CATEGORY

HEOR Services

Last phase of a trial where economics of a drugs performance in a market is studied

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like HEOR Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoHEOR Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoHEOR Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in HEOR Services category is 5.40%

Payment Terms

(in days)

The industry average payment terms in HEOR Services category for the current quarter is 73.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the HEOR Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoHEOR Services market frequently asked questions

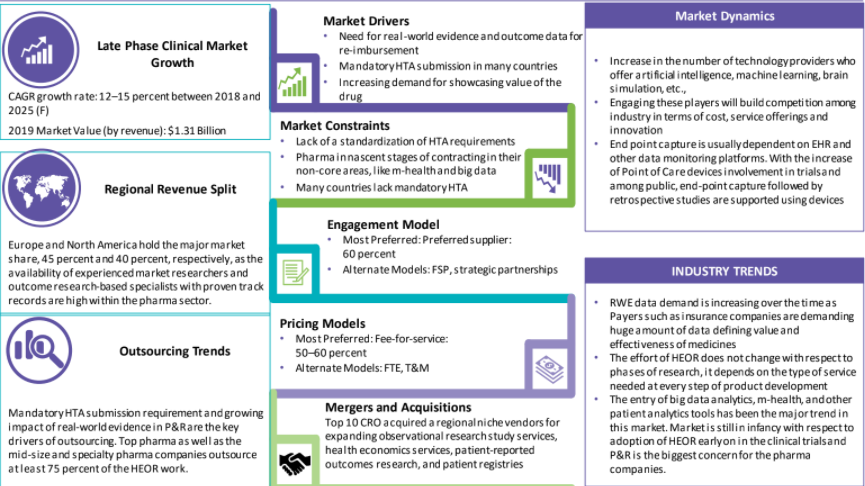

The HEOR market is rapidly growing and the industry is witnessing regulations that require real-world evidence and data outcome which results in the entry of various disruptive innovations like big-data analytics, m-health, bioinformatics, and other patient intelligence technologies.

As per Beroe's study, Europe and North America are known to be the largest shareholders covering 45% and 40% of the HEOR market. It's primarily because the pharma sector has high availability of experienced market researchers and outcome research-based specialists with a proven track record.

Following the insights of Beroe's report, it's evident that both HEOR and RWE are interlinked as mandatory HTA submission requirements and the growing impact of real-world evidence in P&R are the key drivers of outsourcing. The report also indicates that top pharma companies along with mid-size and specialty pharma companies outsource nearly 75 percent of the HEOR work.

As per reports, the market size of HEOR is the highest in Europe with a valuation of $351 Mn. Next is North America with a size of $312 Mn, followed by the Asia Pacific region having a valuation of $78 Mn.

The top ten key players of the HEOR market include the following names: AdRes srl Parexel (Heron) Covance (Medaxial) EPI-Q IMS Health PPDi IQVIA Evidera RTI Health UBC

As per Beroe's analysis, the most preferred engagement model w.r.t. the HEOR market is from the supplier's point of view covering nearly 60 percent of share. Alternative models include FSP and other strategic partnerships. Similarly, the most preferred model for the HEOR services market is by leveraging a fee-for-service model that covers nearly 50 ' 60 percent market share. Other models that exist within the industry include the names of FTE and T&M.

HEOR stands for Health Economics and Outcomes Research. The primary factor that boosts the outsourcing trend within the HEOR market is because of the varying needs of each study that depends on competition, market, and disease. Even the CROs are improving their value proposition by providing HEOR as an integrated service in combination with clinical trials

Major insurance companies often demand a huge amount of data to identify the value proposition and effectiveness of the medicines and this contributes to the growth of RWE data within the HEOR industry.

As per the HEOR analytics report generated by Beroe, there are three types of service providers within the HEOR industry namely ' academic, consultants, and CROs. Out of these, CROs and consultants are given preference over academicians because the latter has little experience w.r.t. real-world drug development & isn't able to scale to large trials.

