CATEGORY

Hotels

The hotel industry suppliers are expanding their service offerings and are making their presence geographically with mergers and acquisitions, benefitting global companies by engaging with fewer hotel chains

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Hotels.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Minor Hotels Announces Strategic Expansion of its Avani Brand in Europe & Latin America

April 20, 2023The U.S. hotel pipeline indicates increased confidence in business travel

April 19, 2023Sofitel Legend The Grand Amsterdam receives the EarthCheck certification

April 18, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Hotels

Schedule a DemoHotels Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoHotels Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Hotels category is 25.00%

Payment Terms

(in days)

The industry average payment terms in Hotels category for the current quarter is 29.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

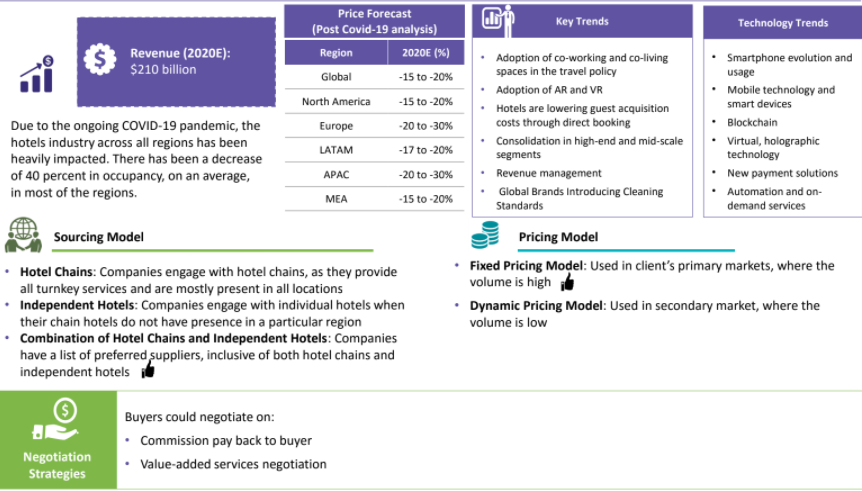

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Hotels market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoHotels market report transcript

Global Market Outlook on Hotels

-

The global hotel industry is estimated to be valued at ~$550 billion in 2022 and is expected to grow by 20 percent to reach ~$660 billion in 2023

-

The industry’s recovery has been supported by the pent-up leisure travel, along with the return of business travel demand. Travel intensive sectors, like industrial and production-oriented sectors, are driving the increasing demand for hotels.

Global Hotels Market: Drivers and Constraints

-

The major drivers of hotel industry are geographical diversity of businesses and expansion of businesses into emerging economies. Low demand, virtual meetings, due to the pandemic, are affecting the traditional hotel industry. Shared accommodation was on a rise before the COVID-19 pandemic, and the trend is expected to boom again once the pandemic is over.

Drivers

-

Technology: Increased use of AI and digital controls help hotels to manage their travel bookings and enhance guest experience.

-

Geographical Diversity: Global Chains are protected from the local market’s uncertainty by having presence across the world.

-

Direct Meetings: Given the nature of few business, it often require direct meetings, which leads to the increasing demand for hotels.

Constraints

-

Virtual Meetings: Increased digital interactions, such as online meetings and conferences, are affecting the traditional hotel industry.

-

Non-homogeneous Markets: Lack of common regulations across markets is making it difficult for corporates to frame travel policies.

-

COVID-19 Crisis: Amid the persistent COVID related threats & disruptions, the market recovery could be hindered

Global Hotel Industry Performance – 2022 vs. 2019

-

Occupancy across regions were lower than the pre-pandemic comparable in 2022, but it is expected to stabilize throughout 2023

-

In terms of revenue per available room (RevPAR), Asia was the only region to witness a decline in RevPAR from 2019

-

Hotel room rates have been the key driver of recovery, as each of the global regions (excluding Asia) showed an increase in average daily rate (ADR) from 2019

-

The global spending on business travel is witnessing a continuous increase and is expected to surpass the pre-pandemic levels by 2026. With business travel gaining momentum, the demand for hotels is expected to increase throughout the next few years

Cost Structure: Hotels

Amid the increasing labor cost and other operational cost, hotels increased their room rates. Among the global regions, Asia was the only region to witness a decline in revenue per available room (RevPAR) from 2019.

-

Rate negotiation : Volume discounts can be negotiated where there is enough volume or negotiate consortia rates through the TMC. Minimum global spend for discounts is $0.5 million.

-

Value-add services : Negotiate for amenities, such as non-smoking rooms, high-speed internet, free local phone calls, breakfast, meeting rooms, health clubs, and business center, etc. Hotels generally tend to provide this if the client has a minimum of 50 room nights/annum per property.

-

Cancelation fees : Negotiate on the cancelation fees. Most hotels have a pre-written cancelation clause that can be adhered to or can be revised based on the client–supplier relationship.

Pricing Analysis: Hotels

Hotels offering only room service operate slightly at a higher net profit, when compared to hotels offering both room and MICE services; the reason being the high level of energy and infrastructure needed for providing meetings and events service.

-

All travel segments in the value chain were impacted: suppliers, distributors, travel managers/agencies due to the COVID-19 pandemic

-

Most of the travel destinations are flooded with supply but have lower demand

-

The year 2023 looks promising for hotels with the gradual increase in travel demand

-

With the increase in demand and associated labor & other operational cost, hotels are expected to increase their room rates by ~8 percent in 2023 compared to 2022

-

With business travel gaining momentum, due to the ease of travel restrictions, up-scales hotels are expected to witness higher occupancy levels and higher room rates

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.