CATEGORY

Guar Gum

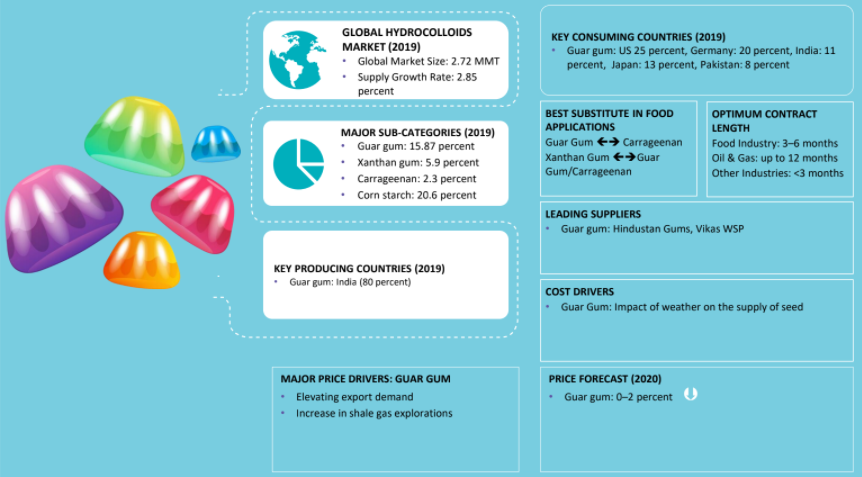

Guar gum is one of the major markets in hydrocolloids that is extracted from guar beans that is majorly grown in India. It is used in food and feed applications

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Guar Gum.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoGuar Gum Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoGuar Gum Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Guar Gum category is 10.00%

Payment Terms

(in days)

The industry average payment terms in Guar Gum category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Guar Gum market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoGuar Gum market frequently asked questions

As per Beroe's analysis, guar gum market price and net profitability of guar splitters is determined by the market price of the by-products, like guar churi and korma

Guar cultivation is known to be highly productive as it requires lower agronomic inputs and provides multiple ecosystem services through activities like prevention of water pollution, conservation of nutrients, lower utilization cost, and others. Some positive impacts of guar gum include: Longer photosynthetic process, extended growing season and longer green leaves enhance the air purification processes Presence of greater root mass reduces soil erosion and soil carbon loss Having deeper rooting depths allow them to intercept, retain, and utilize more precipitation It's a low emission crop releasing less than 3,000 kg of CO2 equivalent emissions Owing to these benefits, the future demand of guar gum is quite high since it brings a positive impact on the environment and successfully converts multiple arid areas into productive uses.

Guar Gum market report transcript

Global Market Outook on Guar Gum

Global hydrocolloids market (2022–2023)

Global Market Size: 3.05 MMT

Supply Growth Rate: 15 percent

-

The hydrocolloids supply is likely to have decreased in 2022, owing to limited supply of guar gum, xanthan gum, and LBG. In 2023, the supply is estimated to increase, as the production of guar gum and LBG is set to improve

Global Supply–Demand Analysis

-

The hydrocolloids supply is likely to have decreased in 2022, owing to limited supply of guar gum, xanthan gum, and LBG. In 2023, the supply is estimated to increase, as the production of guar gum and LBG is set to improve

-

Demand is estimated to remain stable with a slightly reduced consumption from food sector, as major global economies prepare to face the recession headwinds

-

Corn starch leads the hydrocolloids market segment, followed by guar gum, due to the steep demand from the oil and gas industry and the food sector

-

The use of xanthan gum, guar gum, Locust Bean Gum (LBG), and carrageenan in the food and beverage industry has been in demand, owing to the increasing health consciousness among the consumers and multi-functionality of hydrocolloids. Other hydrocolloids, such as alginates, agar, and CMC, hold a minor share

Global Demand by Application: Guar Gum

Demand for guar gum continues to rise in the crude oil industry. This is leading to other end-use industries, like food, textile, paper printing to replace guar gum with the other thickeners.

-

Oil and gas, mining explosives are still the leading end user of guar gum, due to its friction and viscosity controlling properties

-

As of 2022, Fast Hydrated Gum is the leading sub-segment of the global guar gum market under function segment, occupying 62 percent of the market share

-

Use of guar gum in the food and beverage industry was estimated to be $183.7 million in value in 2022

Guar Gum Cost Structure Analysis

-

Cost of cultivating guar seeds have been stable in the past few years. Cost has been rising proportionate to general inflation rates as major cost contributors are land and labor

-

Miscellaneous cost includes cost of transportation, marketing and storage

-

The seed production cost has increased by 50 percent over the past two years because of an increase in seed, land and labor prices

-

Guar gum exports are expected to surge, backed by a rise in crude oil price

-

Export demand from Europe, Latin America, China and Southeast Asia is expected to improve

Supply Chain Analysis of India

Despite the opaque nature of guar gum’s supply chain in India, demand continues to grow for the commodity. Close monitoring of the development of guar supply chain may help to predict future price and supply trend.

-

These seeds are collected, stored, loaded into transport and taken to the mundi (market). It is a large market place, where all the agricultural produce of the farmers are brought and sold to ensure fair price to the farmers

-

The produce brought by farmers are auctioned by authorized ‘aadats’ (commission agents)

-

Auction participants mainly consist of traders, splitters, processors, and stockist. No exporters are involved here, as export of guar seeds is not allowed

-

There are lot of traders, stockist, and brokers who have their office, situated in the mundi area itself. They deal with multiple commodities. However, guar has been their favorite recently. There are around 300–400 guar splitters located just in Rajasthan

-

The major suppliers of guar chemicals in India, such as Vikas, HiChem, Rajasthan Gums, etc., are vertically integrated from making splits to exporting of the chemicals

-

The guar market is fairly consolidated, as the top five processors are believed to be controlling more than 60 percent of the market

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.