CATEGORY

In-Vivo Toxicology Testing

Testing of drug in animals prior to a clinical trial.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like In-Vivo Toxicology Testing.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoIn-Vivo Toxicology Testing Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoIn-Vivo Toxicology Testing Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in In-Vivo Toxicology Testing category is 10.00%

Payment Terms

(in days)

The industry average payment terms in In-Vivo Toxicology Testing category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the In-Vivo Toxicology Testing market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIn-Vivo Toxicology Testing market report transcript

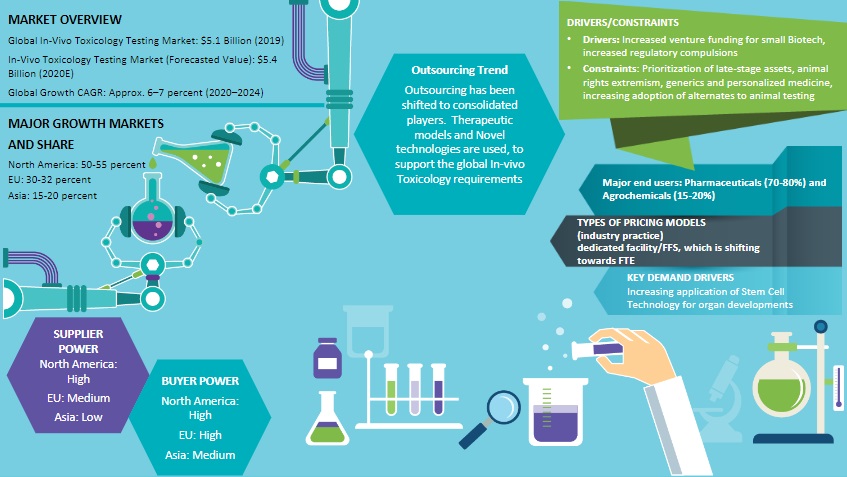

Global Market Outlook on In-Vivo Toxicology Testing

-

Outsourcing of this category by large pharma has shifted to a more consolidated state, with two or three preferred suppliers, and one or two niche suppliers

-

The focus is on novel technology and therapeutic models, so as to support the global in-vivo toxicology requirements

-

CROs are now embedding the 3R (Replace, Refine and Reduce) principle, in order to reduce the number of animals used for toxicology studies

-

Universities develop a free online kidney atlas that will enable stem cell scientists to generate human-like tiny kidneys. This will ease testing of new drugs and creating renal replacement therapies

Pre-clinical Toxicology Industry Trends

Increased protest of animals used in pharma research have led to numerous technologies offering alternatives to animal testing. Also, regulatory compliances mandate that service providers restrict the number of in-vivo models, through the application of the 3R principle.

3R Principle

-

CROs are now embedding the 3R (Replace, Refine and Reduce) principle, in order to reduce the number of animals used for toxicology studies

Agrochemical Industry Demand

-

Toxicology testing demand is expected to grow at 4–5 percent for the next five years. This growth will be driven by demand for chemicals, in order to increase crop yields; prompted by the growing global population and limited land for agriculture

-

The recurring need for testing services, due to the regulatory requirement for re-registration every 10 years, for agro-chemicals is already on the market

-

REACH initiative testing backlog, and an anticipated future testing is expected to create significant demand through 2025

Pricing

-

Pricing for safety testing has improved in 2021 by 2-3 percent when the pricing remained stagnant

Alternatives

-

Suppliers concluded collaboration agreements and launched the world’s first commercially available 3D printed human tissue that has the potential to replace anima testing

Engagement Model: Adoption Rate

Strategic deals involving lift-out in preclinical toxicology services by the pharmaceutical companies would increase, in contrast to the current scenario, where the widely adopted engagement model is project by project, as it would help in reducing their fixed cost by shutting down or transferring the toxicology facilities that are under-utilized.

Engagement Model Adoption

-

Majority of the suppliers (small Biotech) were adopting the project-by-project model, as the volume of work is not large, and this helps to establish a relationship before engaging into a strategic partnership

-

Adoption of strategic partnerships is getting attraction towards putting less time and investment

Market Overview

In vivo toxicology services is a highly fragmented supply tail, giving sponsors high bargaining power. Service providers, on the other hand, provides allied and proactive services to their sponsors, to differentiate among themselves in the in vivo toxicology market. According to in vivo toxicology studies, industrial competition is expected to further increase, as suppliers differentiate themselves with the service (alternatives/technology) capabilities they offer. Threat of substitutes will be extremely low in the market, as alternate testing methods have not replaced in-vivo testing fully, and are at best seen as supplements only. The in vivo toxicology market is highly characterized by early stage attrition, and increased regulatory mandates. Also, the usage of in-vitro and in-silico technologies in ADME and toxicology are the latest trends.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.