CATEGORY

Isopropanol

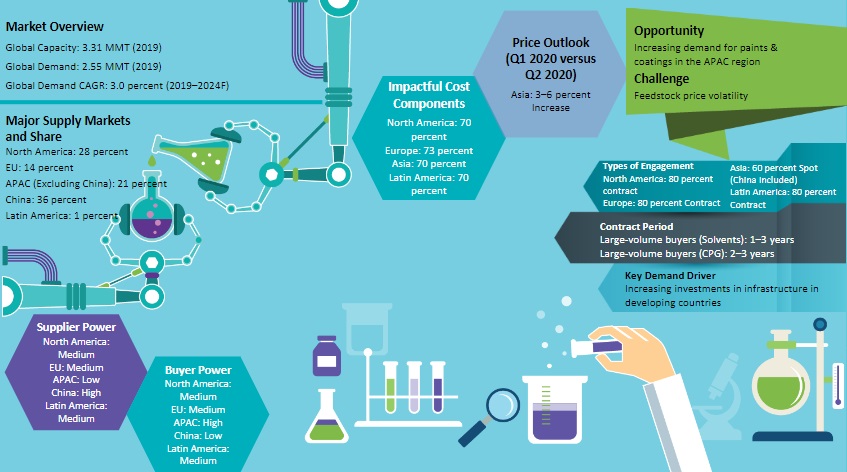

The global Isopropanol demand is estimated at 2.62 MMT in 2019, which is expected to grow at a CAGR of 2.6 percent until 2023 North America, followed by China, has the largest installed capacity.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Isopropanol.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoIsopropanol Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoIsopropanol Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Isopropanol category is 5.60%

Payment Terms

(in days)

The industry average payment terms in Isopropanol category for the current quarter is 105.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Isopropanol market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIsopropanol market report transcript

Global Market Outlook on Isopropanol

-

The global IPA demand is estimated to be at 2.66 MMT in 2022, which is expected to grow at a CAGR of 2.4 percent until 2026

-

North America, followed by China, has the largest installed capacity. China is the fastest growing region, with demand from downstream construction and automobile industries

Industry Best Practices : Isopropanol

In the US and Europe, propylene (or/and) acetone contract prices are used as a base to arrive at IPA prices. Around 70–75 percent of the total price change in propylene is usually passed on to IPA prices.

Contract Models

- Key contract models followed in the industry:

–Index-based pricing

–Fixed price with renegotiation option

–Volume-based pricing (mostly followed)

–Per-order contract (spot purchases)

–Cost plus pricing

–Mixed pricing

Contract Length

-

Typical length of the contract varies between construction and CPG industry

-

The length of the contract is between 1 and 3 years for the paints & coatings industry, as the industry is well supplied and it is easy to switch suppliers, whereas pharma and CPG industries require specific grade of IPA for which the suppliers have their negotiation power, and the length of the contract is 2–3 years

Pricing Index

-

In the U.S. and Europe, propylene (or/and) acetone contract prices are used as a base to arrive at IPA prices

-

A 70–75 percent of the total price change in propylene is usually passed on to IPA prices

Isopropanol Global Capacity–Demand Analysis

-

The current installed capacity will be sufficient to meet the global demand of IPA until 2026. The demand for IPA is expected to have increased to 2.5–3 percent in 2021, owing to an increase in demand from hand sanitizers, disinfectants, and wipes, amidst the COVID-19 pandemic, however, in 2022, the demand growth has slowed down significantly to 0.5–1 percent Y-o-Y on the account of bearish market sentiments in the downstream industries on the account Russia-Ukraine crisis that triggered high energy costs and recession concerns triggered by increasing interest rates to counter high inflation

Isopropanol Global Demand by Application

-

Steadily improving demand from the paints & coatings industry and anticipated improvement in demand from the automobile industry in APAC will be the key demand drivers of IPA until 2026.

IPA Downstream Demand Outlook

Growing Demand from the Paints & Coatings Market

-

Anticipated improvement in demand from paints & coatings in the APAC drives the demand for IPA in the future

-

Seasonal demand from the construction and de-icing industries in North America and the EU, respectively, is expected to drive the demand for IPA in these regions

Increasing Demand from the Cosmetic Segment

-

The grade required for the cosmetic and pharmaceutical segment is more expensive as compared to technical grade required in the paints & coatings segment

-

If there is a shortage in the supply of technical grade IPA, generally during summer, buyers tend to go for pharma grade IPA, and dilute it. However, this turns out to be expensive

Isopropanol Cost Structure Analysis

-

The average operating costs are high in Europe, due to low number of IPA producers in the region. Asia is the only cost-effective region, due to cheaper feedstock, labor, and the region with one of the lowest electricity prices.

-

Cost of production has significantly decreased, post the fall in the prices of high-level feedstock crude

-

Propylene is the key cost driving raw material, contributing to two third of the total raw material cost

-

European IPA producers have eliminated the risk of feedstock availability to a certain extent. However, as propylene prices are more prone to the upstream market fluctuations, there is a direct impact on the producers’ input costs

Why You Should Buy This Report

The report gives information about the isopropanol market size, demand analysis, import, export, trade dynamics, etc. of the global and regional markets. It gives the Porter’s five force analysis of North America, Europe, APAC and Latin America markets and lists out the industry drivers and constraints. The report does a cost structure and isopropanol market price analysis. It details the global and regional capacity share and gives SWOT analysis of major isopropanol suppliers like Dow Chemicals, Exxon Mobil, Shell, etc. It lists out the best contract and sourcing models for isopropanol manufacturers.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.