CATEGORY

LAB

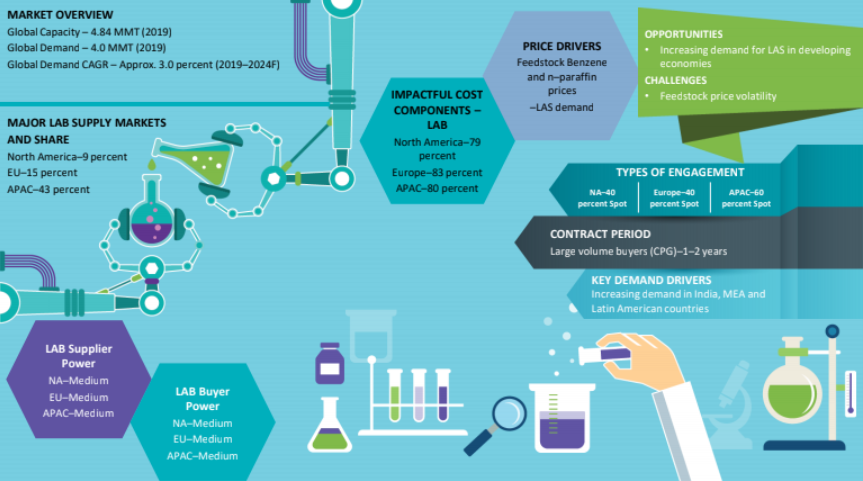

The global LAB market is currently operating at ~81 percent capacity, and there is sufficient supply to meet the demand About 98% of the LAB produced globally is used to produce LAS

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like LAB.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Unilever is the world's first to use sustainable linear alkylbenzene (LAB) developed by Cepsa

July 26, 2022Unilever is the world's first to use sustainable linear alkylbenzene (LAB) developed by Cepsa

July 26, 2022Unilever is the world's first to use sustainable linear alkylbenzene (LAB) developed by Cepsa

July 26, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on LAB

Schedule a DemoLAB Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoLAB Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in LAB category is 6.50%

Payment Terms

(in days)

The industry average payment terms in LAB category for the current quarter is 70.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the LAB market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLAB market report transcript

Global Market Outlook on LAB

-

Currently, the APAC accounts for approx. 42 percent of the global LAB capacity. While the APAC is the largest demand market for LAB, MEA has a cheaper feedstock advantage, which positions it favorable for exports to other regions

-

Present global installed capacity of HLAS (Captive + Merchant) is around 6.5 MMT, and it is sufficient to meet the current demand levels of HLAS

Demand Market Outlook on LAB

-

Increasing demand for detergents, especially in the developing regions like China, India, LATAM, etc., due to growing disposable income and infrastructural growth is expected to drive the demand for LAB and LAS

-

Demand from North America and Europe is expected to remain flat or reduce slightly due to the regional shift from powder to liquid detergents, which consumes less LAS, leading to reduced demand for LAB. Liquid detergents consumer ~40 percent less LAS compared to powder detergents

Global Market Size- LAB & LAS

-

The global market size for LAB and LAS is expected to grow at a CAGR of 5.6 percent Y-o-Y from 2023 to 2026, mainly driven by the demand from the home care sector

-

LAS, and in turn LAB demand, will be mostly driven by industrial and household cleaners, with APAC accounting for majority of the growth during the forecasted period

Global Capacity–Demand Analysis

Market Outlook

-

Increasing population, rising disposable incomes in developing economies such as APAC, LATAM due to rapid industrialization is expected to increase the demand for industrial and household cleaners, increasing the demand for LAS and LAB

-

The global LAB market is currently operating over 85 percent capacity, and there is sufficient supply to meet the demand

-

The capacity–demand gap is expected to reduce to 0.2 MMT in 2026, due to increasing LAB demand at a faster rate, compared to capacity additions that are being planned

-

Additional 0.05 MMT capacity is expected to be added in India by 2024. Most of the capacity additions are concentrated in the Middle East due to the availability of cheaper feedstock kerosene

-

Present global installed capacity of HLAS (Captive + Merchant) is sufficient to cater to the present HLAS demand. Future LAS capacity expansions are expected to come up in APAC, as the LAS capacity–demand gap is expected to reduce by 2023–2024

Engagement Outlook

-

Large volume buyers of LAB prefer to have a mix of contracts/spot to leverage the uncertainty in crude prices. The Middle East can be considered as an alternate sourcing destination for sourcing LAB due to cheaper feedstock and capacity additions

-

Bulk CPG buyers should consider having a mix of engaging with toll manufacturers and with LAS suppliers who are backward integrated to LAB and further feedstock

Global LAB Trade Dynamics

-

North America: It will continue to be a net exporter because of the increasing usage of liquid detergents, which consume less LAB

-

Europe: Cheaper imports from MEA is affecting the domestic suppliers, despite huge installed capacity

-

APAC: Net importer of LAB, due to no major planned capacity additions and is expected to remain the same unless any major additional capacities are introduced

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.