CATEGORY

Grinding Media

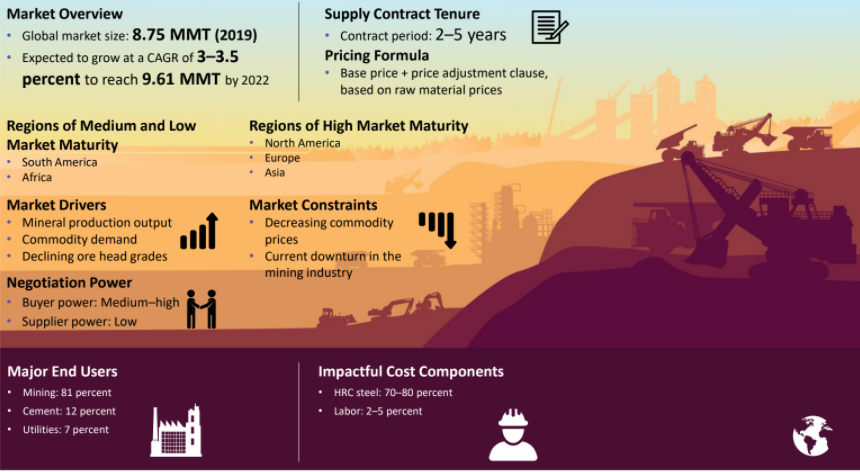

Grinding media are mining consumables used for removing inmpurities from ores

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Grinding Media.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Prices of Tangshan billet decline due to reduced cost support.

April 19, 2023Negative sentiments weaken prices of Tangshan billet

April 13, 2023Prices for Tangshan billets could strengthen in April

April 06, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Grinding Media

Schedule a DemoGrinding Media Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoGrinding Media Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Grinding Media category is 6.70%

Payment Terms

(in days)

The industry average payment terms in Grinding Media category for the current quarter is 72.7 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Grinding Media market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoGrinding Media market report transcript

Global Market Outlook on Grinding Media

-

The demand for the global GM is expected to grow at a rate of 4–5 percent from 2022 to 2025, owing to an increase in mining activity, supported by high commodity prices and robust demand outlook

-

The demand growth is expected to come mainly from gold and non-ferrous metal segments. The copper market is expected to grow by about 4–5 percent between 2021 and 2026

Global GM Drivers and Constraints

-

The demand from the cement and mining sector, coupled with declining ore head grades, is the key driver of GM consumption rate in the mining industry. The supply chain disruptions caused by the Russia–Ukraine war, the recent earthquake in Turkey, and the outbreaks of new waves of Covid-19 in China have pushed the grinding media and its feedstock market into a period of volatility for most part of last year. However, a recovery is anticipated in H2 2023

Drivers

Increase in Mining Activity

-

Gradual increase in mining activities in the key global markets will drive up the demand for ore processing, in turn, the demand for Grinding Media in the long term

-

For instance, the copper market is expected to grow by about 4–5 percent by 2026

Decline in Ore Head Grades

-

Declining mineral head grades increase the number of ores to be milled, which results in increased utilization of grinding media in mineral processing

Constraints

Volatility in Commodity Prices

-

China accounts for around 40–50 percent of the global commodity demand. The Chinese economy has been adversely affected due to Covid-related policies and associated lockdowns. The volatility in commodity prices will hinder the demand for grinding media

Growing trend in favor of Circular Economy, Emissions Reduction and Resource Conservation

-

Growing demand for secondary production of key commodities, like steel, aluminum, copper, nickel and other base metals, by way of increasing recycled content, may limit the demand for grinding media from the mining segment

Regulatory Scenario

-

Regulatory scenarios, such as section 232, safeguard tariffs from the EU, export duties from China could impact the prices of metals and allied products, thus indirectly impacting the HCGM industry

Market Driver – Commodity Price

-

Prices of key commodities are the best indicators of mining activities, which, in turn, evinces the demand for grinding media

-

Iron ore prices have increased by 2 percent, and averaged at 126 $/MT due to the improved demand from the end users

-

LME Nickel prices averaged at 12.2 USD/lb in Feb 2023, a monthly drop of around 5.7% compared to 12.8 USD/lb in Jan 2023.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.