 4–5 percent, which are set to fuel the demand for labels

Innovation

-

The labels market is highly driven by innovation, which reflects the market growth. To stay competitive in the market, suppliers are coming up with innovations in facestock and printing, which will drive the demand for labels in the future

-

The retail and logistics industries are increasingly focused on using barcode labels and RFID labels, respectively. This resulted in high demand for such labels, especially across developed markets

Demographics and Lifestyle

-

Increase in disposable income of the middle-class people will lead to high spending on FMCG and retail sectors, which will indirectly boost the demand for labels Brand owners and FMCG

-

Today, CPG and FMCG companies are utilizing a high range of labeling and packaging formats in order to meet the customers’ changing needs and enhance the brand image

Packaging Types

-

Increase in serialization by pharmaceutical companies has provided an added leverage for the growth of labels in the pharmaceutical industry, as it can help secure and trace drugs throughout the supply chain, making it tamper proof

Sustainability

-

The rising e-commerce activity has led to the need for more effective and sustainable packaging. This has prompted the consumers to look toward attractive and sustainable options, like liner-less labels, recyclable adhesives, and clear film labels on clear substrates

Global Labels Industry – Constraints

Impact on Environment

-

Some forms of labels cannot be recycled and are not bio-degradable, hence, is a serious hazard to the environment; and with increasing focus on sustainability, it acts as a hurdle to the growth of certain types of labels, such as plastic labels

Volatility of Raw Material Prices

-

Frequent fluctuation in prices of facestock, such as paper, PE, and PP, lead to uncertainty in the market

Competing in Red Ocean Waters

-

The labels supply market, being highly fragmented, suppliers try to outperform their rivals to gain a larger share of the existing market by reducing the profit margins, thus leading to intensified competition

Product Substitution

-

Alternative packaging options, such as sleeves and pouches, are expected to grow at 5 percent and 8 percent until 2027 and see increased applications in personal care and food sectors

-

They minimize packaging cost also increase the aesthetic value of the product

Energy Price Rise

-

Sanctions against Russia have increased energy prices across globe, increasing the production cost of labels

-

Suppliers are not willing to take further margin cuts and are witnessed to pass on the price rise to end-use buyers

Cost Structure Analysis – Labels

-

The APAC is dominated by supply from China as it exports the raw material to other neighboring APAC countries. The prices depend mostly on China’s output

-

The European raw material prices increased on a monthly basis since COVID-19 outbreak. The price change was due to firm ethylene spot and contract prices, which increased prices in the spot market, which results in the slight variations in the raw material prices during the period

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.