CATEGORY

Glycol Ethers

Trade tariffs have been imposed on glycol ethers due to the on-going US-China trade war which could impact prices and trade patterns significantly.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Glycol Ethers.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoGlycol Ethers Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoGlycol Ethers Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Glycol Ethers category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Glycol Ethers category for the current quarter is 70.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Glycol Ethers market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoGlycol Ethers market report transcript

Glycol Ethers Global Market Outlook

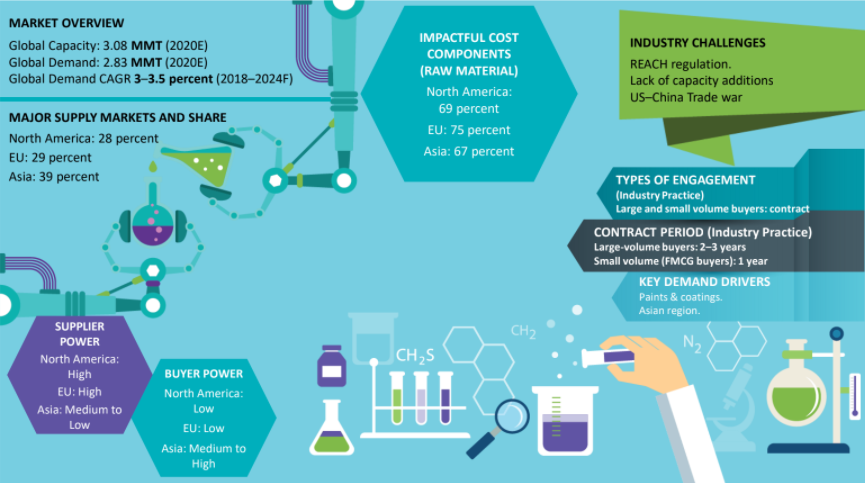

MARKET OVERVIEW

Global Capacity: 3.28 MMT (2022E)

Global Demand: 2.90 MMT (2022E)

Global Demand CAGR 1.5–2 percent (2022–2025F)

-

In H2 2022, the global capacity of both e-series and p-series is currently more than adequate to meet the weak demand from downstream paints and coatings industries on the account of bearish market sentiments in the automobile and construction industries. Weak economic climate driven by inflation and recession concerns, semi conductor chip shortages, zero-COVID policy in China are some key factors impacting the demand sentiments in the downstream industries.

-

The demand recovery from downstream industries is anticipated to remain slow in 2023, and hence, the global capacity is likely to remain adequate in 2023.

Glycol Ethers Demand Market Outlook

-

During 2022–2025, the global glycol ethers market is expected to grow at 1.5–2.0 percent. APAC will be the major demand-driving region for glycol ethers, due to higher growth rates in paints & coatings sector and household cleaning products

-

Glycol ether growth rates in Europe and North America will be low, due to mature downstream markets

Impact on FMCG

-

The FMCG industry accounts for a small share of the downstream demand

-

FMCG buyers are low-volume buyers for glycol ether manufacturers compared with paints & coatings and chemical intermediate buyers. As a result, FMCG buyers have less leverage during contract negotiations and have to contend with higher prices and supply unavailability during tight supply situations

Industry Best Practices : Glycol Ethers

-

Large volume buyers usually prefer buying through contract across all the three major regions. Among the small-volume buyers, FMCG players opt for contracts, due to the need for high quality glycol ethers, while non-FMCG small-volume buyers can buy in the spot market

-

Regional sourcing is preferred in Europe, owing to REACH regulation on glycol ethers, while both global and regional sourcing is followed in North America and Europe

Global Market Size: Glycol Ethers

-

The e-series glycol ether segment accounted for 63 percent of the total glycol ethers market demand in 2021

-

p-series is expected to grow at a higher rate compared to e-series glycol ethers. This will result in p-series glycol ethers, increasing its share of the overall glycol ethers market, in terms of revenue by 2025

-

The Asian region is expected to generate maximum revenue during the forecast period, due to higher growth rates, compared with North America and Europe

Global Capacity–Demand Analysis

-

Only one supplier has added 2,00,000 MTPA of e-series butyl glycol ethers in Jubail, Saudi Arabia in the past five years

-

By 2023–2025, the capacity–demand gap is expected to narrow down. This is due to a lack of new plants or capacity expansions, which could result in supply issues

Market Outlook

-

The current global installed capacity for both e-series and p-series glycol ethers is sufficient to meet the demand. However, the regional scenario gives a different picture, as there is a supply shortage of either e-series or p-series

-

Currently, e-series occupies 64 percent of the capacity share, and it is projected to grow at 1.7 percent over 2022–2025, slightly lesser than p-series, which is expected to grow at 1.8 percent. This is due to toxic effects of certain e-series glycol ethers, which are being replaced with p-series in certain downstream applications in Europe. Additionally, the Y-o-Y growth rates for 2022 and 2023 are likely to be 0–1 percent driven by concerns pertaining to zero-COVID policy in China on the account of continuous outbreaks, economic concerns pertaining to inflation and recession and uncertainty around Russia-Ukraine conflict. However, the growth is expected to recover during 2024 and 2025.

-

In e-series, the butyl and specialty glycol ethers are estimated to grow at a faster rate compared to methyl and ethyl glycol ethers, which are more toxic. An estimated capacity of 2,00,000 MTPA of butyl glycol ethers has come online by 2017 in Saudi Arabia and is the only significant capacity expansion in the last five years

Global Demand by Application : Glycol Ethers

-

The use of glycol ethers in the homecare sector occupies less than 10 percent of the downstream demand and is expected to witness a maximum growth in the Asian market, owing to the rising demand for high-quality household cleaning products

-

The increase in disposable income and purchasing capability has led to this surge in demand for homecare products

Downstream Demand Outlook

-

Demand pull: The key downstream market is the paints & coatings segment, which is projected to grow at a CAGR of 4–5 percent, until 2025

-

Paints & coatings are used in a wide range of downstream industries, such as construction, automotive, which are expected to witness high growth rates globally, as the world recovers from the pandemic impact. The growth of water-based surface coatings is also a key driver for this industry

-

The second downstream driver is the chemical intermediates industry, which is expected to grow at a CAGR of 5–6 percent, owing to a wide range of intermediates obtained from glycol ethers, such as esters and acetates

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.