CATEGORY

Investment Management

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Investment Management.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoInvestment Management Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Investment Management category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Investment Management category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

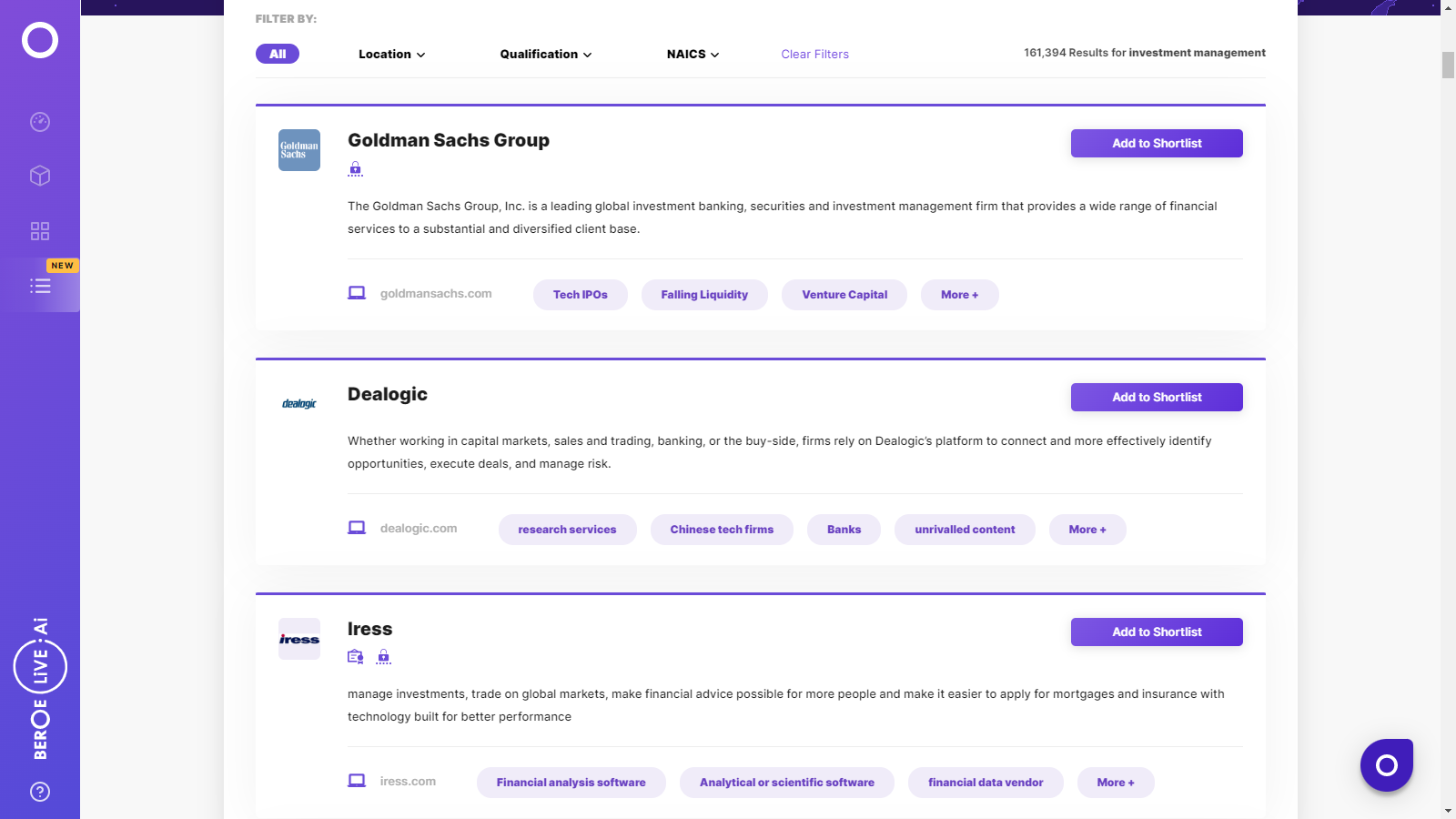

Investment Management Suppliers

Find the right-fit investment management supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Investment Management market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoInvestment Management market report transcript

Investment Management Global Market Outlook:

MARKET OVERVIEW

Global Capacity: 123.65 Trillion (2022)

Global Demand: USD 88.3 Trillion (2022)*

Global Demand CAGR: ~7.4 percent

(2022-2025)

-

The Investment Management Industry saw a decline at an average rate of around 25 percent due to the COVID-19 Pandemic, the economic slowdown, and falling equity markets. It is expected to recover at an average rate of 12 percent till 2026.

-

North America is the largest and most mature market globally. Emerging markets include Western Europe and Asia Pacific with strong retail segments

-

Equity & Fixed Income were the major asset classes followed by alternative investments like hedge funds, fund-of-funds, commodities, real estate, etc. The uncertainty in returns from the Equity markets will force Investment Managers to opt for Fixed Income Securities

-

The market is expected to witness an increase in the use of Artificial Intelligence (AI), Data Analytics Process Automation, and Outsourcing for efficient decision-making and increased customer satisfaction

Market Overview: Global Investment Management Industry

The investment management industry is expected to recover from the Covid-19 decline at a rate of 10 percent till 2026. Firms will continue to invest in digital transformation with new technologies that will improve client experience and operational efficiencies. Leadership can enable to drive the changes with effective communication across departments. This will in turn lead to higher chances of success at many levels.

-

North America is the largest and most mature market globally

-

Emerging markets include Western Europe and Asia Pacific with strong retail segments

-

Equity and fixed income were the major asset classes followed by alternative investments like hedge funds, fund-of-funds, commodities, real estate, etc.

-

The uncertainty in returns from the equity markets will force investment managers to opt for fixed-income securities

-

The market is expected to witness an increase in the use of artificial intelligence (AI) and process automation for efficient decision-making and increased customer satisfaction

-

The investment management industry declined at the rate of 25 percent due to the COVID-19 Pandemic, the economic slowdown, and falling equity markets and is expected to recover at a rate of 10 percent till 2026

Key Technology and Market Trends on Investment Management

Use of Advanced Technologies

-

Investment management companies are using artificial intelligence (machine learning, natural language processing) for portfolio optimization, risk and compliance, data analysis, and process automation

-

Companies are not only using technology to save costs but also to make the business model flexible and adaptable enough to the current and future uncertainties

-

Use of blockchain in investment management is the latest trend in investment management to reduce costs related to intermediaries and improve security-related aspects of transactions

Automating More than just the Basic Business Processes

-

Investment management companies are introducing Robo-advisory services for investment advisory, chatbots for better customer service, and algorithmic trading is adopted by top global players that automate the trading process through a set of rules, thereby reducing the number of people required to carry out the trading process

Outsourcing more than just Back Office Operations

-

Top global players are outsourcing middle-office functions like data management, asset servicing, transaction processing, etc., and back-office functions like IT services and IT infrastructure to financial services firms or traditional BPO service providers in order to focus on their core competencies

-

However, financial services firms are preferred by companies due to their wide experience and service capabilities

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now