CATEGORY

Industrial Ethanol

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Industrial Ethanol.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoIndustrial Ethanol Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoIndustrial Ethanol Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Industrial Ethanol category is 4.50%

Payment Terms

(in days)

The industry average payment terms in Industrial Ethanol category for the current quarter is 93.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Industrial Ethanol market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIndustrial Ethanol market frequently asked questions

As per Beroe's ethanol market report, the countries with a major share are Asia (21%), Brazil (16%), EU (10%), and US (5%).

The ethanol industry overview as presented in the Beroe report is that the production of industrial ethanol is expected to increase by 2025. Asia has become the largest producer and consumer of industrial ethanol with about 50% of the global share. Europe is the second largest consumer of ethanol with demand from industries such as personal care, cleaning products, and food and beverage.

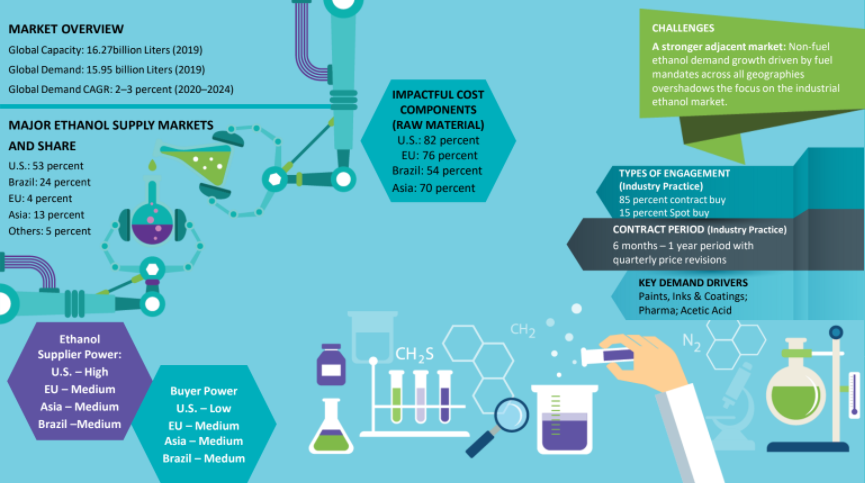

As per Beroe's ethanol industry outlook 2020, the global ethanol demand is expected to grow at a CAGR of 2-3% over the next five years.

As per Beroe's ethanol demand projections report, the key demand drivers for the ethanol industry are paints, inks and coatings, pharma and acetic acids.

Industrial Ethanol market report transcript

Industrial Ethanol Global Market Outlook

-

The global industrial ethanol market is set to grow at a CAGR of 3.7 percent over the next five years

-

Non-fuel ethanol accounts for approximately 9 billion litres of the total ethanol production. In other words, 7 percent of the total ethanol consumption is for non-fuel applications, such as chemicals, plastics, pharmaceutical and beverage industries, including cosmetics, cleaning products, paints and alcoholic drinks

-

Key regions driving growth: Growth in Asia, Brazil, and Europe will be driven by the demand from the solvents and chemical intermediates sector

Industrial Ethanol Demand Market Outlook

-

The global non-fuel ethanol market is balanced in mature markets, like the US and Europe, having sufficient supply, while demand is marginally higher in the emerging markets, like China and Brazil

-

Brazil is looking to leverage on the existing capacities and reducing exports, while China is dependent on imports from other Asian markets

Industrial Ethanol Global Supply-Demand Analysis

-

Demand and production is expected to grow in tandem and the market is expected to remain balanced with a very narrow supply–demand gap

-

Asia is the center for the industrial ethanol market, as it is the largest producer, as well as consumer of industrial grade ethanol, accounting for slightly over 50 percent of the market

-

Europe, with its large base of pharmaceutical, personal care and food and beverage industries, is the second largest consuming region for industrial grade ethanol, accounting for more than 2.5 billion liters

Market Outlook

-

With the recent spike in demand from hand sanitizers and cleaning segments, the demand for industrial ethanol is expected to grow at a higher growth rate for the next 1–2 years

-

Recent capacity additions in Europe, which is a major consumer (importer) of non-fuel ethanol, will bring down its dependency on other exporting markets, such as South America and Asia (Pakistan)

Engagement Outlook –Change in Procurement Pattern

Europe may not continue to get regular material from Asia (Pakistan)

-

It is imperative that buyers in Europe look for alternate sourcing destinations as in the recent times, the market was heavily reliant on material from Asia, and particularly from Pakistan, which is changing winds

China pulling significant material from Pakistan

-

China has been drawing substantial amount of industrial ethanol from Pakistan, as it is cost effective in comparison to the domestic ethanol prices and it makes it even more attractive for sellers in Pakistan, as there are no import duties, owing to the Free Trade Agreement with China

Industry Drivers and Constraints

Drivers

Major demand for bio-fuels is driving the Industry

-

Fuel sector: Bio-fuel usage largely driven by national mandates is the major consuming market of ethanol, accounting for ~77 percent of the total ethanol consumption. The other demand sectors are the industrial and beverage markets that take up the remaining 23 percent of the demand. Bioethanol growth rates are ~4 percent

Co-Product Output from feedstock like Corn and Sugarcane

-

Co-product credit on DDGS is a significant negotiation lever in the US market as corn is the major feedstock. On general basis, producers of ethanol make a profit of around ~9 percent on the sale of ethanol. During periods of increased animal feed demand, this profit margin moves higher, on the back of hike in DDGs price

-

Likewise, In Brazil, co product credits from bagasse can be utilized for producing heat and electricity. These parallel markets indirectly drive the ethanol industry

Constraints

Low Oil Prices & Campaign against Renewable Fuel Standards (RFS)

-

US Market: Ethanol production economies are often challenged by lower oil prices, regulations on feedstock (corn) – Lobbying against use of corn for purposes apart from food needs

Feedstock Differentiation resulting in varies input costs

-

Each region has different feedstock for the production of ethanol. For instance, In the US it is corn whereas in Europe beet molasses is largely used. This brings in price differentiation and price variations at contrasting levels as well

-

In addition, production costs are higher in Europe, compared to the US and Brazil. This again can bring varied price levels across markets

Global Trade Dynamics

-

Over the last two years, traditional trade patterns have been changing, as there is a shift in demand dynamics across major markets. Export levels from the US have increased, while Brazil is looking to restrict their exports in order to cater to local demand

-

CPG participants in China and Europe are likely to leverage on the inflow of material into these markets

Global Exports: Ethanol

Shift in Export Trade Patterns

-

The US, which was traditionally a net importer of non-fuel (industrial) ethanol, has been exporting more volume in comparison to imports over the past two years

Global Imports: Ethanol

-

Canada, the Netherlands, India, and South Korea were the major importing countries during FY 2021. Majority of their imports were from the US, due to rising demand from disinfectants and cleaning products

-

Imports from countries, like south Korea, increased by about 30 percent on a Y-o-Y basis, due to rising demand from hand sanitizer and cleaning segment, due to the widespread impact of COVID

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.