HEOR Services market report transcript

HEOR Services Market Growth and Global Outlook

-

The global demand for HEOR market is expected to grow at approximately 13-14 percent CAGR through 2022–2032E. The current market size is $1.43 billion (2022E)

-

Mandatory HTA submission requirement and growing impact of real-world evidence in P&R are the key drivers of outsourcing

-

The industry is witnessing regulatory reforms, which require greater real-world evidence and outcome data, which is resulting in the entry of disruptive innovations, like big-data analytics, m-health, bioinformatics, and other patient intelligence technologies

-

Large CROs have been continuously expanding their supply base through acquisitions and partnerships to provide integrated services

Growth Drivers and Constraints : HEOR Services

Drivers

-

Real-world evidence and outcome data for reimbursement

-

Mandatory HTA submission in many countries

-

Pharma being forced to go beyond their comfort zone, like using big-data analytics and m-health technologies, which is driving outsourcing to a large extent

-

Pricing control forcing pharma to invest in substantiating their case (commercial trials)

-

Cost cutting within pharma, leading to increased outsourcing of these services without increasing the head count

-

Improved adherence to patient outcome data, as drug-repurposing is picking pace

Constraints

-

Lack of experience in using genomics, determining sub-group populations for effective outcome demonstration

-

Lack of a standardization of HTA requirements

-

Pharma in nascent stages of contracting in their non-core areas, like m-health and big data

-

Many countries lack mandatory HTA

Outsourcing Adoption Rate : HEOR Services

Key Outsourcing Trends

-

Outsourcing is well established and a matured trend in this industry

-

Manpower cost is an issue (for small/mid-size pharma companies)

-

Novel outsourcing for big data analytics or acquisition by other companies to strengthen their own portfolio is the new trend. E.g., OPEN Health’s acquisition of Northwest UK-based medical communications agency Spirit in early August 2021

-

Large pharma companies conduct 30–50 percent of trial in-house that provide them with evidence/outcome data freely, eliminating a need for third-party players for those specific data

-

The major reason for greater outsourcing in this market is because of varying needs of each study, depending on competition, market, and disease

-

CROs are improving their value proposition by providing HEOR as an integrated service along with clinical trials, which can be a negotiation lever for pharma in a bundle

-

In the future, this category will see entry of disruptive technologies, like big data analytics and m-health, as more HTA organizations around the world require real-world evidence

Cost Drivers and Cost Structure

-

The cost of manpower and complex data analysis are projected to increase with the increase in demand for the HEOR services

-

The factors that contribute the most to costs across all the trial phases include patient recruitment involving clinical procedure costs, vendor fees, site related costs, clinical procedures cost, data management and central laboratory costs

HEOR Services Top Suppliers

-

IQVIA

-

Parexel

-

LabCorp

-

Syneos Health

HEOR Services Market Overview & Trends

-

With Turnbull ‘s efforts to stimulate medical and biotechnological innovation, pharma giants are showing interests in investing in this continent. Australia contributes up to 20 percent of the overall APAC pharma earnings and entering the market must be done strategically for better penetration and returns

-

Being an emerging geography, the HTA is developing as a means of controlling prices as well as access. In terms of reimbursements limited expansion of existing public programs are seen in comparison to the tighter payer controls and restrictive conditions as that of USA and the Europe

-

The clinical trial environment is not well supported in Australia, but initiatives from suppliers as well as buyers are focusing on bringing about innovative approaches to ease trials as well as understand the health economy better to enter this region.

-

Regulatory environment is also changing and promoting RWE studies as well as creation of new and improved patient databases for assessment.

Why You Should Buy This Report

- The report details the pricing models, supplier landscape and outsourcing adoption rate for the HEOR market.

- Information about what is HEOR, HEOR full form, global HEOR market size, emerging markets, drivers, constraints, etc.

- Porter’s five force analysis of the HEOR industry

- It shows the key market trends like novel partnerships, new technologies, full-service providers and emergence of biologics.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.