CATEGORY

Insurance Services

Generally it has been observed that Fortune 500 clients have a mixed insurance placement approach.These companies use self insurance captive model for high value claims such as Death, Disability and Medical or Health insurance

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Insurance Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoInsurance Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoInsurance Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Insurance Services category is 6.80%

Payment Terms

(in days)

The industry average payment terms in Insurance Services category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Insurance Services Suppliers

Find the right-fit insurance services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Insurance Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoInsurance Services market report transcript

Global Market Outlook on Insurance Services

-

The global health insurance market is valued at almost $2201.6 billion globally in 2022

-

The market is forecasted to grow annually, at the rate of 8.5 percent, to approximately $3086.2 billion by 2026, and demand is expected to increase drastically

-

North America dominates the market because of the high disposable income of individuals, followed by Europe, due to its corporate demand for health insurance

-

The countries of APAC are expected to have significant growth, due to the rising awareness among the people

Insurance Services Demand Market Outlook

-

The health insurance industry is expected to grow further after 2022, due to the rising awareness and people’s interest in life and health insurance post-COVID-19

-

There is a drastic increase in demand for health insurance policies globally, due to the outbreak of the COVID-19 pandemic, and rising inflation, which is set to continue until 2023 and beyond

-

Health insurance providers are partnering with health and wellness providers and organizing health screening programs for reducing the health-oriented risks of corporate employees

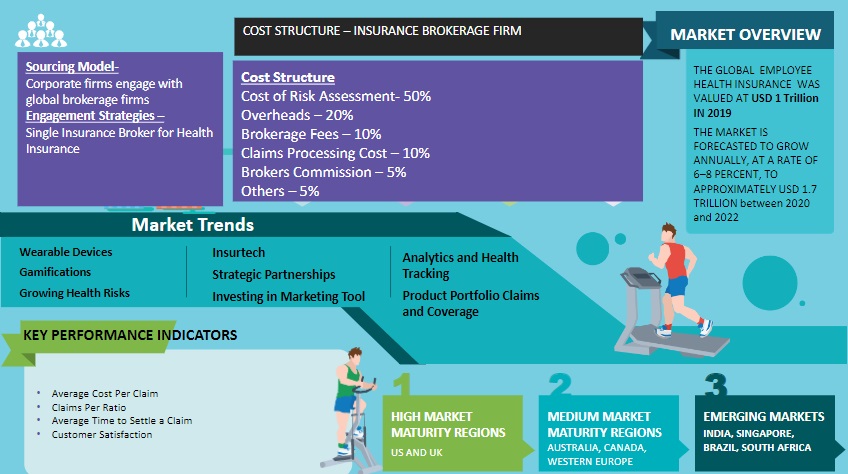

Health Insurance Market Maturity

-

It has been observed that health insurance penetration is still very low outside North America and Europe

-

The APAC and Latin America are witnessing an increase in adoption, due to efforts by large global buyers to consolidate supply base

-

Health insurance providers are partnering with health and wellness provider and organizing health screening programs for reducing the health oriented risks of corporate employees

Global Health Insurance Drivers and Constraints

Due to the outbreak of COVID-19, the demand for health insurance policies increased and so did the premiums, due to the increase in claims, but 2022 saw a little mention of COVID-19-related reasons for the hike in price and demand.

Drivers

Increase in healthcare costs

-

Increase in healthcare costs made employers come up with new preventive measures, lifestyle management programs, and health education for their employees

Occupational health and safety

-

Traditionally, health and wellness have been focused on minimizing the risk of physical hazards in a workplace, but for the past few years, this has been changing to incorporate broader psychosocial considerations, health plans, and Employee Assessment Programs

The surge in awareness among people

-

Post-COVID-19, most people are aware of the importance of having health insurance, and how much they can benefit from it. This led them to give an understanding of pre and post-hospitalization, ambulance expenditure, etc.

Constraints

Involvement of employees

-

Employers find it difficult to involve all their employees in wellness and assistance program participation

-

Rewards and incentive systems are growing, to increase the participation of employees

-

Less than 25 percent of eligible employees participate in the programs in the US and Europe and much lesser in APAC and other regions

Increase in claims

-

Due to the outbreak of COVID-19 (SARS 2 Virus), there has been a significant increase in health insurance claims

Increase in health-insurance premiums

-

Increased premiums, due to the surge in the inflation rate, medical expenditure, admission fees, etc., might affect the customer’s mentality and the market growth

Insurance Services Technology Trends

Technology trends have begun to dominate the life and health space with the use of wearable devices, analytics, gamification, and InsurTech.

Buyer Trends

-

Wearable Devices - The use of wearable devices is becoming popular and helps customers get discounts on life & medical insurance policy premiums for sharing the data in their fitness tracking device. Analytics is done on the fitness information shared and is used by insurers for creating customized products and for accurate pricing and underwriting.

-

Gamification - Gamification is used by life insurance companies to create more awareness of life insurance products to younger generation. When the results of the game is shared in social media, this also leads to brand awareness for the insurers. E.g., AIA launched Crazy Cash game in Indonesia where less than 2 percent of the population have insurance to educate them about insurance.

Supplier Trends

-

Robotic Process automation (RPA) - Offering end-to-end process automation, it frees up the FTEs in an insurance company to focus more on critical tasks at hand than mundane works. It helps streamline processes seamlessly right from claims management, servicing, to fraud detection and policy administration. Research has shown that RPA decreases 50 percent on claims processing expenses, 60 percent reduction in error rates, an increase of 70 percent of processing speed and has shown 100 percent regulatory compliance maintenance when compared to manual processing.

-

InsurTech - InsurTech Capabilities adopted by insurers, like advanced analytics and mobile applications, help insurers to know the needs of the customer and create specific short-term policies at a lower premium in life insurance. InsurTech also enables insurers easily reach new markets.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now