CATEGORY

In-vitro Toxicology

Evaluation of toxicity of a drug in 96 well plates prior to in vivo studies.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like In-vitro Toxicology.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoIn-vitro Toxicology Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in In-vitro Toxicology category is 5.40%

Payment Terms

(in days)

The industry average payment terms in In-vitro Toxicology category for the current quarter is 73.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the In-vitro Toxicology market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIn-vitro Toxicology market report transcript

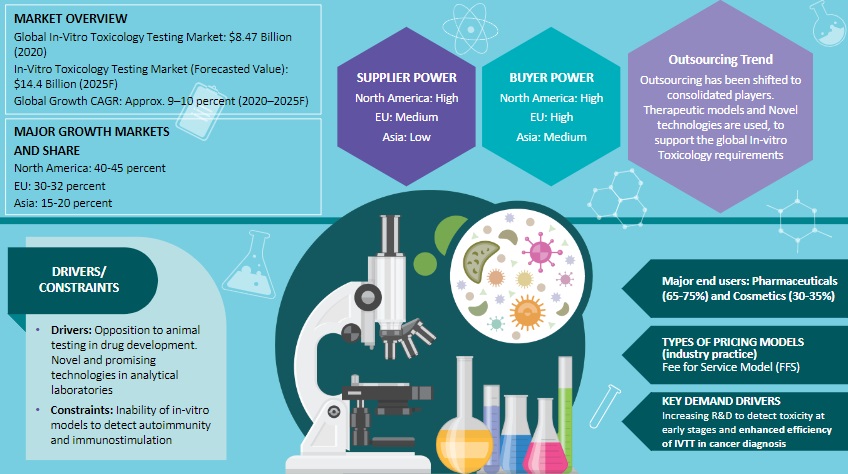

In-vitro Toxicology Testing Market

-

Emergence of new approaches of 3D cell culture can boost the in-vitro toxicity testing market. 3D cell culture represents the next generation of in-vitro toxicology testing market

-

Increase in adoption of outsourcing, due to an increase in research expenditure. Rising technological advancements and growing opposition to the animal testing have paved way for the growing demand for the in-vitro toxicology market

-

The focus is on emergence of novel technology mostly with CROs to support with the global in-vitro toxicology requirements

-

Given the high emphasis on quality, sponsors heavily depend on dominant supply locations, like North America and Europe, for skilled FTE and testing infrastructure

Growth Drivers and Constraints : In-vitro Toxicology

Drivers

-

Increasing R&D to detect toxicity at early stages. Investigative toxicology group that de-risks findings observed in non-clinical studies

-

Rapid up gradation of databases that serve information for toxicity profiling and lethal dose determination of different compounds

-

Multiple regulatory endpoint verifications

-

Enhanced efficiency of IVTT in cancer diagnosis

-

Data-Driven Toxicology Testing: There has been an increase in alternate methods to animal testing, due to data-driven technologies and informatics

-

For example, there has been 3–5 percent increase in the adoption of in-silico models, organ on chip studies, and other testing methods, like organoids, 3D cell cultures, bio printing, etc.

-

Impact: Increased precision, quick turnaround, novel endpoints

Constraints

-

Predictive ability of the tests, stringent regulatory framework, and the inability of in-vitro models to detect certain anomalies are the major challenges faced by the market

-

Failure of organ on chip devices and other technologies that are strengthening reliance on animal models

-

Despite the growing popularity of outsourcing, in-house ADME-Toxicology testing still accounts for four-fifth of the industry’s total expenditure

-

There are also some in-vivo tests, for which, no in-vitro alternatives have yet been developed that exhibit acceptable predictability, such as for complex toxicological endpoints

Cost Drivers and Cost Structure : In-vitro Toxicology

-

Cost varies according to lab location, technician type (senior scientist/mid-level/junior scientist), type of sample, test requirement according to protocol, equipment (HPLC: gas/liquid), and lab facilities (in-built alarm system, 100 percent back-up electricity generator, humidity stability chamber, etc.)

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.